History says that global software company Nuix (NXL) is in for a tough 12 months. Switzer Report expert and veteran IPO watcher Tony Featherstone says that IPO darlings who “bomb” on the first real occasion do it very tough on the ASX over the next 12 to 18 months. Credibility, when lost, is hard to regain.

Last year’s biggest and most successful IPO, Nuix, is a case in point. Following an IPO price of $5.31, the shares soared to a first day close of $8.01 on 4 December. By 25 January, they had reached $11.45, valuing the company at $3.6 bn. Then came a disappointing maiden half-year profit report on 26 February and a further profit downgrade last Wednesday. After trading as low as $4.20, the shares closed on Friday at $4.61.

Nuix – 12/20 to 4/21

So will Nuix follow history and wallow over the next 12 months, or is it a buy now? Let’s starts with a recap on the company and its prospectus forecasts.

The Nuix story

Nuix is a provider of investigative analytics and intelligence software. Its software helps customers to process, normalise, index, enrich and analyse data from a multitude of different sources.

Principally used with unstructured data (for example, a collection of emails or chat messages), the inhouse developed software of the Nuix Engine assists customers to solve complex data challenges. Examples include investigations relating to the Panama Papers, the Banking Royal Commission, organised crime rings, corporate scandals and terrorist activities.

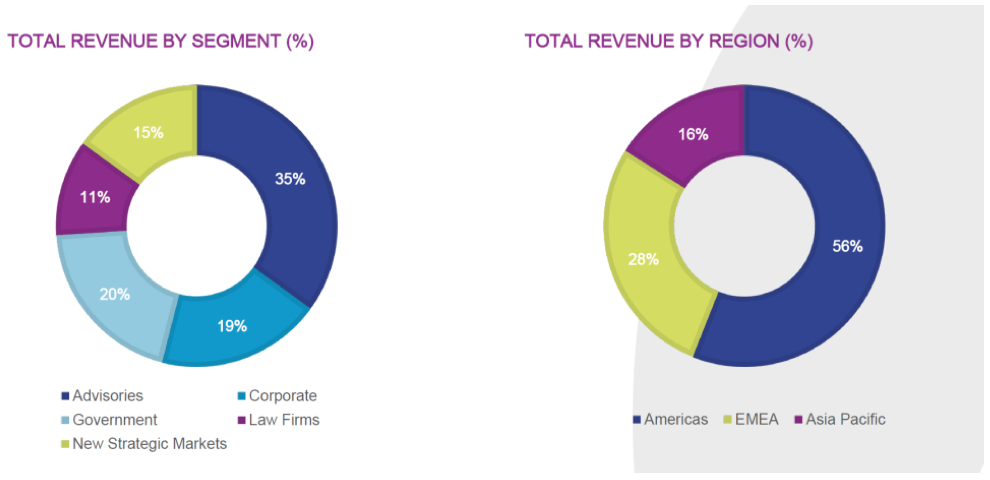

As of 30 June 2020, Nuix had more than 1,000 customers in 78 countries including large government agencies, regulators, corporations and professional service firms. Marquee customers include AIG, Amazon, Grant Thornton, “big 4” accounting firms, ASIC, the SEC and the United States Department of Justice.

Nuix primarily competes in the eDiscovery software market (the process of analysing electronic data for the purposes of litigation or regulatory investigations), and the smaller digital forensics software market. It is an emerging player in the larger governance, risk and compliance software market and the endpoint security software market. Each of these market sectors is forecast to grow at a compound annual growth rate of 3.6% or higher.

It says that its competitive advantages include that it has the fastest digital processing engine that can review the most file types, handle the largest volume of data and has more extensibility across use cases. Nuix customers rate it for the richness of functionality and quality and promptness of customers and technical support.

Nuix’s growth strategy is to win new customers and market share by expansion into targeted industries and regulated verticals such as financial services, pharmaceuticals, energy and utilities; an industry centric “land and expand” strategy to drive acquisition, upsell and renewal of existing customers; investment to extend the Nuix platform; operating efficiencies; building a network of strategic partners who can provide complementary delivery and market expansion capabilities; and value accretive M&A.

The IPO and Macquarie selldown

Conceptualised in the early 2000s, Nuix entered the North American market in 2007. In 2011, Macquarie Corporate Holdings first invested, and by the time of the IPO is December 2020, owned 76.2% of Nuix’s shares.

All up, $953m was raised through the IPO by the issue 179.5m shares at $5.31 per share. $677m was paid to selling shareholders, with the remainder used to pay option holders to cancel existing options, repay borrowings, cover offer costs and increase working capital.

At the conclusion of the IPO, the investing public owned 56.5% of the company and existing shareholders owned 46.5%. Macquarie retained a 30.1% holding. It and 5 other shareholders (representing 37.9% of the ordinary shares) have entered into a voluntary escrow arrangement. Under this arrangement, they can’t deal in their shares until Nuix releases its FY21 results in August 2021.

On a price of $5.31, Nuix was priced on a multiple of 9 times EV/Revenue (enterprise value to forecast FY21 revenue), and 27.5 times enterprise value to forecast FY21 EBITDA.

The company forecast total revenue for FY21 of $193.5m, Gross Profit of $166.7m, proforma EBITDA of $63.6m and proforma NPAT of $20.0m. With IPO and other costs, statutory NPAT for FY21 was forecast to be a loss of $7.7m.

Over the period from FY18 to forecast FY21, the compound annual rate of growth (CAGR) in revenue was forecast to be 19.4%. For EBITDA, the CAGR was 64.0%.

April Trading Update

Nuix reaffirmed its prospectus forecasts when it announced its first half result on 26 February, However, first half revenue of $85.3m was much weaker than the market expected (44% of forecast total). Further, an additional key revenue metric of annualised contract value or ACV (essentially, the 12 month equivalent value of all revenue from the sale of software licences at the end of the period) of $162m was short of market expectations.

Last week, Nuix formally revised its forecasts. It said that revenue for FY21 was now expected to be $180m to $185m ($193.5m in original forecast), annualised contract value of revenue to be $168m to $177m (prospectus forecast of $199.6m) and EBITDA of $64.6m to $66.6m (prospectus forecast $63.6m).

Nuix blamed a shift in the licensing model, with a number of customers electing to transition from module based subscription licences to consumption and software as a service (SaaS) licences. Near term, this was a negative for revenue and ACV, but long term, more SaaS business would be a positive.

It said: “Some of Nuix’s law firm, advisory and service provider customers have informed Nuix of a reduced add-on (upsell) requirement for existing licences. This is due to both their unutilised licence capacity in the current climate, as well as the recovery in legal case backlog being slower than anticipated”.

Despite the fall in revenue, EBITDA is tracking higher than forecast due to lower headcount, reduced travel costs, and a FX benefit from USD costs.

What do the brokers say

The only major broker who covers the stock is Morgan Stanley, who was the lead manager at the IPO in December. They have a target price of $7.50 (recently lowered from $10.75). This is FN Arena’s precis of their analysis following the trading update last week:

“Morgan Stanley lowers the target price to $7.50 from $10.75. Management lowered FY21 revenue guidance by -4-7% and sees FY21 growth at only around 5%, well below recent history of circa 20%, explains the broker.

The analyst explains covid disrupted the business by reducing near-term usage of the Nuix products as corporate/government business activity has stalled, particularly in the US. Additionally, there was a negative FX impact of a stronger Australian dollar.

Finally, there was an acceleration in the shift of customers away from traditional licences to consumption-based/SaaS products, as users look for greater flexibility in managing their use and their cost base, explains the broker.

Morgan Stanley stays Overweight as the global forensic and investigative software market is a structural growth story. The broker still views Nuix software as a leader in processing and search. Industry view is Attractive. “.

Morningstar’s quantitative valuation is $5.51, implying it is undervalued by 18%.

My view

I am with Morgan Stanley and the “true believers” who feel that the global forensic and investigative software market is a structural growth story and that Nuix is a good way to gain exposure to this. It is a leader, boasts an impressive customer list, has a strong growth record and has 15 years’ experience in the North American market.

I also know that Macquarie is one of the most astute investors in Australia – and it has been on the journey with Nuix now for a decade.

My concerns: the escrow arrangements come to an end in 4 months’ time (potentially, this could put 120.4m shares up for sale); history is against it with respect to IPOs; and bad news tends to come in “threes” – so far, two poorly received announcements. Further and perhaps more importantly, I really have no basis for saying whether around $4.50 is a “good price” for the company. My instinct is that it is (because it is significantly cheaper than the IPO price). I am a buyer. My sense is that I will need to be patient.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.