Over the upcoming holidays, I’m going to revise my portfolio of stocks and will dump some and replace them using one of the most impressive investment strategies I’ve ever come across. I learnt about it a few years ago, and anyone who’s been to any of our investment events has also encountered this really smart way of investing but maybe hasn’t allowed it to review their holdings.

The strategy underpins what the US-based fund manager WCM does in picking companies for its funds. Here in Australia, there’s an ETF-style fund with the ticker code WCMQ, a listed company WQG and a recently listed long short fund WLS.

WCMQ

Listing in late August 2018, this ‘stock’ is up 76% in a little over three years. This Laguna Beach-based fund manager has two standout filters that determine the stocks they select. First, they seek best-of-breed businesses that are leaders in their industry and have a growing moat. The moat refers to the company’s competitive edge and by wanting a growing moat, it implies this is a business with a good future for profit and higher share prices.

The second filter is one WCM has developed to assess the culture of a business. This is harder to do with many unknown smaller companies but they have developed the intellectual property to do so. It’s thought the culture is critically important for the success of a company.

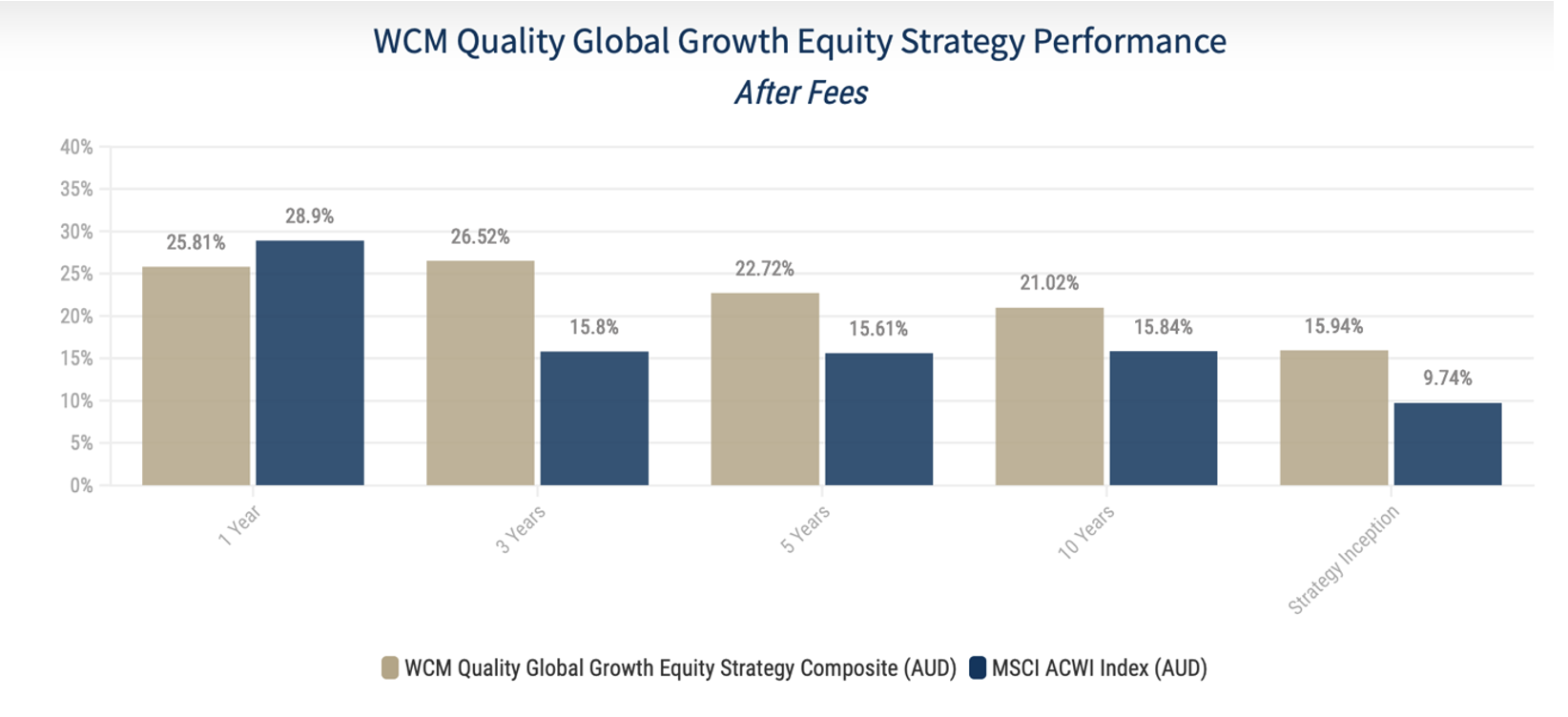

Here’s the long run showing of WCM and the numbers imply their filters and stock selection process undoubtedly has merit.

So over the holidays, I’m going to put my stock holdings through the easiest filter to assess, namely: is the company best-of-breed, leading its industry and a growing competitive edge? If weak performers don’t come close, they’ll go. Some core stocks like the banks will be kept because I bought them cheaply but who knows, over time, they might get replaced with better companies with big futures?

That said, none of the companies I’m seriously assessing will replace the CBA going forward but a lesser bank might cop it!

I can’t easily do a culture test but maybe over time, I can have a crack at it by interviewing the CEOs as a start. That will be a high priority after the February reporting season.

The first company is Megaport (MP1), which was the pick of Eleanor Swanson of Firetrail Investments at the Sohn Hearts & Minds conference. Here’s what the website for the conference reported about her selection:

“She said Megaport was ‘the most exciting tech adventure this decade’. She said its network was faster, more flexible and much cheaper than those of traditional telecommunications companies and had loyal customers who continued to increase their spending by 50 per cent a year.

“She said the company, which is currently trading around $20 a share, with a market capitalisation of $3 billion, had the potential to double its share price to $40 giving it a market capitalisation of more than $6 billion by the end of next year.

“Swanson, an early enthusiast for Afterpay at Firetrail, said Megaport was now growing at 30 per cent a year and was doubling the size of its potential market share to $14 billion. The company has delivered a return of 55 per cent over the past 12 months.

“But she said its recent deals with five US networks including Cisco and VMware had given it a ‘sales force army’ of 40,000. She said Megaport’s customer base was set to take off as ‘more than 40,000 salespeople pounded the pavement telling businesses around the world about their story’. In 2022, Megaport will work with the giants of industry to deliver a better network to thousands of businesses. The little challenger network is now on the precipice of greatness.”

Those who I’ve interviewed on the company say its tech is way above any of its rivals so it looks like it might pass the growing moat test.

Interestingly, the consensus of analysts sees a 9.8% downside but Macquarie’s expert thinks there’s 14.29% upside.

Swanson must see more and you can watch her interview on tonight’s Switzer Investing show on YouTube.

The second company that seems to have a technological advantage over its rivals and therefore a growing moat is Audinate (AD8). Here the analysts think there is a 23.4% upside, with Morgan Stanley the most optimistic with a 31.5% gain seen ahead.

Michael Wayne of Medallion Financial has been a big fan of this company, which he says has a virtual ‘monopoly’ in the private provision of a service akin to Bluetooth but “it’s better quality”. (Bluetooth is managed by the Bluetooth Special Interest Group (SIG), which has more than 35,000 member companies in the areas of telecommunication, computing, networking, and consumer electronics. The IEEE standardized Bluetooth as IEEE 802.15.1, but no longer maintains the standard.) Check out Michael’s take on AD8 on my 5 November 2021 Switzer Investing show.

Apart from leading-edge technology, AD8 also is seen as a reopening trade stock as its tech is used in events, outdoor concerts and so on, which have been hard to put on since the arrival of the Coronavirus.

In this interview, he points out that the company has suffered from the supply chain problems linked to microchips but that won’t last forever.

I think AD8 has a good moat and is a good chance of growing it over the next couple of years, in an industry that has a winning future tagged all over it.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.