Question 1: Why is Pro Medicus (PME) doing a share buyback? Should you read into this that management believes that the share price is cheap?

Answer: The off market share buyback for Pro Medicus is not new, it just hasn’t been active. It was not until late March that the first shares were bought back. It expired on 31 March and on 1 April, the company announced another off market share buyback. This is capped at the maximum limit of 10% of ordinary shares and can be executed over a 12-month period.

To be honest, I am a little bit surprised that directors chose to activate it, given that there had been a fair bit of complaint in the market about the lack of liquidity in the stock (the two founders own close to 48% of the company). And while PME has fallen 30% in the last six weeks, it is still up close to 100% over the last 12 months.

I think you can “read in” to it that directors feel that the shares are relatively cheap.

Question 2: Jun Bei Liu is a regular on Peter’s TV show. I understand that she is now running her own equities fund. How do I invest with her?

Answer: Yes, she is now running her own fund. It is called the Ten Cap Alpha Plus Fund. You can invest by downloading and reading a PDS at tencap.com.au

Alternatively, the fund is now available on most of the major investment platforms such as BT Panorama, Hub24 or Macquarie Wrap.

Question 3: Several market analysts have said that in an environment of lower interest rates, smaller cap stocks should do better than large cap stocks. How is that panning out?

Answer: In March, large caps marginally outperformed small caps. The “top 20” stock index lost 3.2%, whereas the Small Ordinaries Index (which measures stocks ranked 101st to 300th by size of market capitalisation), lost 3.6%. For the March quarter, however, small caps are performing relatively better, with a loss of 2% compared to the loss for big caps of 3%.

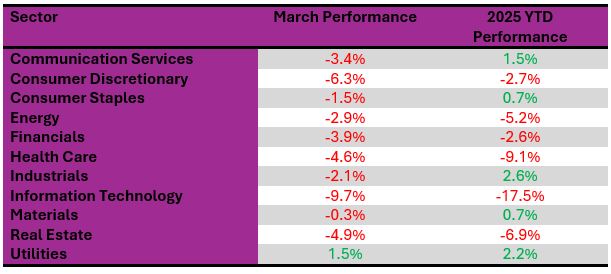

For the industry sectors, information technology stocks are being slammed. The tiny (and defensive) utilities sector was the best performing sector in March and the best performing in the quarter.

Question 4: Defensive stocks like Transurban (TCL) seem to be doing well at the moment. Is there much upside in a stock like this?

Answer: According to the major brokers, there is not much upside. The consensus target price is $13.49, about 1% lower than the last ASX price of $13.63. The range is a low of $12.64 through to a high of $14.85. Transurban has guided to a full-year distribution of 65 cents, which puts it on a yield of 4.8% (unfranked). While attractive, this is not an extraordinary yield.