I was recently asked by a new client to put together a high-growth portfolio for a 50-year-old whose super balance was low. The person in question was bound to inherit some good assets but her partner wanted her to see her super get turbocharged.

In fact, after talking to her, she too admitted that she was tired of being too scared to invest, so she encouraged me to come up with a high-powered investing strategy. I explained that big returns also imply big risks but suggested if the right high-risk investments are selected, then any potential big losses could be short term. Over the longer run, losers in the short term could come back to reward you in the long term.

By the way, if you try this high-return/high risk play, please don’t ever rubbish me if you cop losses. Remember this is for the thrill-seeker who can be patient and that’s often a tough ask for a thrill-seeker.

One of my favourites

One stock I’d put forward is my favourite — Megaport (MP1), which rose 41% two Fridays ago and was once a $21, compared to its current price of $5.57. Six out of six analysts still like the company and the consensus rise is 64.4%, while UBS tips a 104% rise, which is less than Ord Minnett, with a 133% jump predicted.

Another tech stock

For my client I’ll come up with other tech stocks such as Next DC (NXT). The analysts see an average 15% gain for NXT but Citi thinks the rise will be 22.67%, while Macquarie is more optimistic with a 29.88% higher share price for the year ahead.

A healthcare stock

For my client I’ll build in some quality companies currently beaten up, which will eventually rebound such as Ramsay Health Care, which has a consensus predicted rise of 9.4%, but Morgans forecasts a 27.18% jump ahead.

The satellite plays

These will be satellite plays that could be hit or miss in the short term but at the core I want diversified ETF-like products that can really give oomph to overall returns over time.

The first easy one to recommend is GEAR, which virtually gives a magnification effect to what the overall S&P/ASX 200 Index might do.

Before the Coronavirus crash, this was nearly at $30 and is $24.95 today. This is a great buy after a crash and was as low as $11.43, which shows how the magnification effect works in both positive and negative directions. You have to remember this if you want to take the plunge. With US debt ceiling and US small bank concerns, it might pay to wait until Washington deals with these big market headwinds. If Wall Street falls on these worries, we’ll play follow the leader, which could create a more favourable entry price for GEAR.

Let’s go overseas…

That’s a local high-risk play, so let’s go overseas. I reckon there’ll be a tech rebound when the Fed stops raising rates. And believe it or not, the US bond market is tipping four interest rate cuts before year’s end, and that could be good news for the S&P 500.

That makes IHVV a sensible play, as US rate cuts should push the Oz dollar up and the US dollar down. That’s why I’ve opted for IHVV rather than IVV because the H stands for hedging.

The S&P 500 is 13.4% off its all-time high so it has upside. If you want more potential grunt, maybe HNDQ (which is a hedged play on the top 100 stocks in the Nasdaq) might be the way to go. This is 22% off its all-time high. When tech bounces, it will be reflected in HNDQ. I recommended this in November last year and it’s up over 20%, but this has been driven by the big tech companies, such as Microsoft, Apple, Meta and so on. Their commitment to AI has also helped their stock price rebound.

Another high-risk play

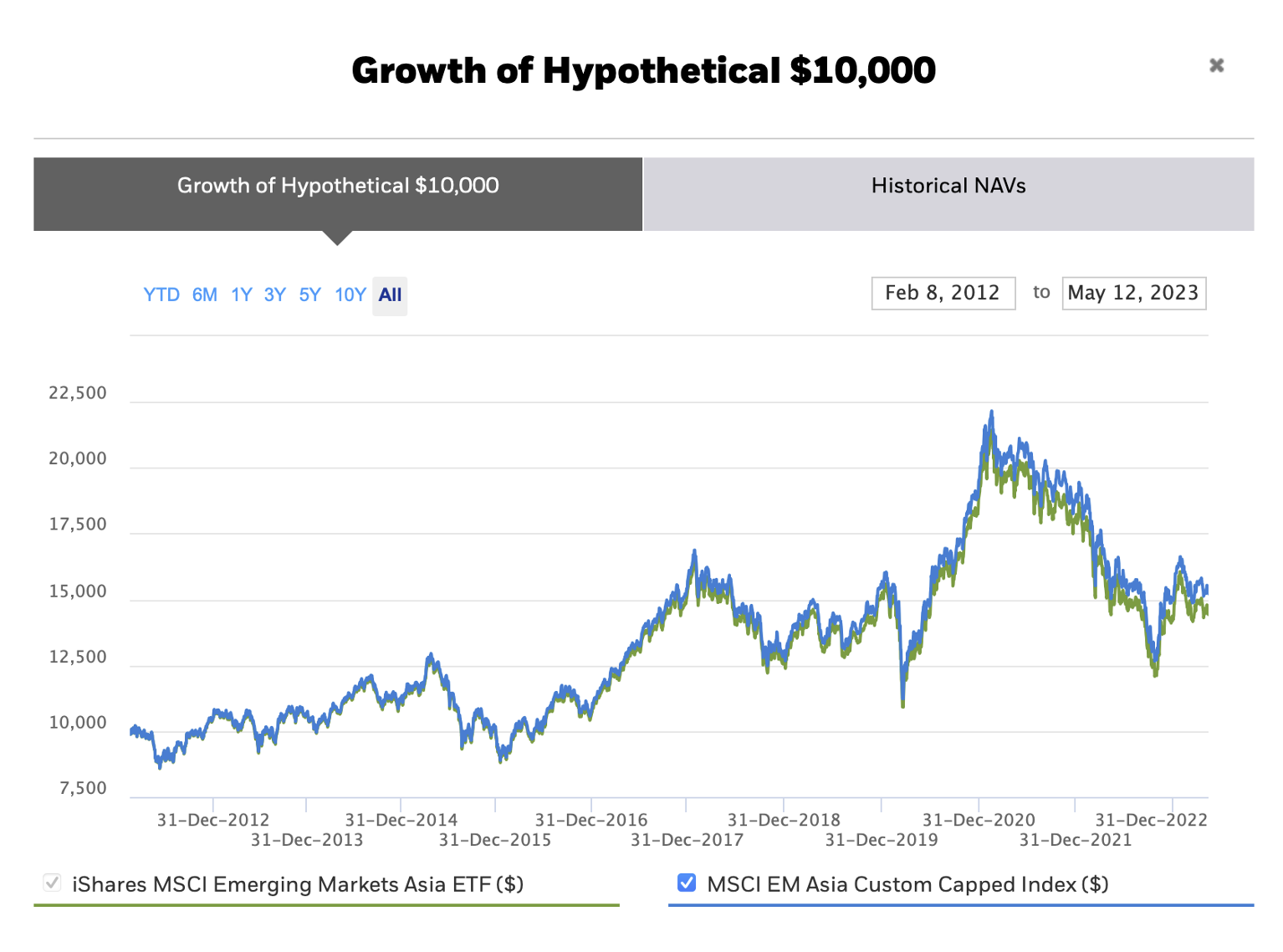

Another high-risk investing play might be to back that by 2024 China and Asia will be on track for better growth. That means an ETF such as the iShares MSCI Emerging Markets Asia ETF or EEMA (that captures the returns of the high-performance companies in the countries to our north) might be worth ‘punting’ on.

The chart below shows how a peak was reached around early 2021 and while there was a small rebound this year, there has been some backtracking.

Beijing seems more willing to be open to better trading relations and they seem to be treating their tech entrepreneurs nicer nowadays, as Jack Ma of Alibaba seems to be showing, or at least he’s on show again!

One for the real risk takers!

Finally, this is one for the real risk-takers. It’s an ETF for the troubled US small banks. It would take real guts to buy this one now with question marks over the smaller regional banks in the USA. Also, the US debt ceiling problems could rebound on these less secure smaller banks, so it adds another concern on top of the current worries about the sector.

This ETF is SPDR S&P Regional Banking ETF (KRE). It is a great way to play this sector, when there are no problems for these banks, but the chart below shows how out of favour these financial institutions are nowadays.

SPDR S&P Regional Banking ETF (KRE)

Since January last year, KRE is down 53% but most of that — 43% — has been lost since February this year. This puts you in the Dirt Harry position where you have to ask: “Do I feel lucky? Well, do ya, punk?”

And while this might unsettle you, you might need to remember what Warren Buffett advises: “Be greedy when others are fearful…”

That was easy advice to take when I put you into CBA at $58 in May 2020 because it is a clearcut quality play, but are the regional banks of the USA quality? Some are and some aren’t, but you have to worry about potential runs on these banks.

Also there doesn’t seem to be a hedged version of KRE, so you have the risk that a rising dollar brings to great US investing ideas. That said, if you bought in at today’s price of 36.67 and the ETF went back to its all-time high of $78.78 or so, then that would be a 114% return! I do think US banks will eventually get sorted out, and the ETF will rebound but what if our currency rises from 66 to 100 US cents, which would be a 51% reduction in the return? Of course, if the rise in the $A is only to the 80 US cents region, then KRE would still be rewarding. That’s a big pay day for a big risk, so I have to ask, do you and do I feel lucky?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances