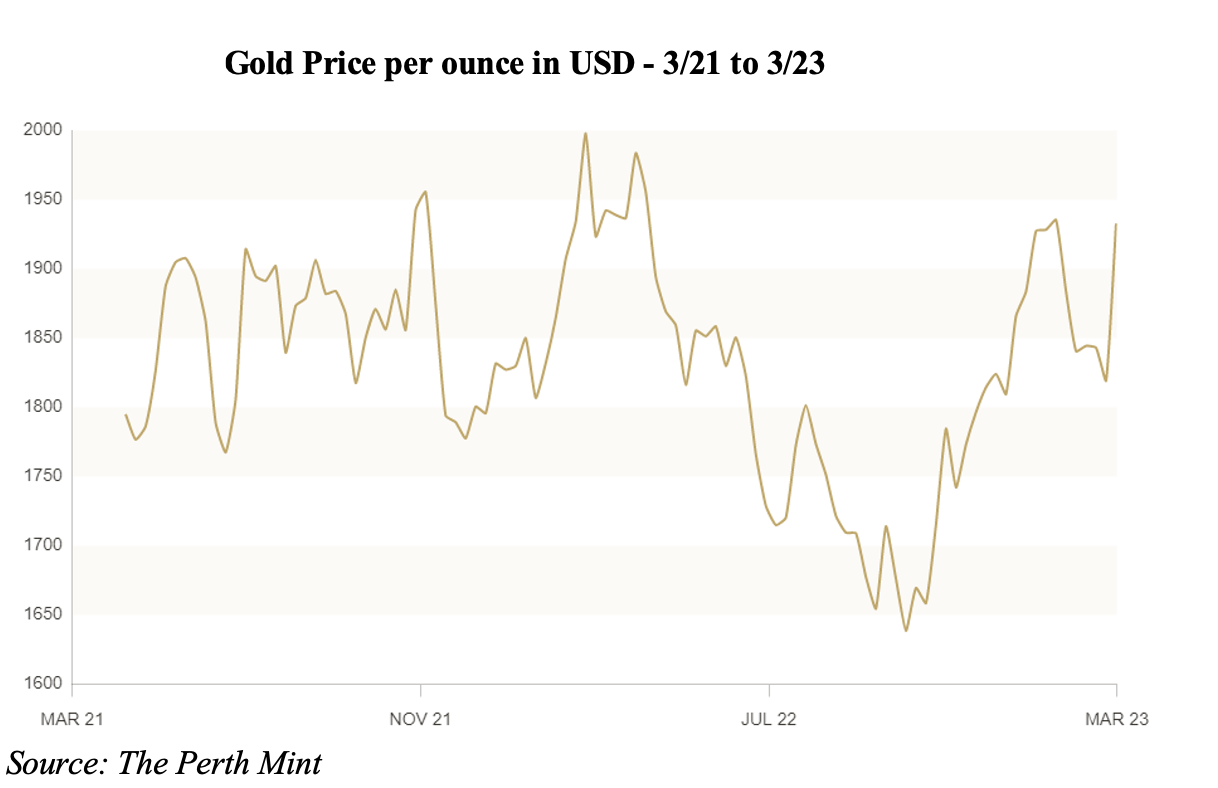

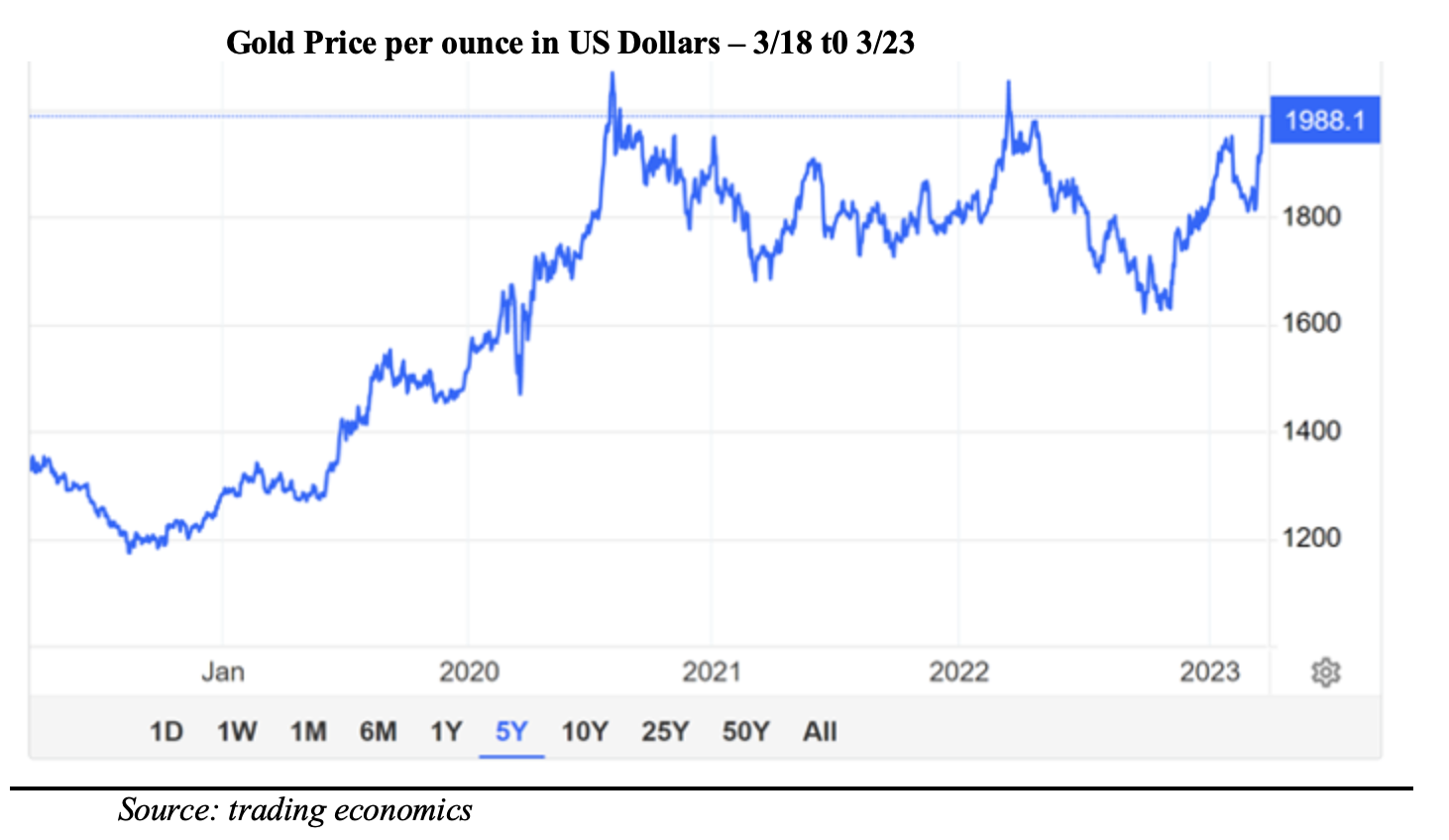

While I have never been a gold bug, I do keep a close eye on the gold price. Since Covid, it has largely been in a range between US$1,700 an ounce and US$2,000 an ounce. It surged briefly following the outbreak of the war in the Ukraine, only to subsequently fall back, and again over the last week or so as in the wake of the crash of Silicon Valley Bank and concerns about Credit Suisse.

Working against gold over this period have been rising US interest rates and a stronger US dollar. Because gold is denominated and traded in US dollars, it tends to do better when the US dollar falls. And because gold holdings don’t earn any interest, it becomes costly to hold when interest rates rise.

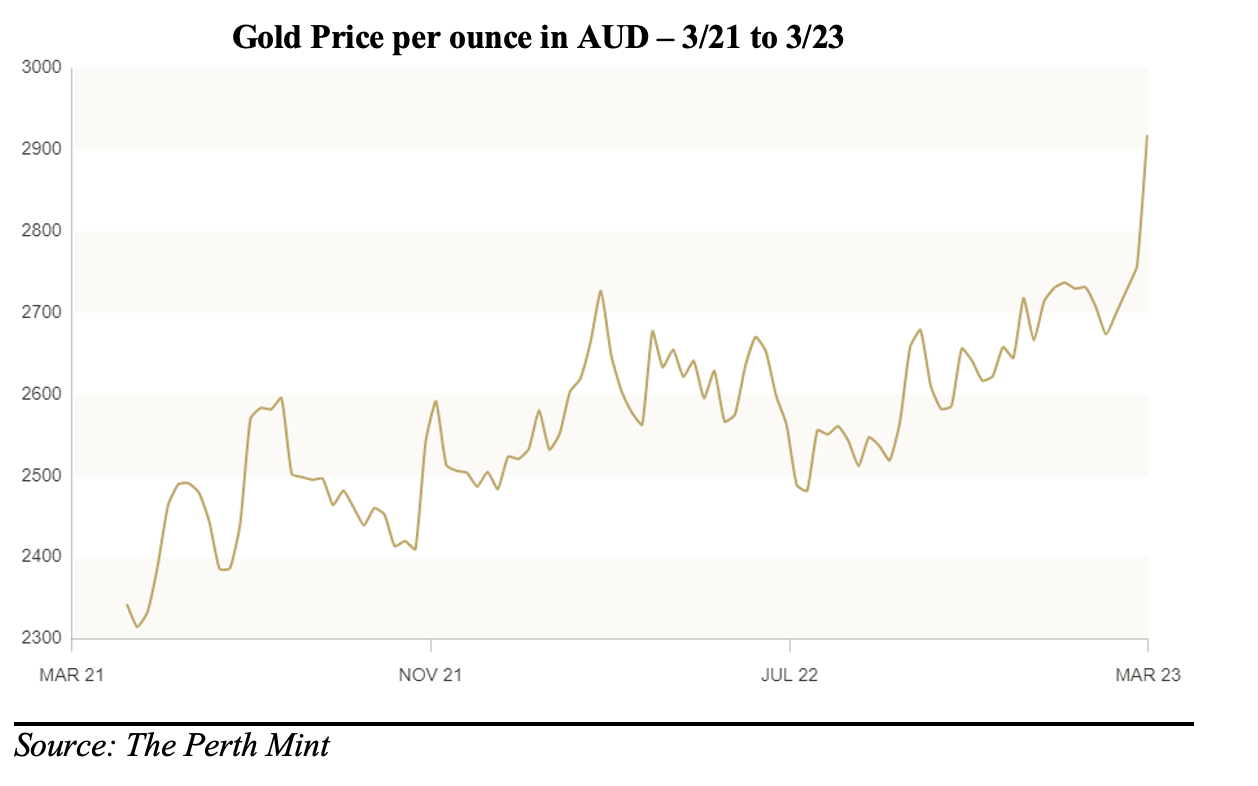

In Australian dollars, the performance looks a lot better over this period (see chart below).

Over the last five years, gold has proved to be a reasonable investment (see chart below). Resilient in that it is higher today than it was five years ago, and the pullbacks have been relatively minor. It hasn’t roared away in the “crises” of Covid, Ukraine or the current banking failures, but it also hasn’t lost much ground despite the very rapid rise in interest rates.

I am not making a case to buy gold (yet), but it is something that I am thinking about. Certainly, when US interest rates have peaked, I will feel more comfortable in buying gold.

Because gold undoubtedly has “insurance value”, many portfolio experts argue that a growth-orientated portfolio should have an allocation of at least 5% exposure to gold assets. This being the case, owning gold is something that is on my investment radar.

So, let’s explore how to buy gold. Essentially, there are three ways to get exposure to gold.

- Physical Gold

You can buy physical gold through The Perth Mint or dealers such as ABC Bullion. With the Perth Mint (www.perthmint.com/storage), you can buy gold coins or gold bars, and elect to take physical delivery of the bullion or have them store your gold securely under a custodial arrangement. The Perth Mint is backed by the WA Government.

You will need to open an account and undergo a mandatory ID check. If you open an account, you will probably want to open their Depository Online account. This allows you to trade gold online (potentially 24 hours a day), and generally has a tighter bid/offer spread than the phone or email service (known as their Depositary Program)

In addition to the bid/offer spread on the bullion, there are transaction fees. For the Depository Online account, they start at 1.0% on the value of a buy or sell transaction. For transactions over $1 million, the rate falls to 0.2%. Additionally, if you want the bullion specifically allocated to you (rather than unallocated), then the Mint charges a storage fee of 1% pa. Alternatively, you can elect to take physical delivery, in which case you will need to pay freight and insurance costs.

The Perth Mint was recently the subject of an ABC Four Corners program. While this exposed some unsatisfactory practices relating to customer identification, as a government backed organization, I think investors can be confident in entrusting gold transactions to this organization.

- Exchange Traded Funds

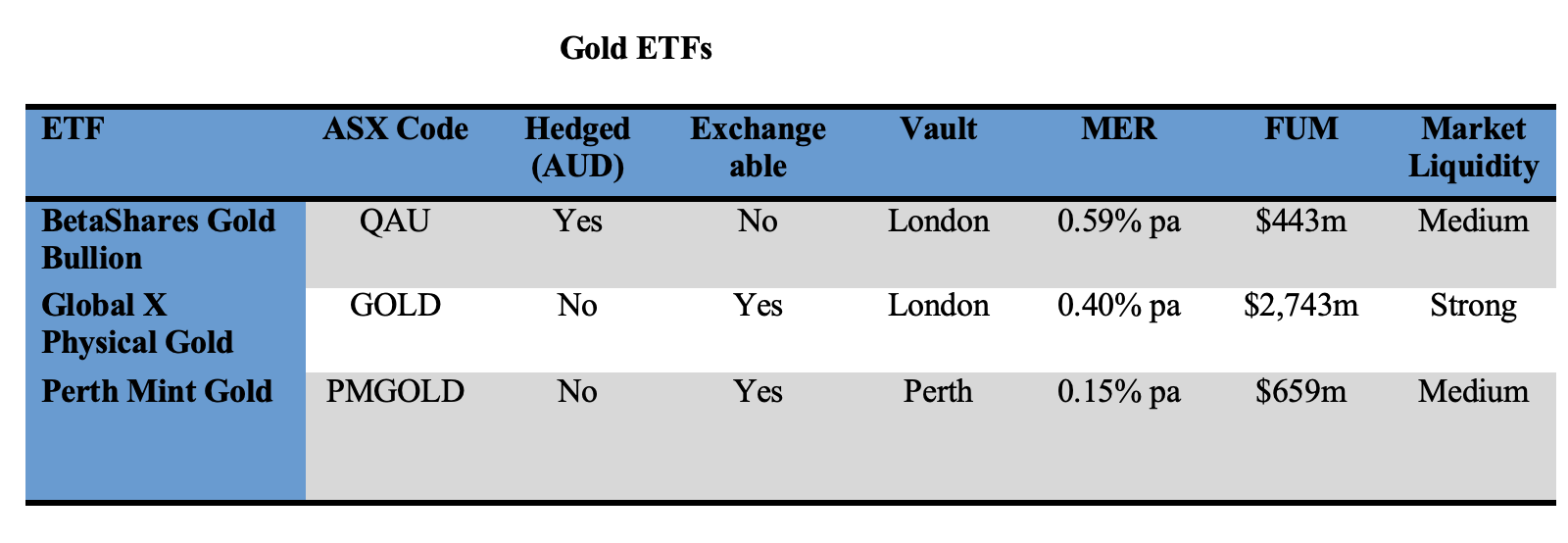

An easier option for most investors is to buy units in an exchange traded fund (ETF). There are three exchange traded gold funds quoted on the ASX.

All the ETFs are backed by physical gold and have a strong record in tracking the gold price. BetaShares QAU hedges the currency exposure into Australian dollars, which means that it effectively provides exposure to the US dollar price of gold. The other two ETFs are unhedged, providing exposure to the price of gold in Australian dollars. They also allow for the units to be swapped back into physical gold.

- Listed Gold Shares

Listed gold shares are highly leveraged to the Australian dollar gold price. Although some hedge part of their output and may have US dollar borrowings, most of their costs are in Australian dollars and tend to move in a narrower band. A small change in the equivalent Australian dollar gold price can have a huge impact on profitability and share price. For example, the second largest gold producer, Northern Star Resources (NST), has traded from a low of $6.60 last July to a high of $13.31 in early February. On Friday, it closed at $10.89.

While there are scores of gold companies to choose from, many are gold explorers, and the sage old advice for investors is to look at high quality producers, particularly those with low production costs and strong reserves.

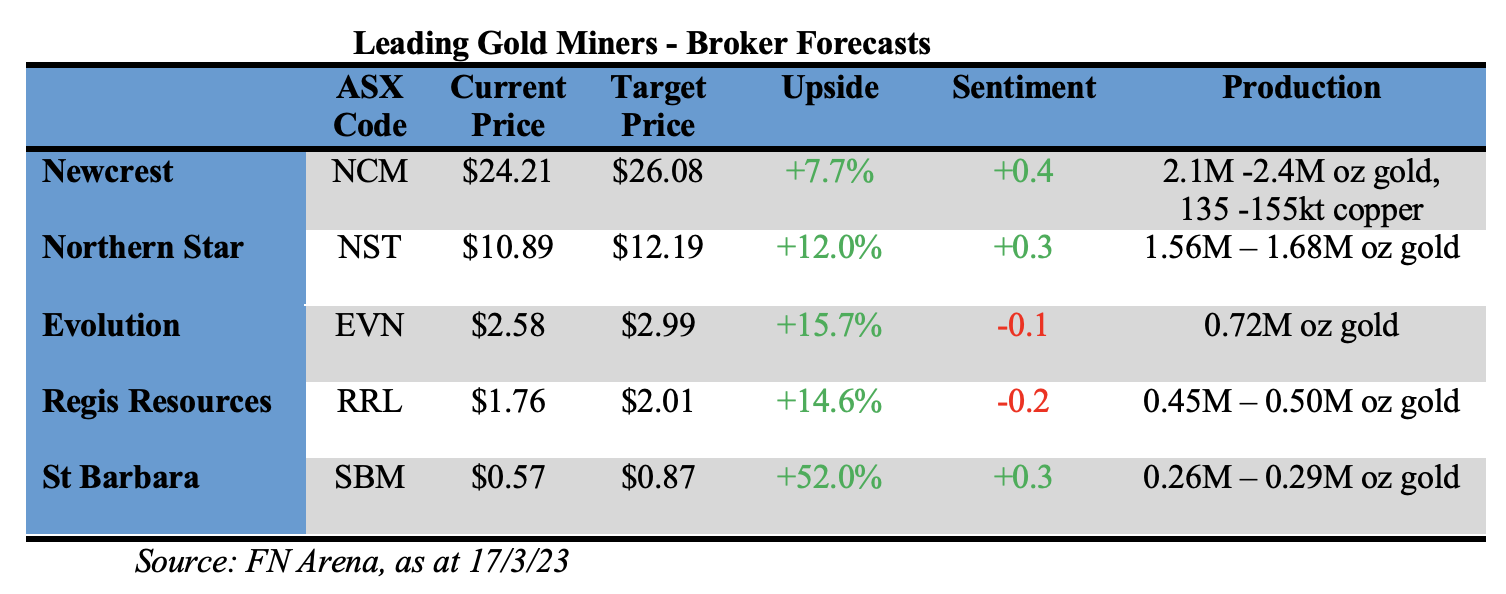

Listed below are the 5 largest gold miners by production and market capitalization. The table shows the consensus broker target price (source FN Arena) and the implied “upside potential” from the last ASX price.

Two important notes of caution. Firstly, target prices are highly sensitive to the brokers’ long term gold price forecasts. Secondly, the companies are not all pure gold miners (e.g., Newcrest also mines copper).

Newcrest has attracted the attention of the world’s largest gold producer, Newmont Corporation. Newmont has lodged a non-binding indicative offer to acquire 100% of Newcrest via a scheme of arrangement, offering 0.38 Newmont shares for each Newcrest share held. This is currently worth approximately A$27.32 for each Newcrest share. The offer has been unanimously rejected by the Newcrest Board, although they have allowed Newmont access to limited non-public information to see if they can develop a more compelling proposal.

St Barbara, which has had a horror run for shareholders, is working through a potential merger with Genesis Minerals (GMD) to form a new company, Hoover House, that will exclusively focus on gold assets in the Leonora District in WA. As part of the transaction, other assets will be demerged into a new ASX company, Phoenician Metals.

Broker recommendations (buy/hold/sell), or sentiment, is another guide. The consensus recommendation is quoted on a scale of -1.0 being the most negative to +1.0 being most positive. The brokers are most positive on Newcrest and Northern Star and least positive on Regis Resources.

Because the share price for Newcrest now has a “takeover” premium built into it, my preference would be to go with the number ‘two’ in Northern Star. It has world class gold assets in tier 1 locations (Western Australia and Alaska), strong reserves, a committed growth path and strong balance sheet. The analysts are marginally positive on the stock (sentiment +0.3) and see some upside in the share price.

Bottom line

Risk takers might like to consider gold shares such as Northern Star. I think that for portfolio holders, the easiest way to own gold is through an ETF. The pick is GOLD from Global X.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.