Here at Switzer, we have made some minor changes to our portfolios for 2022 to take into account the dominant investment themes that we expect to apply. We have also rebalanced the portfolios.

Recap on portfolio objectives and performance

The objective of the income portfolio is to deliver tax advantaged income while broadly tracking the S&P/ASX 200.

Typically, it has delivered an income return of about 4.5% to 5.0% pa, franked to about 80%, with the balance of the return comprising capital gain or loss.

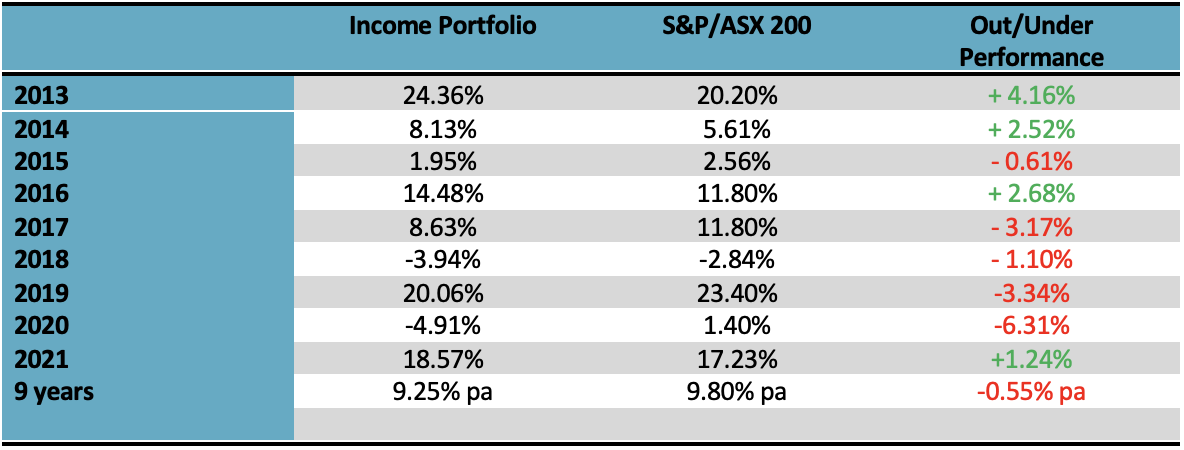

The table below shows the total performance of the income portfolio and that of the benchmark S&P/ASX 200. Over the nine years since 2013, it has delivered an annualized average return of 9.25% pa compared to the index return of 9.80%. These figures don’t include the benefits of franking credits or from participating in capital actions such as off-market share buybacks or share purchase plans.

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, while closely tracking the index.

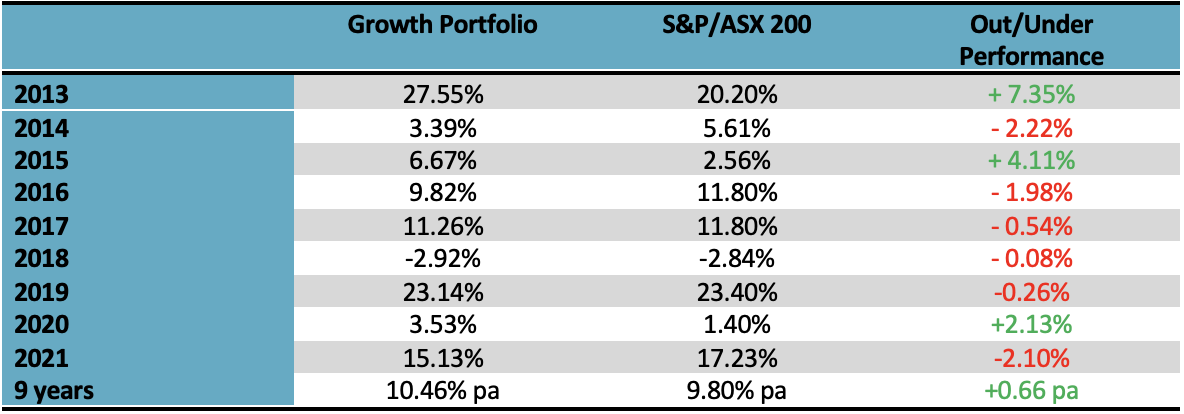

The table below shows the performance of the growth portfolio and that of the benchmark S&P/ASX 200. Over the nine years since 2013, it has delivered an annualized average return of 10.46% pa, outperforming the index by 0.66% pa. These figures don’t include the benefits of franking credits or from participating in capital actions such as off-market share buybacks or share purchase plans.

Portfolio Construction Rules

The construction rules for the portfolios are:

- We use a ‘top down approach’ looking at the prospects for each of the industry sectors;

- for the income portfolio, we introduce biases that favour lower PE, higher-yielding sectors;

- so that we are not overly exposed to a market move, in the major sectors (financials and materials), our sector biases will not be more than 33% away from the index. For example, the weighting of the ‘materials’ sector on the S&P/ASX 200 is currently 19.2%, and under this rule, our possible portfolio weighting is in the range from 12.8% to 25.6% (i.e. plus or minus one third or 6.4%);

- we require 20 to 30 stocks (less than 10 is insufficient diversification, over 30 it is too hard to monitor), and have set a minimum stock investment size of $2,500;

- our stock universe is confined to the ASX 150. This has important implications for the growth portfolio because the stocks with the best medium term growth prospects will often come from outside this group (the so-called ‘small’ caps);

- for the income portfolio, we prioritise stocks that pay fully franked dividends and have a consistent record of paying dividends; and

- within a sector, the stocks are broadly weighted to their respective index weights, although there are some biases.

Investment themes and sector outlook for 2022

In summary, we expect the following major investment themes:

- Equity markets will clock up their 14th year of rising prices. Strong economic growth globally will translate into rising earnings, and with interest rates remaining relatively low by historical standards, the “weight of money” will support share prices. Gains won’t be as big as 2021, but still reasonable;

- Political events will take centre stage – in Australia in the first half with the Federal Election, and in the US in the third and fourth quarters with the midterms. This will subdue equity markets;

- Interest rates will head higher, with both the US Federal Reserve and the RBA increasing cash rates before the end of 2022. But they will retain a bias to supportive policies because inflation won’t get out of hand and they want to make the recovery permanent;

- There will be times when the inflation genie comes out of the bottle and scares investors, but the disruptive forces of new technology will ensure that it is transitory. With governments continuing to run fiscal deficits, bond yields will rise; and

- The US dollar to ease and the Australian dollar to rise, due in part to a general pick up in economic activity being supportive for commodities, and concerns about the ballooning US budget deficit.

And the main risks?

- Covid;

- Inflation;

- China;

- And of course, a “black swan”.

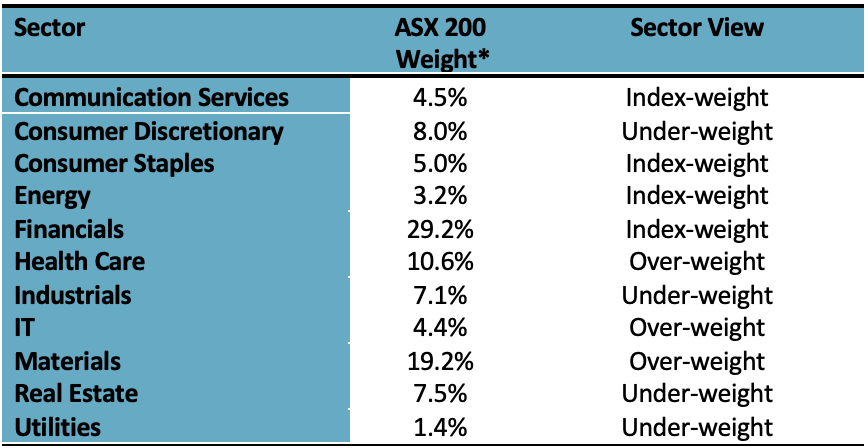

From these themes and other data, we have determined our sector views, which are expressed as a bias relative to the sector’s market weighting.

* ASX 200 index weights as of 31 December 2021

* ASX 200 index weights as of 31 December 2021

Overall, our sector views are not strong and so the biases will be relatively small.

Income Portfolio

The objective of the income portfolio is to deliver tax advantaged income while broadly tracking the S&P/ASX 200.

On a sector basis, the biases for the income portfolio in 2022 are fairly minor. It is overweight financials (in order to find income) and consumer facing sectors, and underweight health care and information technology (where there are very few medium yielding stocks).

In the expectation that interest rates in Australia are staying at relatively low levels, it has a defensive orientation and a bias to yield style stocks. In a bull market, we expect that the income portfolio will underperform relative to the broader market due to the underweight position in growth-oriented sectors and the stock selections being more defensive, and conversely, in a bear market, it should moderately outperform.

Apart from re-balancing and moderate changes with some stock weights, changes to the portfolio from 2022 are the inclusion of Suncorp and Brambles, and the removal of IAG and Aurizon.

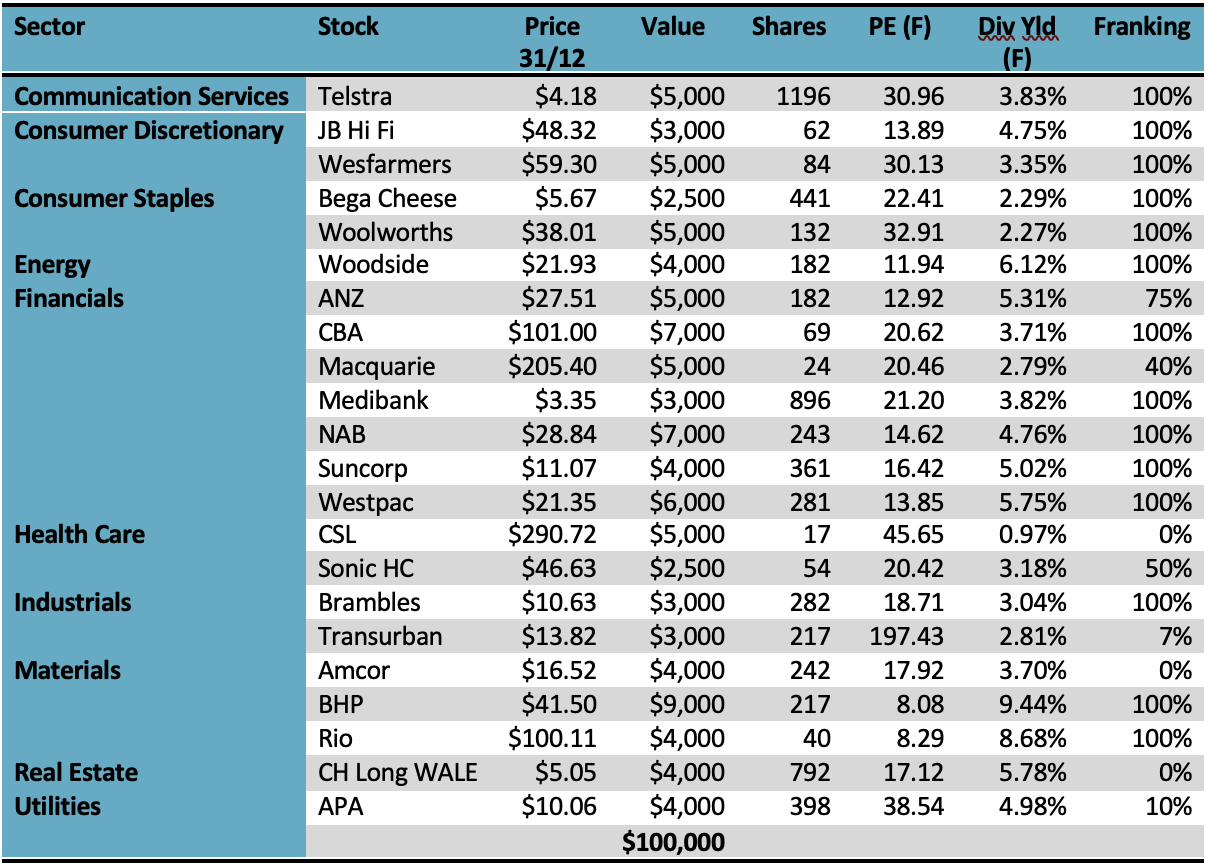

Using consensus analyst forecasts from FNArena, the income portfolio has the following characteristics:

Forecast Price Earnings (PE) for 2022: 25.7 times

Forecast PE for 2022 (excluding Transurban and APA): 19.6 times

Forecast Dividend Yield for 2022: 4.65%

Franking: 79.4% (estimated)

Forecast Dividend Yield (excluding BHP and Rio): 3.97%

The forecast dividend yield of 4.65% is based on stock prices as of 31 December 2021. The franking percentage of 79.4% is reduced by the inclusion of stocks such as Transurban, APA, Charter Hall Long WALE REIT, Amcor, CSL and to a lesser extent, Macquarie, Brambles, Sonic and ANZ.

For an SMSF in the accumulation phase, the forecast 4.65% dividend yield translates to an income return of 5.4% (after tax), and for a fund in pension phase, to 6.2%.

Our income portfolio per $100,000 invested (using prices at the close of business on 31 December 2021) is:

Growth Portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, while closely tracking the index.

The growth portfolio in 2022 is moderately overweight consumer facing sectors, information technology and materials. It is underweight industrials, real estate and utilities. Overall, the sector biases are not strong.

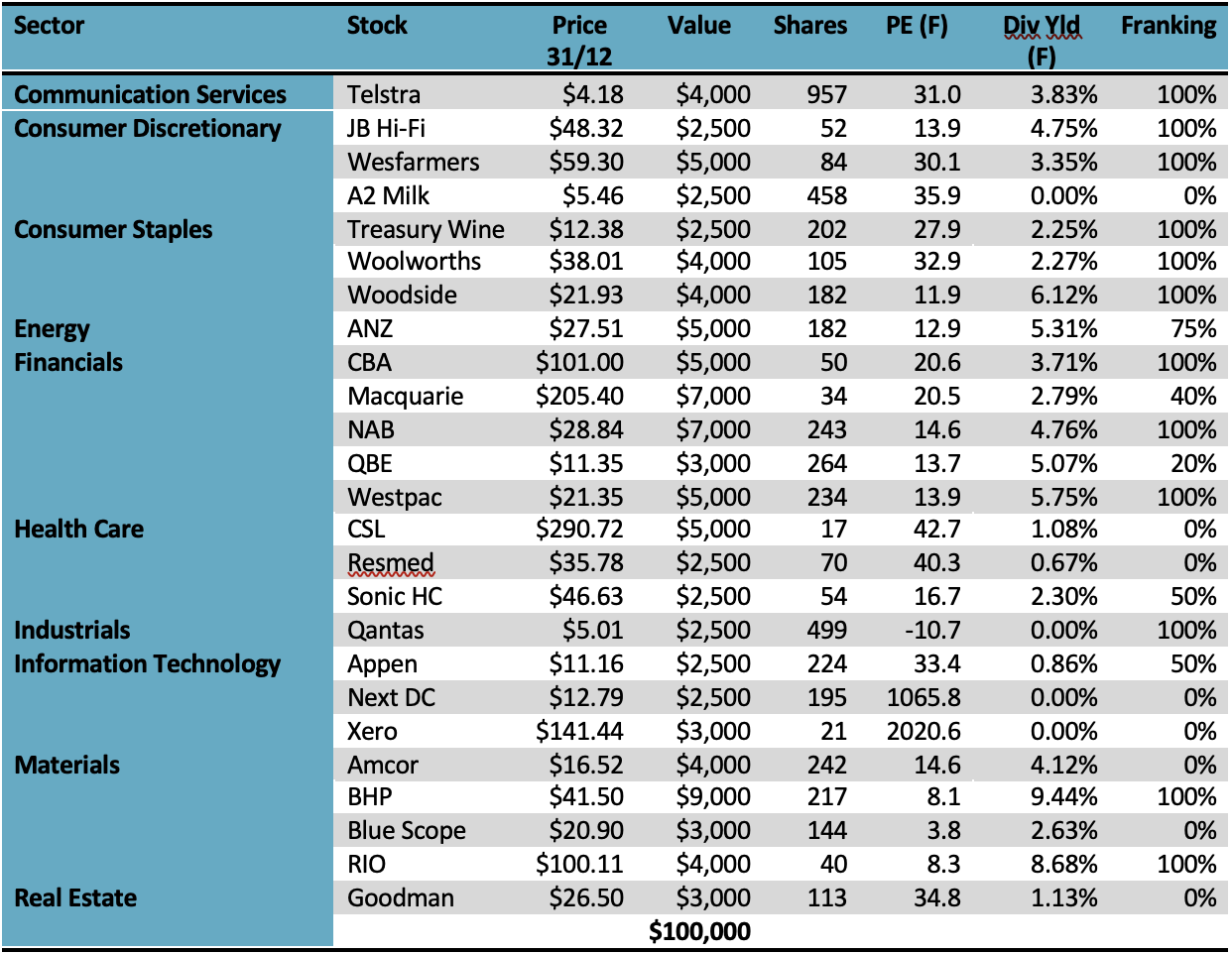

Apart from re-balancing and moderate changes with some stock weights, changes from 2021 are the inclusion of Telstra, QBE and Goodman Group, and the exclusion of TPG, Aristocrat, Reliance Worldwide and Lend Lease.

Using consensus broker forecasts from FN Arena, the portfolio has the following characteristics:

Forecast Price Earnings (PE) multiple for 2022: 105.9 times

Forecast PE for 2022 (excluding Xero, Qantas, NextDC & BlueScope): 21.1 times

Forecast Dividend Yield for 2022: 3.87%

Franking: 82.1% (estimated)

Our growth portfolio per $100,000 invested (using prices as at the close of business on 31 December 2021) is as follows:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.