Question 1: What is the best stock to get exposure to copper?

Answer: If you are looking at “pure play” exposure to copper, Oz Minerals (OZL) is probably the largest producer. If is forecast to produce 120,000 to 145,000 tonnes of copper in FY21. Sandfire Resources (SFR) is another – it is forecasting production of around 70,000 tonnes. Many of the copper mines also produce gold. With Oz Minerals, the revenue split between copper and gold is approx. 80%/20%. Newcrest Mining (NCM), Australia’s leading gold miner, also produces copper.

Of course, Australia’s largest ASX listed producer of copper is BHP. Copper contributes approximately 20% of revenue, and tends to be overshadowed by the company’s exposure to iron ore and to a lesser extent, oil.

Question 2: What are your thoughts on Nuix (NXL) ? Is it a buy?

Answer: I answered a question last week on Nuix, saying: “I really like the look of Nuix (NXL) but I am very wary of companies that have spectacularly successful IPOs (from an IPO price of $5.31 it rose rapidly to $11.85) and then bomb badly at the first real news (an update on how they are tracking against their prospectus forecast). It is now $5.07. The track record of companies in this category is very poor – the market doesn’t forgive readily and usually, the next several months on the ASX are really hard.”

Yesterday, it closed at $4.29 after more bad news about revenue. The company issued an interesting statement, which in part blames customers for an acceleration to “consumption licences” (i.e. pay per use) and a switch away from “subscription” licences.

I am tempted. You might get a short term bounce, but the market’s confidence has been shaken and in the absence of further news, it will struggle. Buyers will need to be patient.

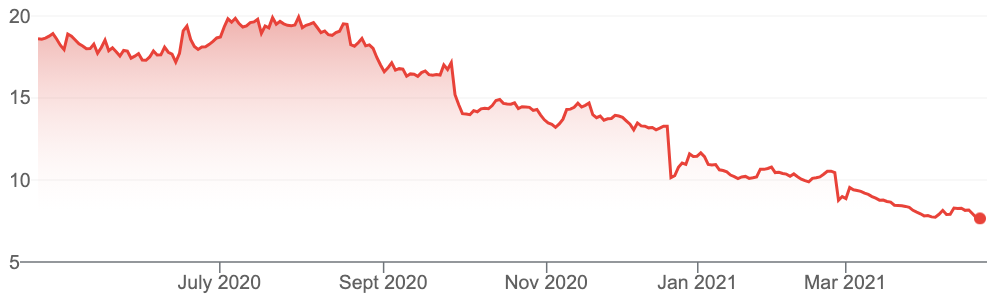

Nuix (NXL)

Source: Google

Question 3: I own A2 Milk shares. They have been pretty disappointing. Should I hang on

Answer: I am a believer in the company, and think that if you have a medium term timeframe, hang on. Don’t expect an immediate bounce because the market is wary of a fourth downgrade, the daigou trade is still struggling, and short selling interest is high. According to the latest ASIC data, 5.84% of the ordinary shares are sold short, making it the twelfth most shorted stock on the ASX.

In the last few days, two major brokers have released reports on A2 Milk. Credit Suisse has a sell with a target of $7.15, while UBS has a buy and a target of NZ$16.00 (about A$14.50). Here is FN Arena’s summary of what UBS had to say: “UBS pins its Buy rating on a meaningful recovery in indirect infant formula sales over the next two years, plus substantial gains in market share in China through the off-line roll-out and free trade zone expansion.

The broker acknowledges short-term earnings risks amid reduced visibility on daigou sales and the conflicting messages from peers in the March quarter. Target is steady at NZ$16.00”.

A2 Milk (A2M)

Source: Google

Question 4:I hold some Altura Mining (AJM) which went into liquidation last year. I rang the liquidators who informed me that they were not involved anymore and the Directors had taken over. What does this mean?

Answer: Altura Mining (AJM) is no longer in receivership. It has not been liquidated, although its major lithium asset has gone. While it remains suspended on the ASX, the Directors are planning to re-capitalise the company and have the shares traded on the ASX. They wrote to shareholders on 19 April.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.