I am a great believer in the idea that in markets you stick with the “leader”. Market leadership attracts and retains a premium, so to invest in tier 2 or tier 3 players in an industry, there has to be something special on offer. That’s how I look at the regional/minor banks – unless they are really cheap or doing something out of the ordinary, why bother when there are 4 major banks to consider (plus Macquarie)?

The regional banks face three pressures that the major banks typically don’t. Firstly, they pay more for deposits. This is a function of capital base, size, not being “systemically significant”, and distribution reach. Secondly, they tend to have concentrated loan books (geographically) which makes them vulnerable to regional downturns. And thirdly, they don’t have the scale (and often the appetite) to invest (enough) in technology. With success in banking increasingly becoming a function of customers and technology, the last point is particularly relevant.

On the positive side of the ledger, their customers tend to be more loyal. Also, their business models are in some ways different from the majors – Bank of Queensland (BOQ) with franchisee-run branches, Bendigo (BEN) with Community Banking and Homesafe.

The market has been pretty tough on the regional banks over the last couple of months, with both BOQ and Bendigo losing more than 20% since the middle of April. In contrast, the majors are down in the order of 10-12%, so the regionals have cheapened quite considerably. This poses the obvious question: Are they “cheap” enough to buy?

Here is my analysis, followed by what the major brokers have to say.

Bank of Queensland (BOQ)

BOQ’s financial year ended on 31 August and it is due to report its full-year results on 12 October. The latest financial information covers the half year to 28 February 2022.

Cash profit for the half year of $268 million was up 14% on the corresponding period in FY21. Volume growth and controlled costs offset a fall in the net interest margin. The main reason for the improvement was a write back in bad debts of $25 million. Before bad debts, operating profit was flat ($370 million vs $374 million for 2H21 and $366 million in 1H21).

BOQ grew mortgages at 1.8x system growth (excluding ME Bank), business loans to small and medium enterprises at 2.7x system and loans to corporates at 1.0x system. Operating expenses fell from $473 million in 2H21 to $461 million in the half.

The deterioration in the net interest margin was the main negative of the result. This fell by a whopping 12bp over the half (from 1.86% to 1.74%) as the impact of lower margin fixed rate home loans, intense competition, rising swap rates and a build-up in liquidity took their toll. The increase in market interest rates provided some offset. Looking ahead, the Bank said that it expected benefits from a rising rate environment and that “NIM headwinds were reducing”.

BOQ is making progress on the integration of ME Bank, which it purchased in July 2021. It says that it is on schedule, with synergies accelerated and the program operating within the integration cost envelope. Performance has started to improve, with ME returning to growth in the second quarter of the half year.

System transformation (BOQ calls it ‘digital transformation’) is the Group’s major strategic initiative. Working with Terminos, BOQ is aiming to deliver a single cloud-based platform to service BOQ’s three retail operating divisions – Virgin Money Australia, ME Bank and BOQ Retail. BOQ says this program is on track.

For shareholders, BOQ is targeting a dividend payout of 60% to 75% of cash earnings. The first half dividend of 22c per share was equivalent to a payout ratio of 53% but adjusted for normalised loan impairment expenses, 66%. The brokers expect a full-year dividend of 46c per share, putting it on a yield of 6.7%.

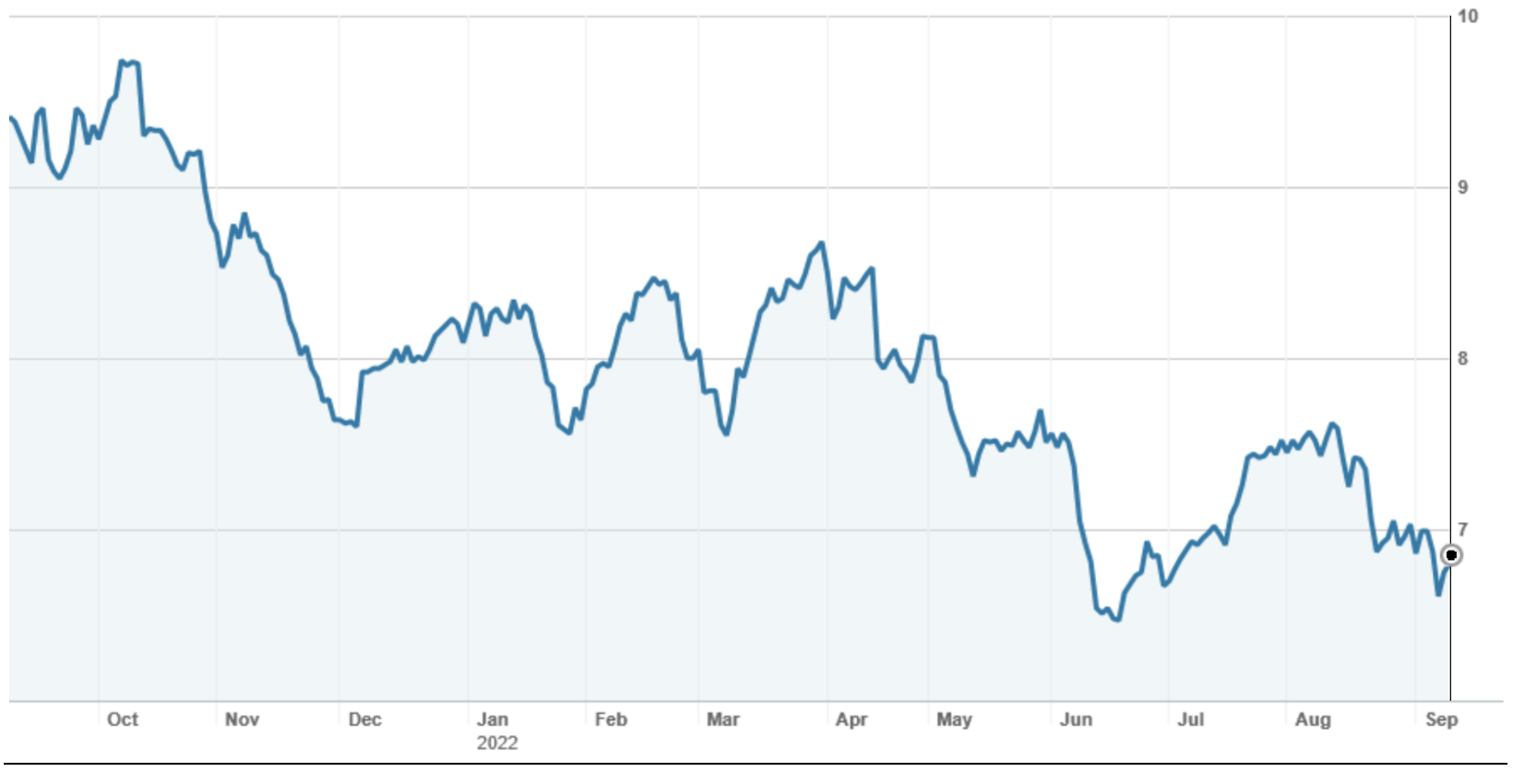

Bank of Queensland

Source: nabtrade

Bendigo and Adelaide Bank (BEN)

Bendigo’s full-year profit to 30 June rose by 9.4% to $500.4 million. Adjusting for the impact of a writeback of credit expenses, operating profit rose by 2.7% from $675.1 million to $693.6 million.

Operating income rose by 0.4% over the year, while operating expenses fell by 1.1%. A major component of the fall in expenses was reduced investment expense, with Bendigo choosing to increase the amount capitalised and also reducing the outright expenditure in response to a “slowing revenue environment”.

The net interest margin was under pressure, falling by 0.21% over the year from 1.95% to 1.74%. Competitive pressures in the home loan market, with customers switching to fixed-rate loans, plus an increase in the average amount of liquids held were the main drags. Offsetting this, Bendigo benefitted from the impact of higher rates on its deposit portfolio.

Bendigo said that its exit NIM in June was higher than the average NIM in the second half. Looking ahead, it said that it should benefit, although this would largely be offset by a higher revenue share payment to Community Bank franchisees.

Overall, it foreshadowed subdued lending growth and heightened competition for deposits, It was targeting broadly flat costs, with headwinds including wage and price inflation, investment opex and amortisation.

Priorities include raising the ROE (return on equity) closer to peers in order to lift organic capital generation, and cost efficiency (to drive down the cost-to-income ratio). Up (a digital bank), Homesafe and Tic:Toc (Bendigo owns 27% of the latter) are key parts of its growth agenda.

For shareholders, BEN declared a final dividend of 26.5c per share taking the full year to 53c per share. At $8.55, this puts Bendigo on a yield of 6.2%.

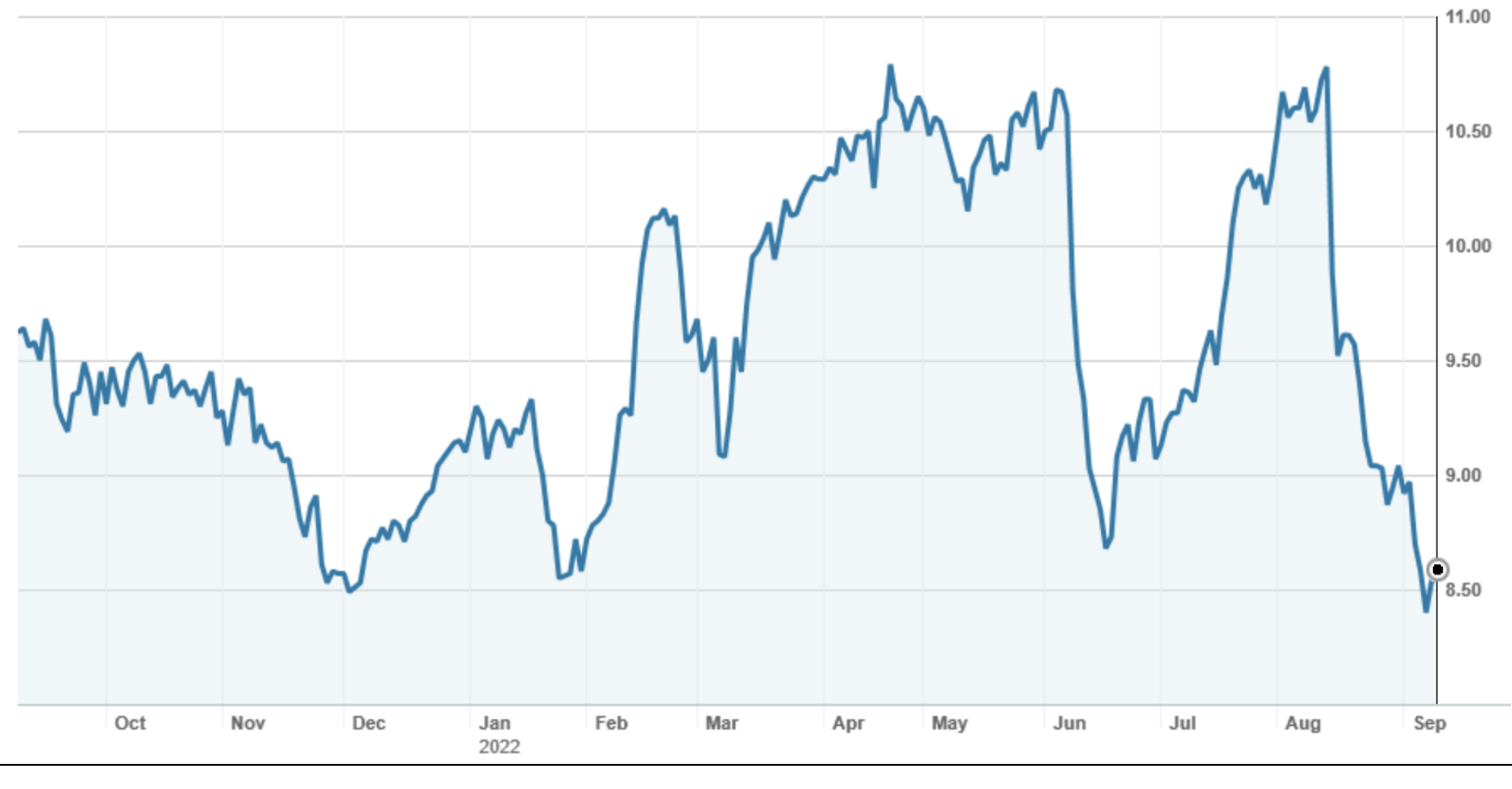

Bendigo & Adelaide Bank (BEN)

Source: nabtrade

What do the brokers say?

The major brokers are favourably disposed to BOQ, with five “buy” recommendations and two neutral recommendations. The consensus target price is $8.66, 27.4% higher than Friday’s ASX close of $6.80.

In saying that, Ord Minnett (JP Morgan), which has a “neutral” call, says: “it fails to see a catalyst for a re-rating of Bank of Queensland shares and materially reduces earnings estimates. Greater competition in the mortgage market and emerging wage/inflation pressures are incorporated into the forecasts”.

Macquarie notes that it prefers Bendigo to BOQ within the regionals, while Morgan Stanley goes the other way.

Major Broker Recommendations – BOQ

For Bendigo, the brokers are less bullish, with the consensus target price sitting at $9.93, about 15.9% higher than Friday’s ASX close of $8.55. According to FNArena, there are 3 “buy”, 2 “neutral” and 1 “sell” recommendations.

As a group, the brokers are worried about the NIM (net interest margin) outlook for Bendigo. A revelation from Management at the profit announcement that the revenue share for Community Banks would increase as interest rates increased took the analyst community by surprise.

Major Broker Recommendations – Bendigo & Adelaide

On multiples, the brokers have Bendigo trading on 11.0x forecast earnings. BOQ, which is still in FY22, is trading on a multiple of 9.4x FY22 and 9.5x FY23. Ay $6.80, the forecast dividend yield for BOQ is an attractive 6.7% (plus franking).

My view

I think BOQ on a multiple of 9.4x earnings (a discount of about 57% to CBA and 34% to NAB) looks interesting. If they can execute their digital transformation program, their business mix of Virgin Money, ME bank and BOQ retail and BOQ business puts them in a reasonably strong position.

BOQ’s immediate problem is a catalyst for a re-rating (this potentially could come with the October result). At $6.80, there is value in the stock, although investors may need to be patient.

Bendigo appears to be “battening down the hatches” for tougher times. While it is admirable to be talking about improving ROE, I can’t see much in the strategy to do so. I don’t find the multiple of 11.0x sufficiently attractive… prefer others.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.