A colleague’s portfolio has always been pro-growth and diversified and it provides good returns through the cycle, but he’s been toying with going excessively pro-growth now for a big pay-off later this year, when he expects growth and tech stocks to boom. Yet experts such as Chris Joye say that his economics team predicts a serious US and global recession by late 2023 or early 2024. As Billy Joel might say, they could be right, they could be wrong or they could be crazy!

Forbes’s Kristin McKenna looked at the three reasons why long-term investors should be optimistic. It won’t surprise you that I liked what she dug up. She reminded us that 2022 was the worst year ever for bonds and the seventh worst year for US stocks. My history readings say we should expect a rebound of these markets in 2023 to 2024.

Here are her main points worth noting:

- For the S&P 500 (which lost 18.2% last year) over 37% of years the index ended with a return north of 20%, while “…on average, stocks and bonds end the year with positive returns roughly 75% and 89% of the time, respectively.

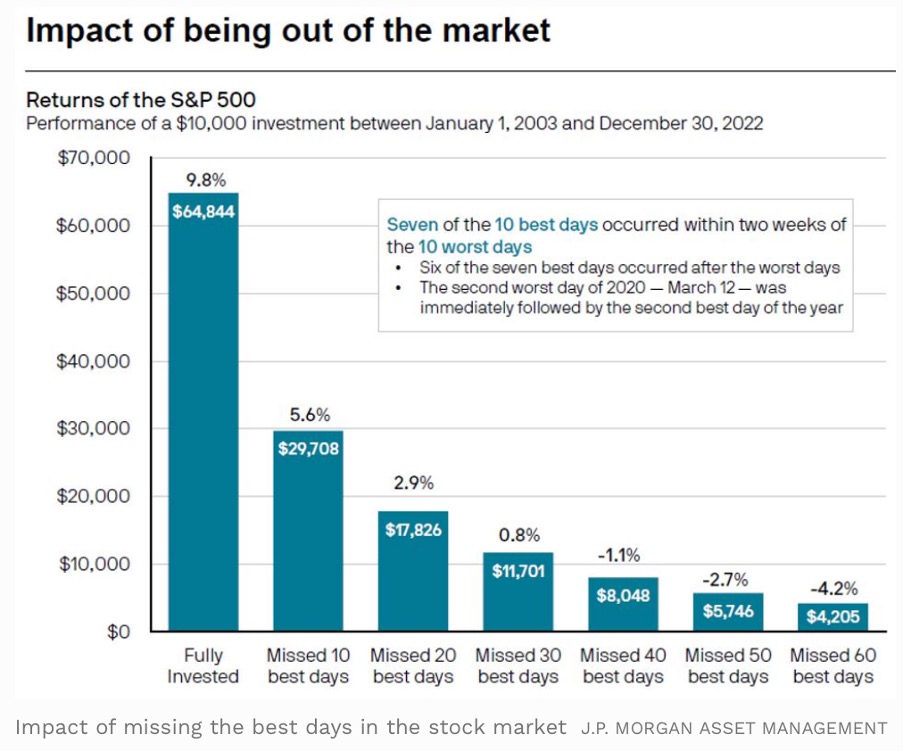

- While Joye says cash and high-grade bonds are the wiser play later this year, McKenna reminds us that “…70% of the best days for the S&P 500 fell within just two weeks of the worst days.” She makes the point that stock markets can turn on a dime. This chart from JP Morgan paints an important picture for investors.

McKenna also runs the argument that I’ve often put forward that “stocks and bonds have, historically, rebounded the year after a down year.”

Average returns for both equities and fixed income have been positive the year after posting extreme losses.

- Last year was only “the third time everstocks and bonds were both negative to end the year.” History has shown that being diversified, holding stocks, bonds, property and cash/term deposits pays off long term and generally most years than not. And this is a ripper chart below showing that it has only ever been three years that stocks and bonds fell at the same time!

And while bond returns have been negative in 2021 and 2022, Blackrock research says bonds have never lost money three years in a row. While the Great Depression was one example of stocks down four years in a row, the dotcom crash of 2000-2002 saw three down years of losses on a trot. But aside from those, there has only been one case of back-to-back losses and that was in 1974 and 1975, which coincided with the oil crisis and runaway inflation.

So that’s the good argument for having faith that stocks and bonds will come good this year and next. Chris Joye in the AFR wrote another of his “beware” columns. As I can’t afford to be one eyed in my coverage of market issues for you, I need to give you the other side of the story.

Since January 2022, the economics team at Coolabah Capital has tipped a US and global recession in late 2023 or early 2024. Chris says their models are still telling the same story. Fortunately, economists aren’t always right! Let’s hope these guys get trumped by sensible central banks who raise interest rates by the right amount and end up with a short recession or slowdown.

Helping his ‘disaster’ story is his belief that central banks won’t or can’t bail out the world by creating easy money because the fight against inflation is too important. That’s probably true but you can never underestimate the power of the White House over the Federal Reserve, especially when an election is due in 2024 and Donald Trump is stalking President Biden.

The fight against inflation has made high-grade bonds really attractive, but, for the moment, stocks aren’t dumped to chase them. This is how Joye puts it: “…less sophisticated investors are continuing to allocate capital to assets trading on inferior yields to cash and government bonds with vastly higher probabilities of loss and little-to-no underlying liquidity, which makes scant sense.”

What are they investing in? Try residential property, commercial property, private equity, venture capital, high-yield debt and private loans.

He sees a crunch coming for those heavily in debt that will creates a recession but central banks will be afraid to cut rates because of inflation. It could continue to hike if core inflation doesn’t fall.

By the way, Joye’s economics team is at odds with the likes of Westpac and CBA, who see our central bank cutting rates either late in 2023 or early 2024, just when Chris thinks a US/global recession will happen.

So, the question is this: will central banks follow Joye’s script and permit a serious recession and keep hiking rates? My gut feeling is a recession historically burns inflation out of an economy and therefore interest rates will be cut. The economist who tipped the GFC crash, US-based Nouriel Roubini, agrees.

He told an AFR Business Summit last week that central banks will “wimp out and blink on inflation” to avoid a serious economic and financial crisis.

The debt in the system that was used to save us from a pandemic-induced financial and economic collapse, means raising interest rates to beat down inflation will smash everything. He thinks we will have to get used to higher inflation and we could see a rerun of the stagflation of the 1970s, when inflation and unemployment remained high.

I think Roubini is right. While I’d love to place big bets/investments on a big bounceback in the stock market over 2023 (especially tech stocks) I will need to see inflation fall at a faster rate before I can go in with my ears pinned back. For my portfolio, I’ll maintain a diversified strategy and only swing to a heavy growth-oriented position when I see inflation drop more than expected.

And it might be time to give myself some exposure to high-grade bonds, just for insurance purposes.

P.S. Chris Joye’s team manages the Switzer Higher Yield Fund, so when it says cash and high grade bonds will do well, I hope he’s talking about SHYF!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances