In case you don’t think about the big picture when it comes to stocks, there is a ping-pong game going on between the usual suspects — bears and bulls, pessimists and optimists, as well as short-sellers and long-only players. “Bulls say inflation and consequently long-term bond rates have peaked and so it is time to buy on the dip,” explained market-watcher and Visiting Professor at the Institute of Public Policy and Governance, University of Technology Sydney. “Bears say central banks are determined to quash stubbornly high inflation by lifting the cash rate and tightening liquidity, so the market has further to fall.”

I’ve always been in the camp that inflation will dissipate over 2022 and the expectations about a crazy number of interest rate rises will be peeled back as inflation falls. This will effectively make those who sold off growth stocks on the basis of crazy rate rise guesses will then become buyers to bring the stock price up to a more reasonable and rational level.

You can imagine how much better I felt about my minority call on rates when the CEO of our biggest bank came out publicly saying the same thing! This is how the AFR’s James Eyers saw this call: “Commonwealth Bank of Australia CEO Matt Comyn says home-owners may be worrying unnecessarily about the pace of interest rate rises over the next 12 months, because he has confidence in the bank’s forecasts that the cash rate will rise to only half the levels predicted by the market.”

Of course, Matt Comyn doesn’t have a mortgage on being right on interest rates but he’s a smart guy with a pretty good snapshot of what’s going on in this economy, looking at the bank accounts and trends at the CBA. I doubt whether he would try to guess our economic future without factoring in what he’s seeing in the US economy, Wall Street and his rivals in the big banks of the Big Apple and the world.

I also suspect he’s not ignoring the likelihood of China getting out of its chronic pandemic lockdowns (which is inflationary) and when the Ukraine war will stop elevating inflation as well.

If inflation starts to fall to lower numbers (i.e disinflation), then there could be rethinking on the number of interest rate rises here and in the US, which will be important for economic growth, recession fears, business as well as consumer confidence and, ultimately, the stock market.

So the investor’s question is: when will there be a rotation out of the stocks that are popular now (miners, energy businesses, commodities, value stocks and defensives) into beaten up growth stocks, which here means tech, health and consumer discretionary?

Answer? I don’t know but it will start with a vengeance if Matt Comyn and I are right and the number of interest rate rises end up being less than was predicted.

Note that even Chris Joye, who’s tipping a 20% or higher shakeout for stocks, admitted to two things in my recent interview.

First, the number of interest rate rises ahead over the year will be less than the biggest and scarier calls out there.

Second, another rally for stocks is possible in that context later in the year, though it’s not his base case.

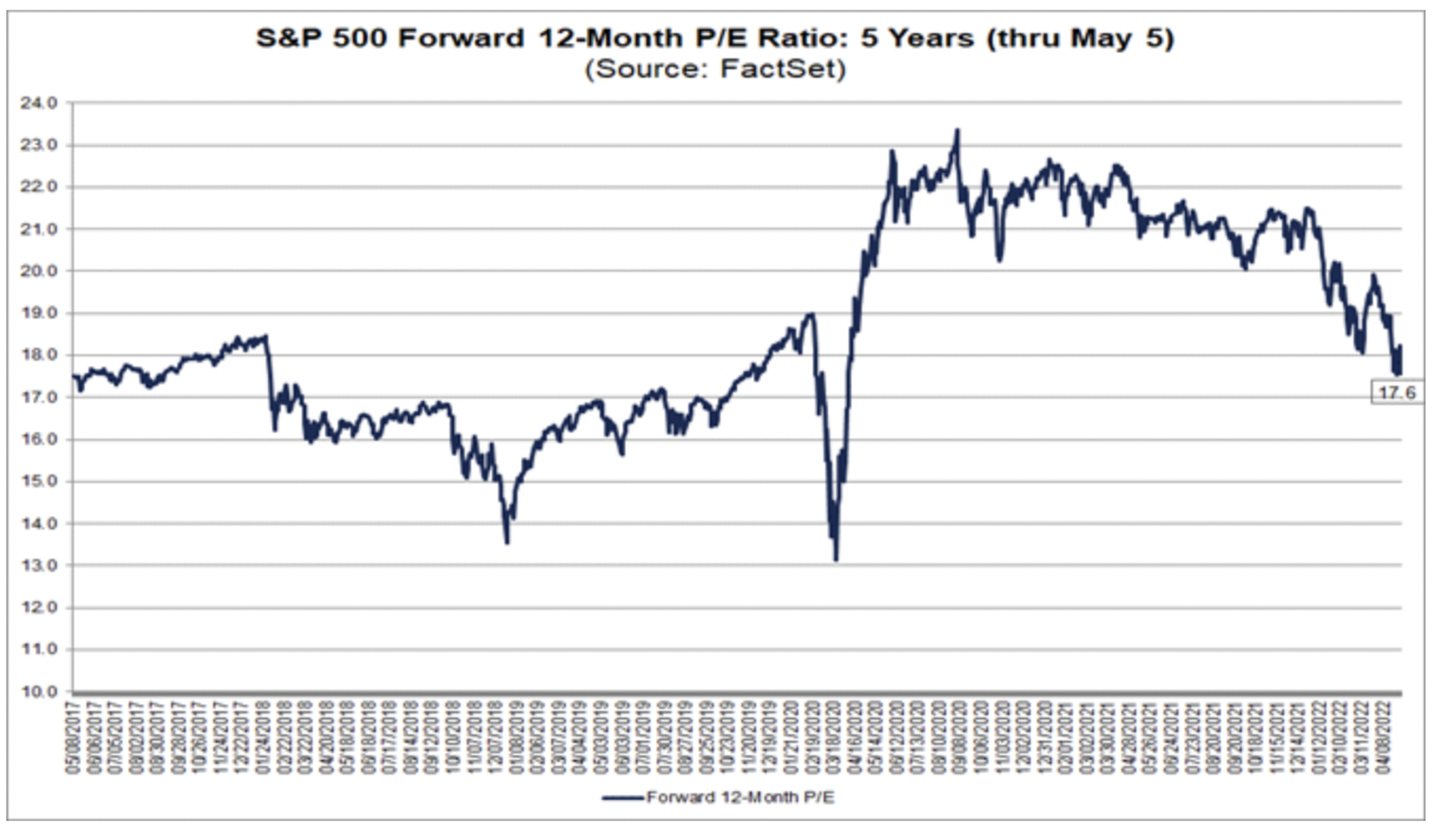

I don’t disagree that an equities shakeout will eventually happen in the US in particular, but a lot of it has happened, as the chart below shows.

S&P 500

That huge gain out of the Coronavirus crash needed to (and still needs to) be brought back to reality, but if you take out the over-bought tech stocks, the PE of the S&P 500 Index puts many of these non-tech companies in the buy zone. The equal-weight S&P 500 PE is now 15, which says the non-tech part of the market is not overvalued.

After big falls in stocks a week ago the forward 12-month P/E ratio for the S&P 500 fell to 17.6 from 18.2. How does this 17.6 P/E ratio compare to historical averages?

The forward 12-month P/E ratio of 17.6 on May 5 was below the five-year average of 18.6. However, it was still above the next four most recent historical averages: 10-year (16.9), 15-year (15.5), 20-year (15.5), and 25-year (16.5).

Importantly, the forward 12-month P/E ratio of 17.6 on May 5 was still well above the lowest P/E ratio of the past nine years of 13.1 recorded on 23 March 2020 but don’t forget that these past numbers for PE were created in normal interest rate environments. This is why I think we can live with higher PE’s until interest rates get a lot higher.

Factset.com tells us: “On January 3, 2022, the S&P 500 closed at a record-high value of 4796.56. The forward 12-month P/E ratio on that date was 21.4. From January 3 through May 5, the price of the S&P 500 decreased by 13.5%, while the forward 12-month EPS estimate increased by 5.7%. Thus, the decrease in the “P” has been the main driver of the decrease in the P/E ratio since January 3.”

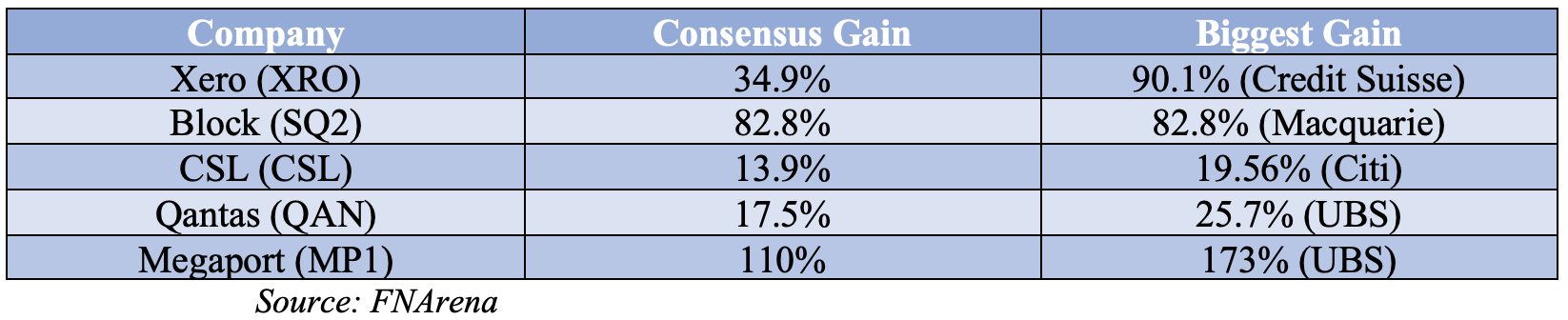

Provided earnings keep surprising on the high side and interest rates don’t increase at crazy rates, there’s scope for share prices to rise in the second half of this year and I’m looking at beaten-up quality plays. Here’s my list, along with what the brokers think about these stocks going forward.

I don’t expect to get a pay-off from many of these in the next few months but I do over the next year, especially if the heat is taken off excessive interest rate falls, the Ukraine war ends and China’s better outlook for dealing with the virus keeps progressing. Then we could see a turnaround in stock market sentiment that we saw here on Friday, and for both Thursday and Friday on Wall Street.

The 6% rise of the Nasdaq last week was a sneak preview of a notable market rebound that will happen sometime this year if inflation drops along with the number of doomsday-merchant predictors of too many interest rate rises in a short period of time.

Rates should rise over time, but not over the shorter timeframe that has led to many thinking that it could lead to a recession, which is never good for stock prices. Our stock portfolios are in the hands of central bankers, so it’s fingers crossed that they get it right.

I’m investing that they will.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.