With tech stocks likely to have a good week following a strong rise of the Nasdaq on Friday (up 183 points or 1.23%) while we were sleeping, it might be timely to look at how our WAAAX and ZEET stocks have performed since I coined the term ZEET.

The news out of the US that helped tech stocks spike was the address from Fed boss Jay Powell, who virtually said not to expect an interest rate rise anytime soon. Interest rate rises hurt tech stocks because there’s a belief that their share prices reflect future earnings, and these are worth less iin today’s dollars when interest rates are higher. (I think it’s an overreaction in the initial stages of rate rise talk, but eventually as more increases happen, it makes more sense. But it is what it is.)

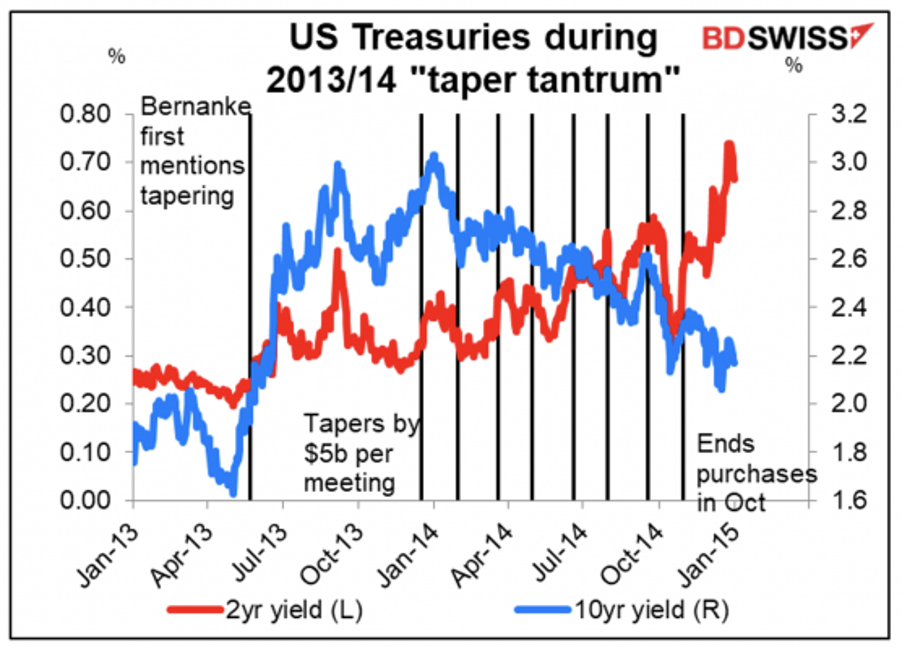

Powell’s message has many thinking tapering (i.e. less bond purchases) will happen in September but most think December. The last time the Fed cut back on bond purchases it caused what was called the “taper tantrum”. That was 2013-14 and the 10-year bond yield popped higher and the stock market sold off as a reaction.

Source: Nasdaq.com

Nasdaq

But the negativity didn’t last and actually was a buying opportunity for the longer-term investor. Remember the bond purchases are only reduced or ended because the economy is doing well and doesn’t need central bank help.

I suspect tech stocks can do OK until tapering starts. Then there will be a sell off but the good ones will resume their upward valuations. Why? Because they’re often relatively young businesses and are businesses of the future.

Need proof? Well, think about Afterpay, Tesla and Zoom, which wouldn’t have even be dreamt about as being successful market leaders 10 years ago.

So let’s do a check on how the WAAAX and ZEET stocks have done since I first came up the idea of ZEET and wrote about it on 29 May 2020.

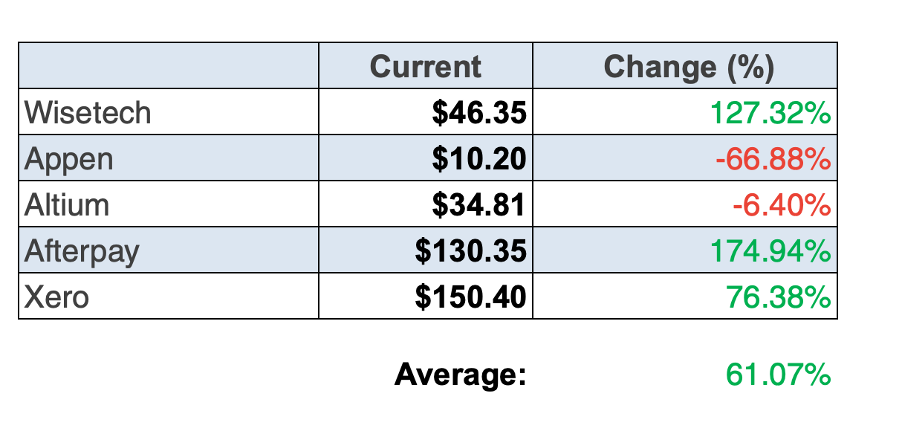

WAAAX stands for:

- Wisetech (WTC)

- Afterpay (APT)

- Altium (ALU)

- Appen (APX)

- Xero (XRO).

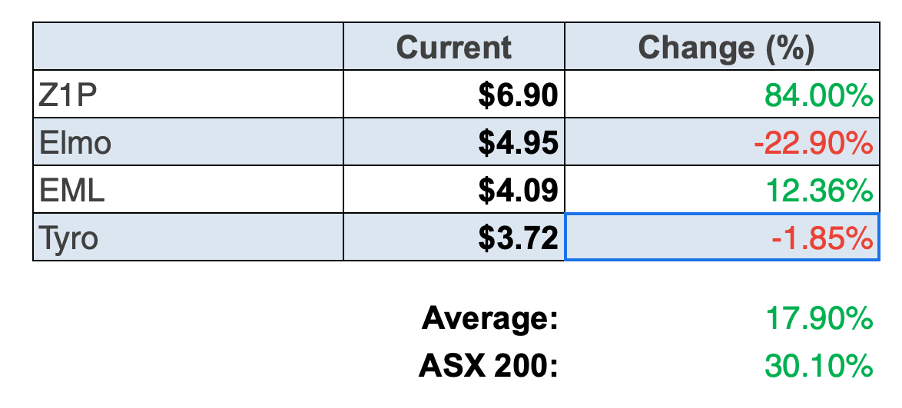

Furthermore, ZEET stands for:

- Zip Co. (Z1P)

- EML Payments (EML)

- Elmo Software (ELO)

- Tyro Payments (TYR).

Since writing, WAAAX is up 61.07% and ZEET 17.9%, while the S&P/ASX 200 was up 30.1%. Interestingly, some months ago, the ZEET stocks were up 45% and the WAAAX stocks were struggling just over 20% and lagged the S&P/ASX 200 Index, which was up about 25%.

Since then, EML copped a speeding ticket from the Irish central bank that hurt its share price. And Tyro copped an unfair hedge fund report that took its share price down 30%, but it has recovered 60% since then!

ELO hasn’t been helped by lockdown and the slow reopening of the economy and Z1P is up 84% since May of last year.

These tables teach us a number of lessons. Appen and Altium show us that diversification with three of the five WAAX stocks more than makes up for the two strugglers. By the way, the analysts believe these two companies have a positive future.

FNArena’s survey of company analysts says Appen has a 46.3% upside and Altium has a 1.4% gain ahead. This company could surprise the consensus of experts as Credit Suisse thinks there could be a 20% rise ahead for its stock price.

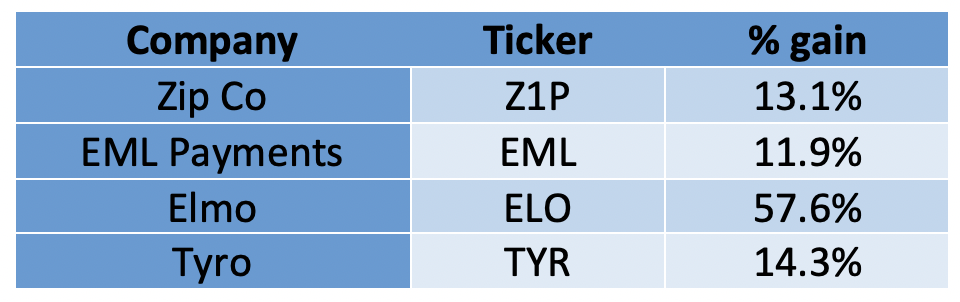

For the ZEET group, the analysts have pencilled in the following gains:

Clearly, the experts can be wrong but they do more work on these companies than most of us, and the bottom-line message is that these businesses look to have a positive outlook.

On 26 April I wrote a story suggesting you could make you own tech fund by adding WAAAX to ZEET and then throw in Megaport (MP1), Next DC (NXT) and Nuix (NXL).

If you’d put $1,000 into each, you’d be down $90 and if you’d put it into an S&P/ASX 200 ETF, you’d be up about $720 or 6%.

If you’d added ZEET to WAAAX on 29 May, you’d be up 61% plus 17.9% (or about 40%), while the S&P/ASX 200 Index ETF is up 30%.

All up, there are strong cases for a diversified tech portfolio and for underpinning your more speculative investments with an ETF for the overall index or some quality managed funds that give you diversification and exposure to lots of sectors.

You could even build your core holdings based on quality income-paying stocks, which, of course, was the basis for SWTZ, which is actually up 8.2% since 26 April.

Once your core holdings are set, buying good tech companies when they’re under selling pressure isn’t a bad investing idea.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.