The re-organisation of risk in capital markets stepped up since February, first with broadening acceptance of upside risk to interest rates, then with geopolitical instability.

We’re seeing significant capital rotating from Growth/Tech equities into Defensives/Value equities and gold.

Inflation protection was sought in commodities which led to speculative activities e.g. oil prices (a sharp rise and fall) and nickel (LME short squeeze).

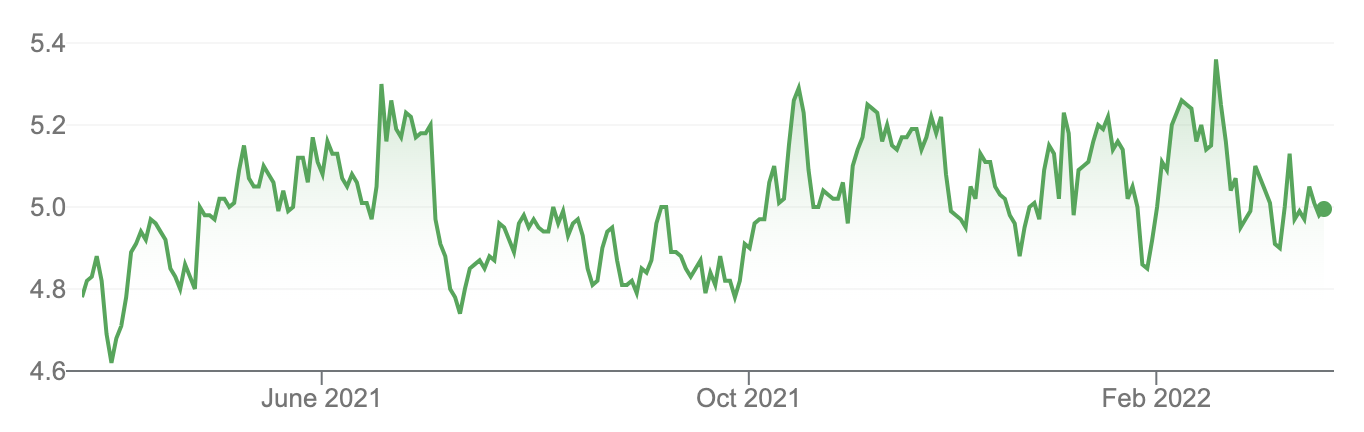

We saw bond yields falling last month before rallying into the FOMC meeting.

Unfortunately, markets are likely to remain volatile in the coming weeks.

Having said that, we argue that the February reporting season was amongst the strongest in recent history. So far, strong results failed to send stock prices materially higher. Further, we are seeing analysts being very conservative in upgrading earning estimates. We think investors can take comfort that recent volatility looks disconnected from strong corporate fundamentals and a solid outlook for the Australian economy.

Morgans best buy ideas:

1. Tabcorp (TAH)

Tabcorp is Australia’s largest gambling company, employing more than 5,000 people. It is the largest provider of lotteries, Keno, wagering and gaming products and services in Australia. Tabcorp is listed on the Australian Securities Exchange.

“We continue to like the risk/reward profile for TAH and think there will be further upside from the proposed demerger of the high quality, infrastructure-like Lotteries and Keno business.

“At the current level, we think this part of the business is trading on EV/ BITDA of 15x and the multiple could expand to 16 – 20x post demerger – in line with its international peers.

“TAH projected yield is 3.5%,” Raymond said.

Tabcorp Holdings Limited (TAH)

2. Macquarie Group MQG

Macquarie Group Limited employs more than 17,000 staff in 33 markets, is the world’s largest infrastructure asset manager and Australia’s top-ranked mergers and acquisitions adviser, with more than A$737 billion in assets under management.

“We still see MQG as relatively inexpensive and continue to like its exposure to long-term structural growth areas such as infrastructure and renewables.

“Near term MQG is likely to face earnings pressure from the impact of soft economic conditions but remains well-positioned to ride out from global COVID restriction.

“MQG projected yield is 3.5%,” Raymond said.

Macquarie Group Limited (MQG)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.