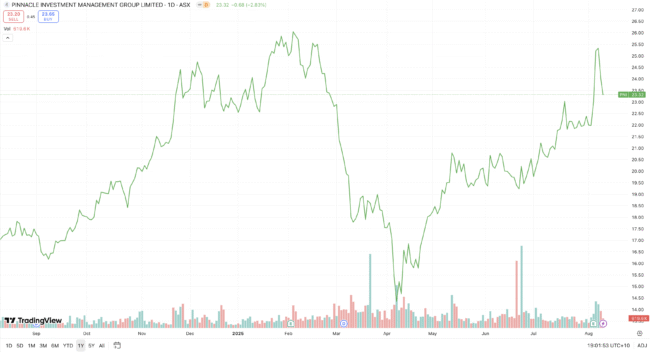

In our “HOT” stock column today, Head of Asian Desk at Morgans Financial Limited, Raymond Chan, explains what Morgans thinks of Pinnacle Investment Management Group Ltd (PNI) mid-term.

“Pinnacle Investment Management Group Ltd (PNI) delivered financial year 2025 net profit after tax (NPAT) of $134.4 million, up 49% on pcp. Affiliate earnings grew 43% to $129.7m and 39% to $83m excluding performance fees (PF),” Raymond said.

“Group funds under management (FUM) closed at $179.4 billion, +15.4% for the half (inflows $16.4 billion; performance $7.6 billion).

‘Life Cycle’ was the standout, with second half inflows of approx. $14 billion.

“PNI cycles a strong financial year 2025 performance fee outcome, however earnings step-ups are coming through in Life Cycle, Metrics and potentially Five V.

“Medium-term ’embedded’ drivers are visible from the scaling of several managers; and the long-term offshore opportunity is significant.

“PNI is arguably expensive on near-term valuation multiples (susceptible to short-term volatility), however, we see embedded strong growth medium term; the operating structure is now expanded to facilitate ongoing offshore growth; and near-term catalysts look supportive (solid flows outlook; acquisitions),” Raymond said.