Each week I try to suggest investment ideas that will inevitably help you build a reliable and rewarding portfolio of stocks. Most of you know that I like to buy quality companies with a good outlook but might be out of favour with the market for cyclical or other reasons. For example, the Chinese trade bans have affected Treasury Wine Estates current share price but assuming these bans won’t last forever, I expect a share price rebound hopefully in a year or so’s time.

I don’t have to make money now with my investments but I do want to gain over time. And after waiting, I want a decent reward for my patience. To arrive at stocks selections, I think about filters to overlay on companies that rule some stocks in and others out.

A lot of companies have had big rebounds since the Coronavirus crash, but the various challenges of this pandemic era we’ve lived through have created some issues for some companies that won’t last forever. Three of the stocks I put forward today are affected in this way.

To arrive at my 5 best of breed stocks with more than 10% upside inside a year, I’ve selected an industry and asked what company is the king pin. Then I looked to see what the analysts surveyed by FNArena think lies ahead for these companies.

For infrastructure, I looked at Transurban (TCL) but it only has 2.5% upside, if you believe the experts that drill down a lot harder than most of us.

My research dug up the following five best of breeders:

Looking at these companies as a group, the average predicted return is around 11% plus franking, so I reckon there’s a prospective return of 13% over the next year holding these 5 best-of-breed companies for their respective industries.

To understand the potential of these 5 companies, I’ll look at the 5-year chart of their share prices to see if there are other reasons to support these companies with our hard-earned income.

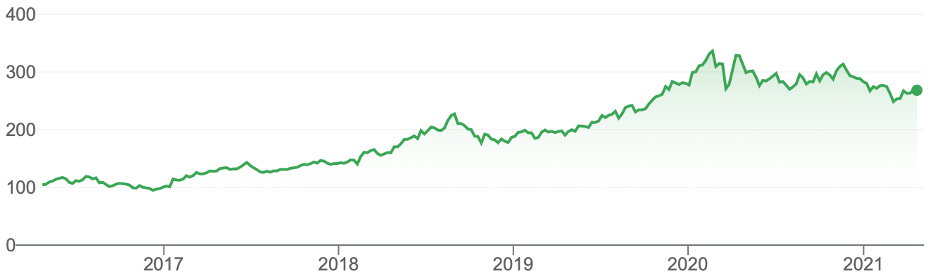

1. CSL

CSL finished Friday at $269.07. The most bullish analyst came from UBS and had a target of $330. The most bearish was from Ord Minnett and the predicted price was $266.20 but he was still saying “hold” the stock.

CSL

The 5-year story is so convincing about the quality of this company, which has been challenged by the pandemic with blood plasma collections in US cities disrupted by the virus’s impositions. I’m with the UBS expert.

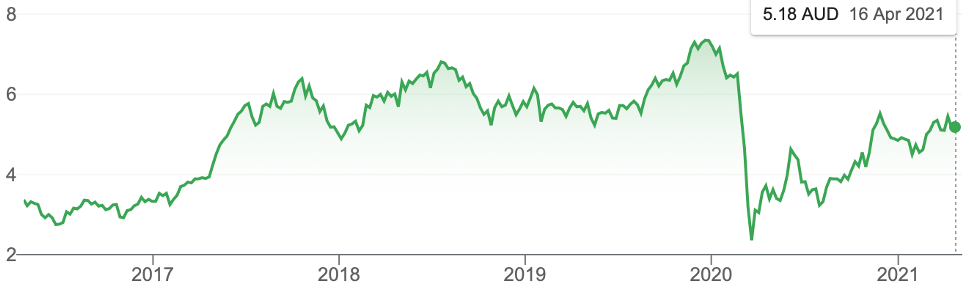

2. A2 Milk

A2 Milk is a company that has three downgrades and some quarters of the market tip another one is possible. Not helping the company is the lack of Chinese tourists, which used to number over a million a year before the Coronavirus came to town. This has robbed the company of the daigou trade, which was like ‘cream’ on the company’s cake — excuse the pun. Internationally, it is seen as best-of-breed and I’m invested on the expectation that this mad market mess won’t last for too long. And the analysts agree, with a 12.9% average target rise for the infant milk business, which implies that the current share price of $8.15 can climb to $9.20. But Morgan Stanley’s expert is looking for $11! That would be a 33.7% upside if this is a good call.

A2 Milk (A2M)

I don’t like that big fall from grace but given this was a $20 stock over the past year, seeing this company rebound to $11 on some good reopening trade news over the next 12 months doesn’t seem like too aggressive a call.

3. Qantas

And while on the reopening trade, Qantas is undoubtedly best-of-breed and will be a big beneficiary of international borders opening up again. And with the experts tipping a 12% rebound, it looks like an easy play for any investor keen to build up a portfolio based on quality operations.

The current share price is $5.18. The conservative target is only $5.80 but four out of the seven analysts think this price will soar over $6 with Macquarie’s analyst tipping a $6.45 price! Only Credit Suisse disagrees about the airlines share price tipping it to fall to $4.15, which has brought the average price target down.

Qantas (QAN)

Before the Covid-19 crisis this was a $7.34 and so a $6 call within the year does not look too ambitious. Also I believe Virgin Australia is going to be a less competitive operation under the new ownership, which should make it easier for Alan Joyce at Qantas to build better profitability.

4. NEXTDC

NEXTDC is a quality tech company, which is really an infrastructure business for the information super highway called the Internet with its new age operation basis called “the cloud”. The cloud actually lives inside NEXTDC’s factories and this operation is bound to grow as digital disruption will redefine the way we do a business, buy and live. One of the portfolio managers at that high-performing US fund manager, WCM, which has listed funds here, mentioned in a presentation recently that “digitisation is only in its infancy”!

If that is right then NEXTDC’s growth trajectory will keep on mimicking its five-year chart or maybe it will be even better!

NEXTDC (NXT)

The Friday share price was $11.90 but the target price of the experts was $14.08, which implies an 18.4% gain, but UBS expects to see a $15.40 stock price, which could easily happen given the economic boom I’m and others are predicting worldwide.

5. Telstra

My final quality company with nice upside is Telstra and here the analysts expect a share price of $3.78 as against a Friday close of $3.43 — that’s a 10.4% predicted gain. I know Paul Rickard and myself locked onto TLS when it was around $2.70 in November and we were happy to predict a $3.50 price was on the cards, however Ord Minnett and Morgan Stanley both see it hitting $4!

Telstra (TLS)

I must confess that I’ve been tempted to take my profit and run but these calls of a higher share price and the nice dividend, given I bought in at a low price, makes me think I will stay a little longer for the ride. That five-year chart does not scream “stick with Telstra” but there are market perceptions that the telco has better times ahead.

Given its shocking past performance, I hope the market experts that analyse TLS are on the money.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.