I am a huge fan of the Commonwealth Bank. It is unquestionably Australia’s best bank – strongest balance sheet, best leadership team, best technology, number 1 in home loans and retail deposits, biggest customer base and number 1 or 2 in most other markets. It deserves to trade at a premium to the three other major banks. But that premium has blown out to a record, and with all four major banks pursuing very similar strategies, I think it is time to reduce and switch.

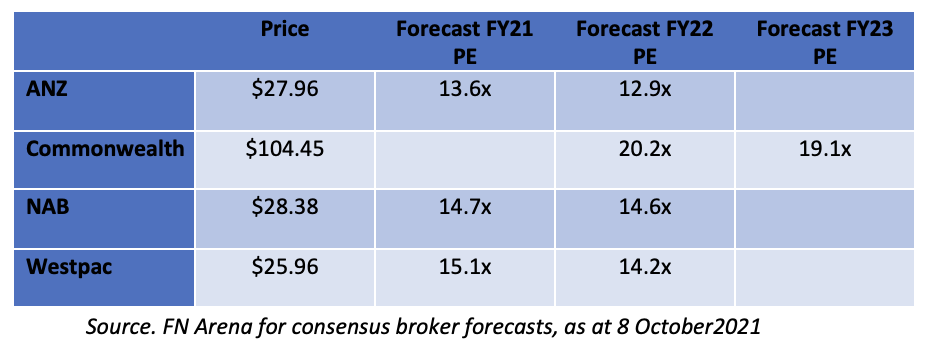

How do you measure the premium? The one I like to use is forecast price earnings multiples. The table below shows the broker consensus multiples for the next two financial years. Leaving aside that the financial years don’t quite line up (CBA, having a 30 June balance date, is shown for FY22 while the other banks who balance on 30 September are yet to report for FY21), CBA is trading near a multiple of 20x forecast earnings – the other three are in the 13x to 15x range. That’s equivalent to around a 40% premium.

I have been tracking this premium for many years and the highest I can recall it getting to be is 35%, and the lowest near 5% when Commonwealth Bank was under extreme pressure due to its money laundering problems.

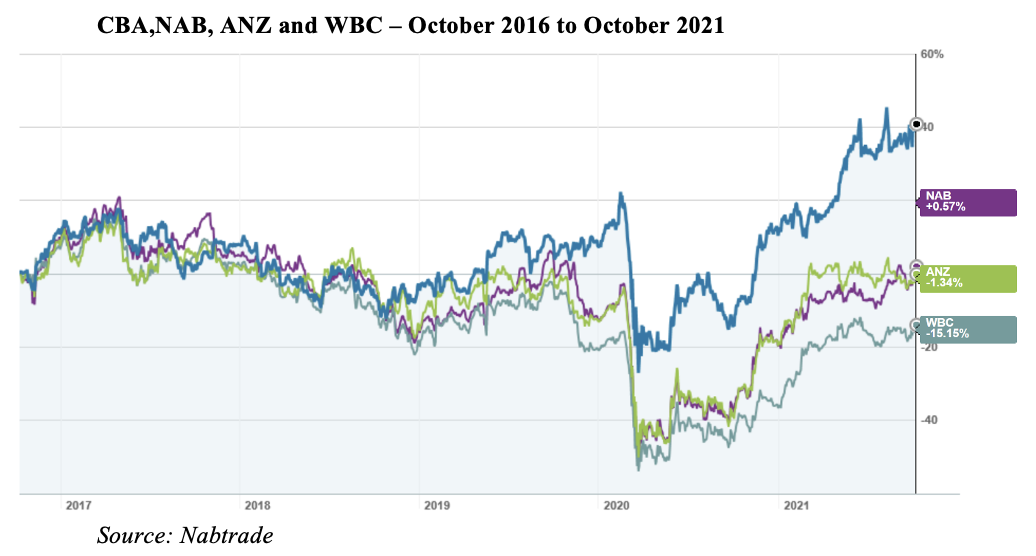

Another way to look at this is relative price performance. The chart below from nabtrade shows the four major banks over the 5 years. Starting from a common base, CBA (blue) is up by around 40%. NAB, in purple, is up by 0.5%, while ANZ (bright green) has lost 1.3% and Westpac (dark green) has lost 15.1%. These returns don’t include dividends, but that doesn’t change the relative ranking to any major degree.

Interestingly, the banks tracked each other pretty closely for the first three years but started to diverge in 2019 as CBA recovered from its money laundering scandal and Westpac suffered its own fate. When the Covid crisis hit, CBA held up better, and in the recovery phase, outperformed the other banks.

Part of the reason for the recent outperformance of CBA has been its $6bn off-market share buyback. Off-market share buybacks work for some shareholders because of the franking credits attached to the very large dividend component, and so many of those same shareholders who sell into the buyback replace their CBA shares by buying them on market. This puts a floor under the share price.

With “replacement buying” coming towards an end, I think this is the time to reduce exposure to CBA and look at its competitors. CBA’s a core holding for me, so I won’t be quitting my exposure – just re-weighting. And I have time on my side because it may take months, if not a year or two, for the market to bring the banks back into line. As any seasoned investor knows, a stock can stay expensive for an awful long time!

So, which bank to buy?

Let’s start by seeing what the major brokers say.

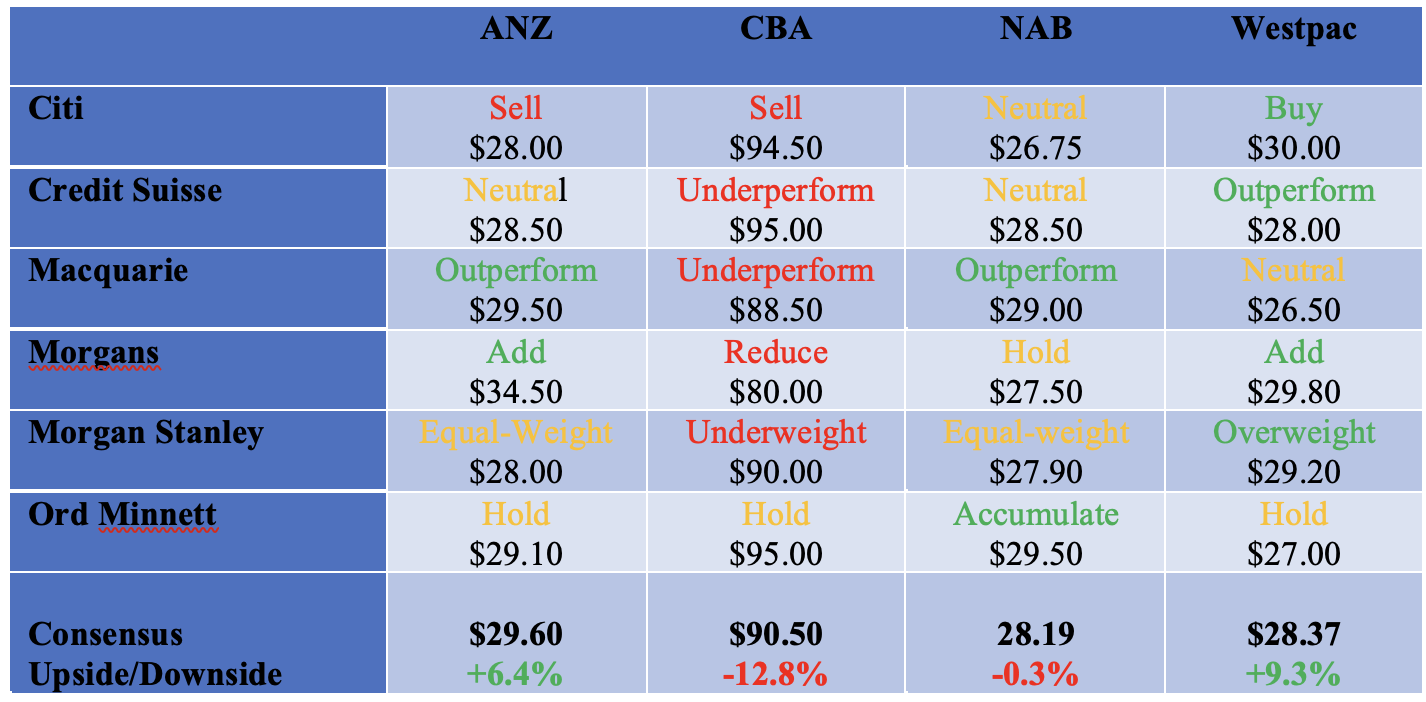

The table below shows the recommendations and target prices from the six major brokers for the big four banks.

In summary, the brokers are most positive about Westpac and not surprisingly, negative about the CBA. On consensus, they see 9.3% upside for Westpac and 12.8% downside for CBA.

Citi, Credit Suisse and Morgan Stanley each rank Westpac as their preferred pick. Ord Minnett goes for NAB, while Macquarie and Morgans are split – both ranking ANZ as a buy, and also liking NAB and Westpac respectively.

I am not sold yet on the Westpac leadership team and whether it is making sufficient progress in upgrading its technology, so I am going for the NAB. I am encouraged by CEO Ross McEwan’s approach to simplifying and streamlining the NAB businesses, and if the post lockdown economic recovery is strong, NAB is well positioned to benefit due to its oversize share of business banking.

Unlike the other major banks, Westpac hasn’t announced any capital actions (CBA has completed an off-market buyback, both NAB and ANZ are currently implementing on-market share buybacks). Westpac is due to report on 1 November and it is possible that the profit result could be accompanied by an announcement of a buyback. If it announced an off-market share buyback, my preference would swing back to Westpac. But on current price differentials, I am banking on the NAB.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.