The idea of investing for your kids or grandchildren may be something you have been considering, particularly with Christmas fast approaching. In this two-part series, I looked last week at taxation issues (including applying for a TFN and how minors are taxed), road-tested kids’ bank accounts and how to buy shares for your kids. This week, my personal favourite when it comes to investing for kids – insurance bonds (also called investment bonds).

Insurance bonds

Insurance bonds (also called investment bonds) are long term investment vehicles that offer tax efficiency for some investors. While technically incorporating a life insurance element, they are tax-paid investments that focus on wealth creation by investing in single asset (e.g. ‘Australian shares’) or multiple asset classes (e.g. ‘balanced’).

Insurance bonds are designed to be held for at least 10 years. The issuer of the bond pays tax on the earnings of the underlying investments at the corporate tax rate of 30%, which under a special tax rule, means that the investor does not need to include any investment earnings in his or her tax return. After 10 years, the investor can redeem the insurance bond and won’t be liable for any capital gains tax.

If the investor chooses to redeem the insurance bond before 10 years, he or she is required to pay tax on the earnings of the bond at their marginal tax rate, less a tax offset of 30% to reflect the tax the issuer has already paid. If the bond is redeemed during the 9th or 10th year, transitional provisions apply.

One additional rule (known as the ‘125%’ rule) makes them attractive as savings vehicles. Under this rule, investors can make additional contributions up to 125% of the previous year’s contribution with the benefit of these contributions being treated as if they were invested at the same time as the original investment. For example, if you invested $1,000 to start an insurance bond, you could invest a further $1,250 in year 2 and a further $1,562.50 in year 3 and have, for tax purposes, the same 10-year term expiry being the 10th anniversary of the original $1,000.

How do they work for kids or grandchildren?

If the child is 10 years or over, then with parental consent, the investment can be made directly in the child’s name. The minimum investment for some insurance bonds is as little as $500.

Most insurance bonds also include a ‘child advancement policy’. Under this feature, the investment is initially made in your name and at a certain nominated time (known as the ‘vesting age’), the bond is automatically transferred to the child. Vesting does not trigger any tax consequences, and there are usually no fees or charges. The child must initially be under 16 at the time the policy is taken out, and the vesting age can be any age from 10 years to 25 years.

Who issues them?

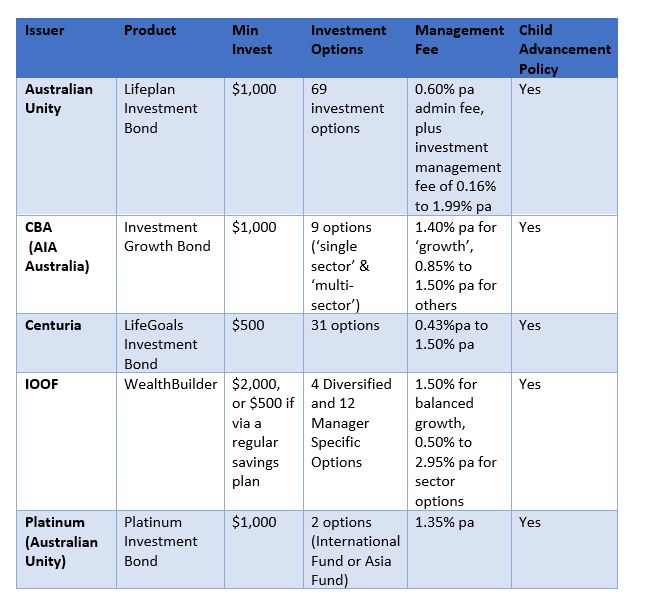

Insurance bonds are issued by life insurance companies (or companies who leverage a life insurer). Five of the major issuers and details of their bonds are detailed below:

Pros and cons

As they are tax-paid investments and you can invest in relatively small starting amounts, they are attractive vehicles for investing for your kids or grandchildren. There are no issues with the minor’s ‘unearned income’ tax and in most cases, the tax paid rate of 30% on an insurance bond is going to be more tax effective than the minor’s tax rate of 45%.

The 10 year investment time frame (minimum) will probably not be an issue for most parents or grandparents considering this alternative. Downsides are the management fee, buy/sell spreads and unlike direct shares, an insurance bond may not be quite as effective in helping your child or grandchild develop an interest in investing.

Choosing an insurance bond

If selecting an insurance bond, look at a ‘growth’ oriented option such as ‘Australian shares’ or ‘growth’ – 10 years is a long time. Management fees also matter. Whilst some of the above issuers incurred the wrath of the Royal Commission, this doesn’t reflect on their ability to manage monies in these products.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.