The US earnings season has clearly been better than the lowered expectations ahead of it. The consensus earnings forecast “bar” as such had been lowered and the vast bulk of US equities have beaten consensus expectations. This development, combined with the view that the Federal Reserve may even cut interest rates this year, has driven US equities back to all-time highs.

While there’s a lot to digest in the US reporting season due to the vast depth and breadth of the US economy and equity market, today I thought it would be useful to focus on what I thought was one of the standout results from the season.

Microsoft (MSFT) today is the largest company in the world, with a market capitalisation of $1 trillion US dollars. Its business has traditionally been focused on manufacturing, selling, supporting and licencing software products like the Windows Office program, however since Satya Nadella came to the helm as CEO in 2014, the strategy has been to deprioritise Windows (which made the company a household name) and focus on things like Cloud, AI, subscription services and gaming. Commercial cloud has been especially important and has grown at an 85% CAGR since FY13. There’s every chance these trends continue over the next decade as the US continues to digitise its economy (currently only ~30% of US GDP is digitised) and software continues to “eat the world”. MSFT is well positioned in key secular growth trends such as Public Cloud, Machine Learning and the Internet of Things, which should see it move well through the $1 trillion market cap “glass ceiling” in our view.

MSFT’s 3Q19 results showed it is clearly gaining “IT wallet share” in both the commercial and consumer segments. The positioning in key secular growth trends is driving double digit top line growth and solid execution is squeezing increased operational efficiency and margins out of the business and continues to drive double digit EPS growth. Management has confidence in the durability of double-digit EPS growth through FY20.

MSFT remains undervalued vs its technology peer group, with the stock trading on a price to growth ration of 1.6x. It’s also worth remembering that MSFT has a fortress balance sheet with $60b in net cash. The company pays a 1.5% dividend yield and has bought back $17bn in stock over the last 12 months.

MSFT is a classic example of a dominant business that is actually increasing its dominance. The so called “moat” around its business is expanding and leading to margins expanding, profit growth and returns to shareholders accelerating in the form of dividends and buybacks.

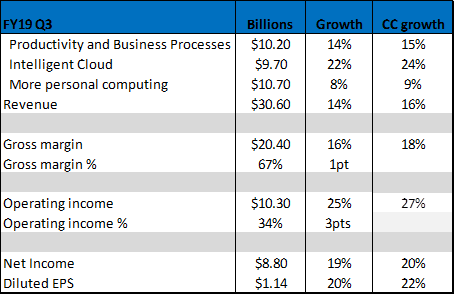

Summary of Microsoft’s results:

Source: Microsoft, AIM estimates

The growth rates above are outstanding for a $1 trillion market cap company. Also take note of the gross margin of 67% and EPS growth of +20%.

In terms of the Q3 result, we think the highlights were:

- Another acceleration in commercial

Commercial cloud revenue grew 43% year-on-year in cc to $9.6 billion, a slight deceleration from 47% year-on-year growth in cc last Q.

- Hybrid story powers intelligent cloud strength

Q3 Azure growth of 75% year-on-year cc proved durable vs. 76% year-on-year in Q2. Together, Server Products and Cloud Services revenue grew 29% year-on-year cc from 24% cc in Q2.

- Commercial office growth improves

Office 365 commercial business again benefited from strong seat growth (+27% year-on-year), driving 31% year-on-year cc growth in Commercial Office 365 revenues, relatively in line with 33% growth last quarter. With Office 365, dollar gains well offsetting the dollar declines in Office product revenue, the overall Office commercial franchise grew 14% year-on-year cc in 3Q19, an acceleration from 11% year-on-year cc in 2Q19.

- Windows OEM rebounds

Windows OEM (which is preinstalled on new PCs) revenue rebounded to 9% growth, up from -5% year-on-year last Q, with Windows OEM Pro +15% in 3Q19 vs. -2% in 2Q19, ahead of the commercial PC market, and Windows OEM non-Pro down only 1% year-on-year. Management noted better than expected Q3 commercial PC demand, while improved chip supply drove a bounce back in purchases in both the Pro and non-Pro OEM businesses after constraints in Q2.

- Commercial cloud margins continue to improve

Despite continued strength in Cloud and Surface hardware revenue, overall gross margins improved ~130 bps year-on-year to 66.7%. Commercial Cloud Gross margins increased to 63% year-on-year from 58% in Q3 last year as a material improvement in Azure gross margin offset an increased mix of IaaS and PaaS within total commercial cloud.

- Operating margins continue moving higher

Overall company operating margins improved 290 bps year-on-year to 33.8%, with 9% opex growth vs. 14% revenue growth. MSFT benefited from outperformance of high margin businesses, such as Windows OEM and Server Transactional.

Other financial highlights include:

- MSFT returned $7.4b to shareholders, which is up 17% year-on-year, with $3.9b in share repurchases and $3.5b in dividends.

- Operating expenses were $10.1b, up 9% year-on-year driven by investments in cloud, engineering, LinkedIn and GitHub.

- Effective tax rate was 16%.

- Capex expenditures were $3.4b to support growth in cloud offerings. Cash paid for property and equipment was $2.6b.

- Cash flow from operations was up 11% year-on-year driven by higher collections from customers following billings growth. Free cash flow of $11b was up 19% year-on-year.

The MSFT investment thesis remains compelling in my opinion. The company has a strong position for ramping up public cloud adoption, large distribution channels and installed customer base. Margins are improving. Top line drivers include Azure, data centres, Office 365 (base growth and per user price lift), and the integration of LinkedIn drive durable double-digit revenue growth over the next three years. With improvement in gross margins, continued opex discipline and strong capital return, I see potentially three more years of double-digit total returns from MSFT.

MSFT trades 22x FY20 consensus earnings. Those consensus earnings forecasts will prove conservative as MSFT remains in a “beat and raise” upgrade cycle. The chart below confirms the close correlation between the FY20 consensus MSFT EPS estimate (red line) and the MSFT share price (white line).

All in all, MSFT is one of the best businesses in the world with multiple structural growth drivers. It has a wonderful balance sheet, excellent leadership and compelling investment metrics.

The world simply can’t open for business each day without Microsoft’s products and services. If you want to own one technology stock that has exposure to all the key structural growth themes, it is MSFT. MSFT remains a key holding for the AIM Global High Conviction Fund.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.