One of the enduring lessons I’ve learnt over 30 years of being interested in building wealth was that being fixated on quality assets and being prepared to buy them when their respective markets have problems with them is a pretty good, consistent policy to stick to, if you like to get richer over time.

Last year saw a lot of very good, big market cap companies finish the year with a flourish and many of them have kept it going into 2020. Most of you have read me suggest that a good policy is to “buy the dip” and it goes double when they are very good stocks or property.

So in the interest of testing out my strategy let’s look at how our top 10 stocks performed over the past year, to see if buying the dip would have been a good money-making play.

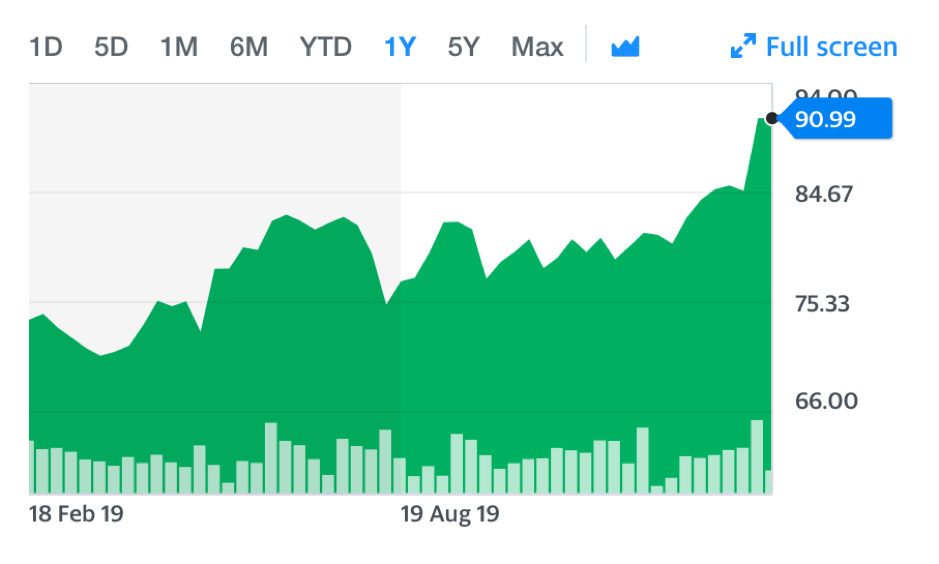

1. CBA

On March 25 last year, the CBA share price hit $70.78. Last Friday was $90.99, so it certainly confirms the good sense in the “buy the dip” strategy. That’s a 28% gain plus 4.7% dividend plus franking.

(I’m going to use the forward dividend yield for 2020 for simplicity but the real yield would be higher if you bought in at the lowest price over the past year.)

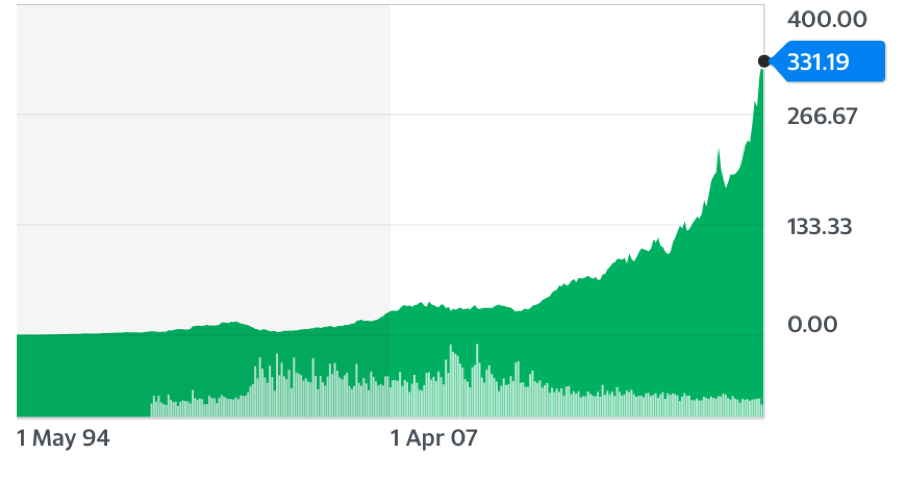

2. CSL

On February 18 last year, CSL was as low as $186.50 after being as high as $227 in August of 2018. This was a classic case of a quality company out of favour in the short term and given it is now $331.19, if you’d been a believer you could have made 48% with a small dividend in about a year. The critical point is that CSL is a quality company and even if you hadn’t got it right and the stock had fallen over that time, you still would’ve been holding a good asset with real growth potential.

3. BHP

This mining stock that usually you wouldn’t associate with income/dividends has changed its ‘spots’ and is providing both capital growth and income but there were four buying opportunities over the past 12 months with the best being October 14 when it dropped to $34.79. Given it is now $38.65, the potential gain if you got in at the right time was 11% and there’s set to be a pretty good dividend on top, of around 5% plus franking. Not bad for one of the best miners in the world!

BHP

4. Rio Tinto (RIO)

Using the same inquiry method, you could have snagged Rio Tinto at $84.21 in August 19 last year and that would have netted you 15% plus dividends and franking.

5. Westpac (WBC)

This troubled bank hit a low of $24.25 on December 16 but now has snuck up to $25.70, which is a 6% gain. With a forecasted yield of 6.2% and franking, this is looking like a damn good investment. If you had received that kind of gain in two years, you should have been happy.

6. NAB

This bank’s share price hit $23.92 on May 13 and is now at $27.35 so that has been a 14.3% uplift. And once we throw a forecasted dividend yield of 5.9% and franking, that’s a potential 20% gain for being a bank believer.

7. ANZ

On December 2, ANZ dropped to $24.59 and is now at $26.61, which means a potential 8.2% capital gain, if you picked the bottom. If you add the 5.9% forecasted dividend yield to franking, we’re talking close to a 16% return.

8. Macquarie (MQG)

On August 12, MQG dropped to $118.54 but now has spiked to $148.58. That was a 25% gain. With a dividend yield forecasted to be 4% and franking, this has been a 30% plus performer over the past year. Who would’ve tipped that?

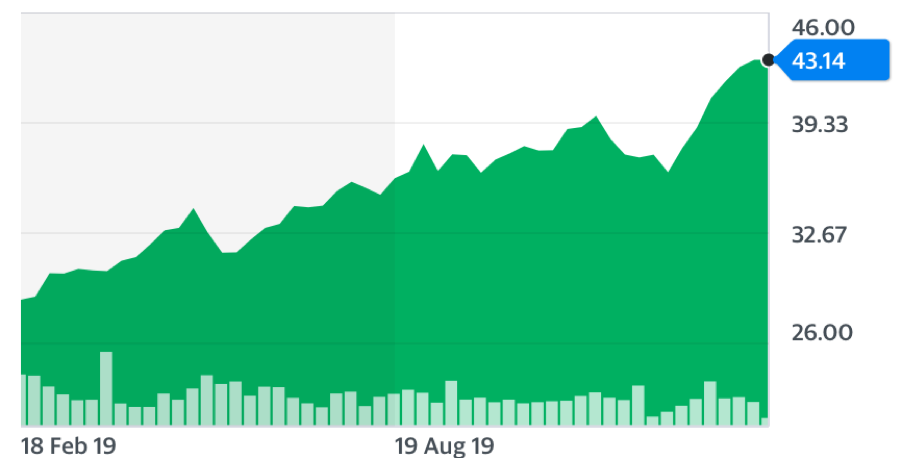

9. Woolworths (WOW)

What about these pretty boring consumer staple stocks? Could they have had a great year for the dip buyer? Yes it did, and the chart below shows it.

Woolies started the year at $28.65 and finished Friday at an unbelievable $43.14, which means a 50.5% gain! That staggers me and you can throw in 2.4% and franking and this, as I’ve said, was “unbelievable!”

10. Wesfarmer (WES)

On February 23, WES was at a low of $33.39 and as of Friday was at $45.65. That’s a 36.7% gain. Throw in a dividend yield of 3.3% and franking and there was a 40% windfall for pursuing quality.

If you’d invested equally across all 10 stocks and picked the bottom in each case, you would’ve made 29% — but that’s too hard. The point is that buying quality companies when markets are distracted by trade wars, Coronaviruses, Grexits, Brexits and the Fed promising three interest rate rises when they actually did three rate cuts, can distract you from smart investing.

Being a diversified buyer of quality companies when they dip significantly can be a rewarding strategy. But even if you get the timing wrong, you still are holding quality assets that should eventually resume their path higher.

This chart of CSL says it all.

That’s 77 cents to $331 in 25 years, which is a powerful, unforgettable lesson.

Our job is to find great companies for you. And as the old Mortein fly spray ad advised: “When you are on a good thing, stock to it.”

Final footnote

According to FNArena’s experts this is where they see share prices going for these top 10 companies:

- CBA – 17.5%

- CSL – 1.5%

- BHP + 2.4%

- RIO + 2.8%

- WBC + 2.5%

- NAB + 0.9%

- ANZ + 0.1%

- MQG – 6.6%

- WOW – 13.2%

- WES – 18.1%.

So what’s the lesson? Buy the dip until this bull market is on its last legs.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.