The next two weeks will be critically important for what stocks do for the rest of the year. Importantly for Wall Street, between now and the end of July, there will be an avalanche of US company reporting results. And the Fed meets over July 26-27, with some tipping a 1% rise in official rates! I don’t believe this, and I’ll tell you why below.

Meanwhile, on the local front, we get our latest Consumer Price Index (CPI) or inflation reading on July 27. This is ahead of the RBA’s August 2 meeting, where some economists want and expect Dr Phil Lowe to stump up a 0.75% increase in the cash rate following that ripper of a jobs report last week. Unemployment is at 3.5% and unions are demanding big pay rises, with the labour market tight. And the AFR is telling us that the National Skills Commission says we need 1.2 million workers within four years.

In fact, most employer groups would tell you that the country needs 500,000 workers ASAP. This is the number of foreign workers who went home, thanks to the pandemic’s lockdowns.

This isn’t meant to be a whinge story but one that looks at the often ignored pluses out there that could make a December quarter rebound for stocks believable.

After reading what I’ve collated, you might even believe that a stocks comeback could show up even earlier. Here’s what’s grabbed me and made me comfortable telling you that the next two weeks could set us for another leg down, which I’d argue wouldn’t be worse than what we’ve already seen on US stock markets. It could be the bottoming process ahead of a comeback for stock market indices.

Here goes:

- Over the weekend, the chief investment strategist at Northwestern Mutual, Brent Schute, told CNBC that US stocks have established a bottom. He’s not alone. (I suspect he’s in a bit early but we’re close. I want to see the next two weeks of reporting but I like what I’m seeing already.)

- Citi’s stock price was up a whopping 13.23% for last Friday alone, while Wells Fargo’s was up 6.25%, following their respective positive show-and-tell reports.

- Those experts believing US inflation has peaked are growing in number. Friday’s revelation that consumers’ inflationary expectations were lower than expected is a good sign.

- The 9.1% rise in inflation in June was half-caused by gasoline/energy prices. In July, oil prices fell significantly, which should be a plus for lower inflation for this month. Oil prices fell from a high of US$120 a barrel in early June to under US$100 a barrel last week.

- As of last Friday morning, stock watcher Refinitiv found 35 S&P 500 companies had reported, and 80% of those reported earnings above forecasts. That’s a good start.

- If the ‘inflation is slowing’ story is right, then the Fed might pause after its next rate rise.

- The IMF thinks inflation will be controlled by 2023 and we know stock markets act in advance of good and bad news.

- CEO of JPMorgan Chase, Jamie Dimon, recently said the US “economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy.” He had other warnings but these are speculations that could or could not be relevant.

- Research firm Bernstein told CNBC that it might be time “to start nibbling at some beaten-down tech stocks”. Furthermore, Bernstein’s analysts led by Toni Sacconaghi said the following: “Tech’s 5-year expected growth continues to be very strong, and tech has the highest quality ranking, highest ROIC, and second highest FCF margins among sectors, and crowding within tech is very muted vs. its history. Our analysis of historical market drawdowns suggests that when tech is not materially overvalued vs. the market, it typically trades in line with the market during pullbacks, as was the case during the financial crisis of 2007-2008.”

- Chief economist at Moody’s Analytics, Mark Zandi, thinks the ‘US recession’ call is wrong and doesn’t believe it’s needed to lower inflation now. “Oil prices are going to roll over. Natural gas prices are going to fall. We’re going to see vehicle prices come down as supply-chain issues iron themselves out and we get more vehicle production. Commodity prices, goods prices more broadly, are going to come in,” he said in an interview for the podcast What Goes Up.

Think about it: if inflation is starting to fall and a recession doesn’t actually happen in the US (meaning the Fed has engineered a “soft landing” as Jerome Powell said he was working on), then what does this mean for stocks?

It has to be positive. That’s why I’ve argued the December quarter should be most likely turnaround time. The December and March quarters are historically the best for stock market returns, and the investing period from the mid-term US election and the Presidential election also has a very good track record for returns for share investors.

US Bank analysis of Bloomberg market data shows:

- The S&P 500 Index has historically underperformed in the year leading up to mid-term elections. The average annual return of the S&P 500 in the 12 months before a mid-term election is 0.3%—significantly lower than the historical average of 8.1%.

- The post-mid-term election period is a very different story. The S&P 500 has historically outperformed the market in the 12-month period after a mid-term election, with an average return of 16.3%. This is especially true for the one- and three-month periods following mid-term elections, which historically have significantly outperformed years with no mid-term election.

One last point! While I like to think historical factors support my investing thesis, I also want economic developments to be heading in the right direction. Falling inflation, no recession and a world hopefully out of the grip of Covid and its lockdown problems for economies, on top of China finally getting back to stronger growth along with an end to the Ukraine war madness, could set 2023 up for a stronger global economy. All this would help stocks track higher. Let’s hope all these positive scenarios come to pass. By the way, I’ve pointed out before that after market crashes, the stock market historically has a big rebound, which also should be another positive worth keeping in mind when working out how you want to invest. The thrill seeker would invest before reporting season hots up but that’s risky. The cautious player will wait for the US and local reporting seasons to show us what might happen to the economy and corporate profits, and then get on a rising trend for stock prices.

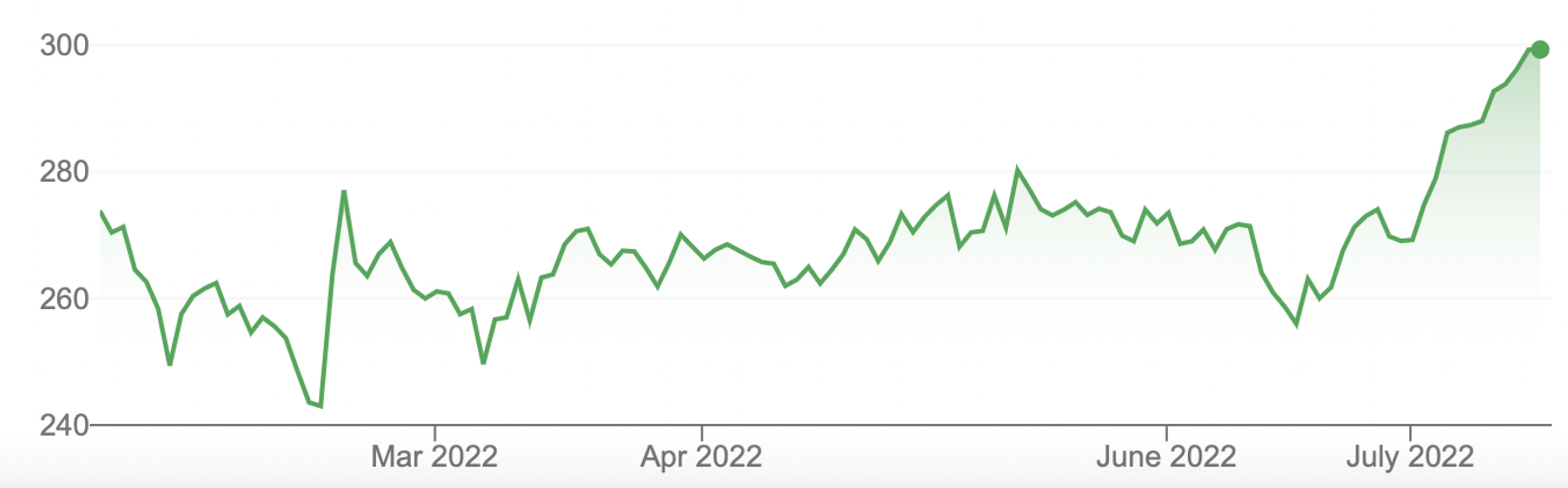

It’s also worth remembering that the US market, now down about 16%, was down over 23% only a month ago. That 7% improvement shows one-time sellers have been nibbling back into beaten-up stocks. Locally, CSL’s bounce-back could be an early sign of changes that lie out there.

CSL Limited (CSL)

The rotation into our healthcare stocks, which are more growth stocks and which fell along with tech stocks, is now up nearly 17%. And note this: the turnaround date for CSL was June 17, which was exactly the same date that the S&P 500 started to rebound off its low! Keep the faith.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.