The question I’m getting the most nowadays is: should I buy BHP, RIO or Fortescue at these current share prices? Let me tackle this from the point of view of a long-term investor, though I suspect we will make money on these stocks inside a year!

Let’s kick off by finding out the experts, who analyse these companies 24/7, think.

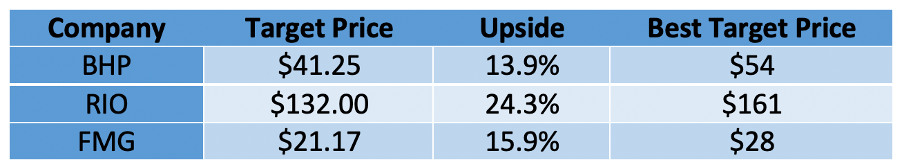

Here’s a summary of what they’re telling us:

The first blush takeout from the table of analysts’ views on our big three miners is that they look like value plays. Of course, these experts can be wrong. Clearly, their predictions about the share prices of these companies are based on assumptions, which could prove to be faulty in the fullness of time.

History has shown that the worse time to be over-exposed to mining stocks is when a recession occurs and worldwide growth falters. Away from this across-the-board threat, commodity prices can slide when the world’s biggest customers, such as China cut back production, aim to slow its economy or decide it doesn’t want to pay high prices for iron ore.

But these analysts know this and would have factored it into their best guesses on the future share prices of these companies.

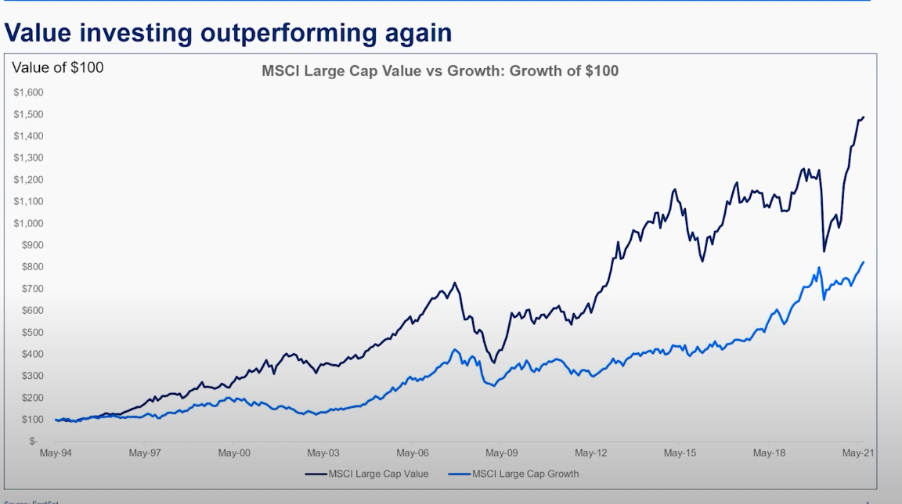

Recently CNBC noted that value stocks would benefit from Wall Street’s likely rotation out of growth sectors into value-like ones. The consensus was that financials, healthcare, energy and materials (miners) should be in for good times.

This chart I showed you last week from Perpetual’s fund manager, James Holt, from our Listed Investment Conference (which is worth checking out here) shows how value stocks perform well after a crash and recession. The dark blue line are value stocks compared to growth.

Interestingly, Perpetual holds BHP in its value stocks fund, giving us a clue that their investment team thinks the stock has upside going forward.

And that’s nice to know, but what explains their confidence? And the same question goes for those analysts I’ve quoted from FNArena’s survey, who think there are good to great potential returns from the big miners. These stocks/companies have actually done well since February 2016, as this chart for Rio Tinto shows.

Rio Tinto (RIO)

Note that the 2003-08 upswing for the miners lasted six years and the boom out of the GFC was less than three years, but it was curtailed by a pullback in spending by China, after it spent so much to overcome the negative forces out of the GFC.

The current boom is over six years long but it did have a Coronavirus hiccup in the middle of it. And given the massive spending by worldwide governments, record low interest rates (with our own RBA telling us last week that it still doesn’t expect to raise rates until 2024), you’d have to think this could be a longer than usual cyclical upswing, at a time in the stock market cycle that favours value stocks.

Last week I interviewed Morgans’ chief economist, Michael Knox, who not only is tipping a huge boom in global economies in 2022 and 2023, he also thinks the Aussie dollar goes over the 80 US cents value in the year ahead.

You can hear the longer podcast here.

On the other hand, if you watch tonight’s Switzer Investing TV program, I’ve pulled out the last 10 minutes, when I grilled him on the 2022 economy and the outlook for material stocks.

He says there is a high correlation between a rising and huge US budget deficit, which he sees already as big and getting bigger, which will turbo charge the global economy and drive the US dollar down.

I asked him whether the year ahead looks good for our big mining stocks and he reminded me that he doesn’t do stock tipping. But when pressed, he did point out that Morgans’ mining analyst is bullish on the big iron ore miners.

And by the way, these predictions are for timelines that don’t take in the full force of a very vaccinated world by mid-2022, which then will be boosted by booster shots and greater steps towards more normal business environments.

In July, Nicholas Snowdon, who’s head of base metals and bulks research at the investment bank Goldman Sachs, gave the sector a thumbs up. “It would be wrong to say that the bull market for iron ore, you know, is on the cusp of ending,” he said. “Importantly, even as China shows some signs of decelerating … steel demand growth rate in the second half of the year and into 2022, [suggests] the rest of the world and (developed market) steel demand dynamics are incredibly strong.”

Importantly, he tips miners will be careful with their supply, which will help iron ore prices defy gravity.

“When you look forward over the next two, three years, supply growth rates will actually decelerate … from where they stand today,” he said. “There is not an imminent risk of major supply response in the iron ore market and that’s very key to the … outlook for price.”

My best guess for economies is that 2022 will see strong growth building over the year and interest rate concerns will also build, which will become more problematic for stocks in 2023. But the strong growth of economies and then company profits will be good for stock prices in 2022 and probably 2023.

The year I’m more worried about is 2024 when the growth might actually create inflation and interest rate challenges. However, that’s about two and half years off, and in that time I reckon the big iron ore stock prices will deliver, even if they disappoint in the short term.

I repeat this often, because it’s important: the long-term investor has a competitive advantage over professional fund managers. We can buy when the market is hitting the share prices of quality companies and we can wait for the market view to change. This chart of Fortescue proves my point.

Fortescue Metals Group (FMG)

Personally, I’m giving BHP, RIO and FMG at least another year. I could even give them a bit longer before I lighten my exposure.

One reason I want to give the likes of BHP the benefit of the doubt is because of what Paul Rickard recently wrote: “On consensus, the major brokers forecast a lower dividend for FY22 than FY21, coming in at A$3.87 per share. This gives BHP a prospective yield of 7.2% plus franking credits.”

I know you should never buy miners for their dividend, but with a boom year for economies coming, I’m prepared to stick with these mining stocks.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.