Is this going to be a year for index or fund plays? Or will it be about stock picking? Fund managers competing with index funds will say it’s about picking stocks, with quality blue chip stocks priced for perfection right now.

Mind you, if you’re happy with a 10% gain, I reckon quality stocks could deliver that kind of return — give or take a per cent.

Let’s select CBA and JB Hi-Fi and see if that’s possible.

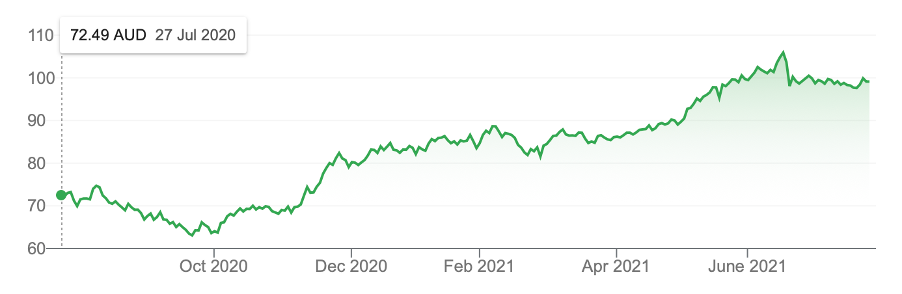

CBA (one year)

The 52-week high is $106.57, which was helped by a strong rebounding economy, which meant less need for the bank to support small business and home loan customers because it looked like lockdowns were behind us, that is until this Delta strain showed up. There was also a belief that a share buyback was on the cards, with the bank using the capital it squirrelled away when it was thought that the economy could generate 10% unemployment levels last year!

Now the economy won’t be as robust, with 14 million Australians locked down, so CBA’s share price has eased. CEO Matt Commyn could easily delay this share buyback, which could take its share price down even further.

If that happens, it would be a great buy-the-dip opportunity for the patient long-term investor.

Even now without any surprise pullback, CBA looks like it has 10% total upside over the next year or so.

My best guess is that ScoMo needs to pull a rabbit out of his hat when it comes to vaccines. We heard of 85 million doses of Pfizer coming, but most of that is for 2022, which will help the 2022 economy and company profits. I know the PM needs a vaccine win and fast or else he’ll have to hand over the keys to The Lodge to Albo! A vaccine win would not only help his popularity but also CBA’s share price.

Let’s assume that 2022 is helped by most of us being vaccinated by Christmas or early January, as Coolabah’s Chris Joye has predicted. Then we could easily see the CBA back at $106 from its current price of $99. That’s a 6% plus gain. And let’s add in 4% for franking and dividends, so we’ll call it 10%.

But then if we also accept Joye’s belief that 2022 will be a big economic rebound year (because of the vaccine rate, the opening up of international borders, the arrival of tourists and international students), someone investing in CBA now or, better still, on a dip in the market, could easily bag a 12%+ return.

It’s the hallmark of my investing style to snag quality companies when short-term market influencers have their way and sell off good companies.

As long-term investors, it really is our competitive edge to be able to buy these stocks when short-term investors sell them off. I said this to you when the CBA was $64 in October. And I also probably said that even if its price fell, you’d still be holding a quality asset with the potential to surge higher when the world got safer and more normal.

Analysts think CBA could fall to $89.33 but if it did it would be a great buy!

What about CSL?

Analysts think CSL has only 3% upside, but the experts are divided. UBS has the company at $330 (or 12.4%) upside, while Morgan Stanley tips a 7.6% slide!

I think the $331 high in February 2020 is achievable over the next year, like UBS, but if the market gives us any short-term sell offs, it could prove even better value for the long-term investor.

CSL

This chart shows what a great company CSL has been. The Coronavirus and the US crazy caseloads of infections and hospitalisations interfered with the company’s plasma collections business model. Getting back to normal over 2022 should be good for CSL and its share price, which makes me think a 10% gain with this quality company is a goer.

Why not play an index fund?

But if we’re playing for only 10%, which is a good average return per annum over a decade, why wouldn’t we just play an S&P/ASX 200 index fund?

The Oracle of Omaha is a big supporter of index funds. Buffett likes the instant diversification it gives an investor, who isn’t as smart as him or his peers.

“To build wealth, investors should “consistently buy an S&P 500 low-cost index fund,” Buffet said in 2017 in a CNBC interview. Keep buying it through thick and thin, and especially through thin.”

By “thin” he was saying when markets sell off. Buying-the-dip strategy works with quality companies but also quality funds.

Since the March 2020 lows, CBA has rebounded 71% while an ASX 200 ETF would be up about 53%.

BHP is up 88% and JB Hi Fi is up 108%. CSL is up only 8.5% but this is also because it didn’t crash like so many stocks in 2020.

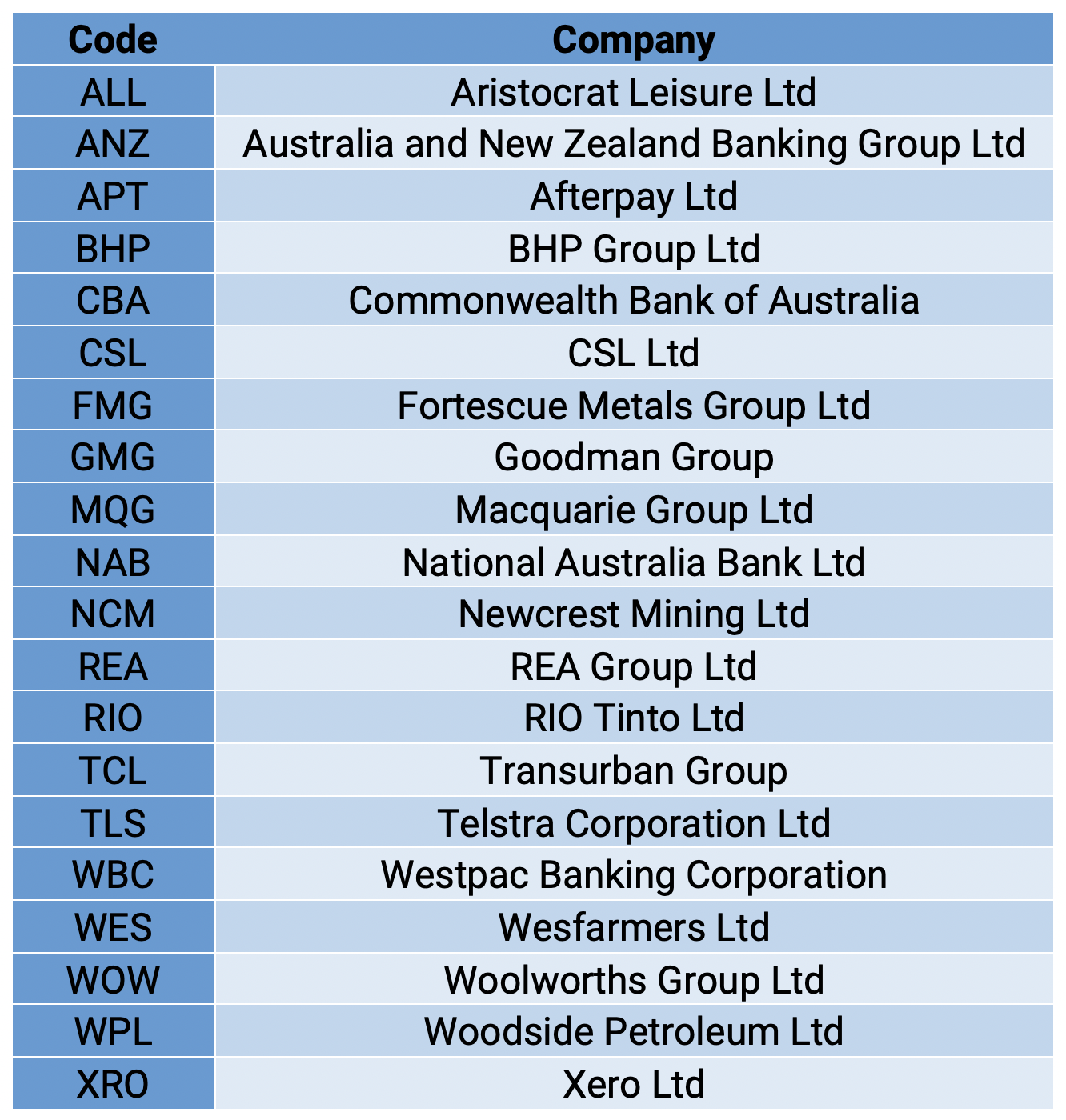

When you run your eye over the top 20 stocks in the ASX 200, you realise that big prime movers of the index — the banks, the big miners, Wesfarmers, Woolworths, CSL, Telstra etc., look like they could be 10% gainers at best after huge run ups since March 2020.

If the overall index is to boom this year, it will have to be via small caps. Or will it? Let’s have a look at how the small caps have done since 23 March 2020.

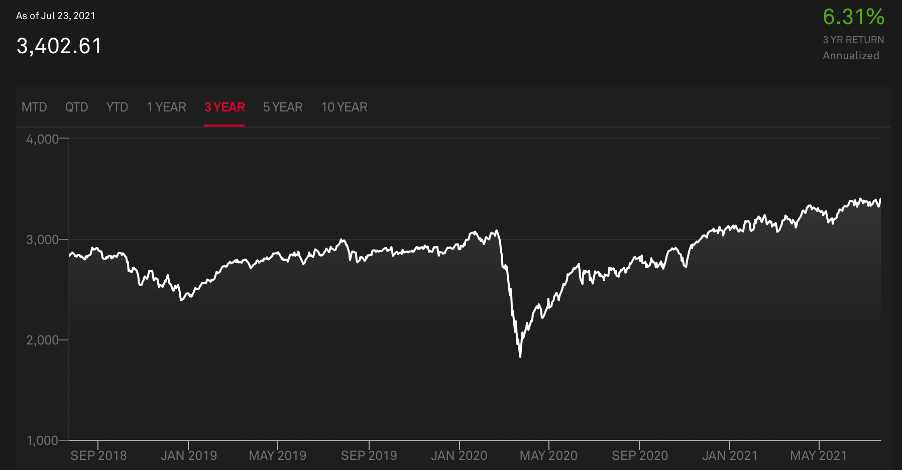

S&P/ASX Small Ordinaries

Source: spglobal.com

This index hit a low of 1577 during the crash. It’s now 3402. I make that an 86% gain! This makes me think that an ETF for the overall market would be a 10% gainer at best, which is pretty good and makes perfect sense, given the past financial year brought in a 24% gain for the market and probably 28% with franking and dividends.

Out of the Top 20 stocks, FNArena’s experts only give Afterpay (up 13.7%), Newcrest (up 22.7%), Westpac (up 14.5%) and Woodside (up 22.6%) any chance of beating the 10% return hurdle.

It makes me think the year ahead is actually going to be good for stock pickers, which makes this Switzer Report valuable when picking stocks for the year ahead, or else you need to look for small cap fund managers with a damn good record for sifting through and finding those companies that have a terrific future.

In his weekend look at markets, Percy Allan explained that the bulls in the US want to be long stocks for a variety of reasons. One big reason is because of what I often refer to as “the businesses of the future.”

This is what Percy says the bulls think: “No investor should miss this decade because artificial intelligence, cloud computing, autonomous robots, blockchain transactions, cognitive computers, connected devices, digital wallpaper, virtual reality headsets, quantum computers and biosensors will all come of age, generating a massive surge in business, government, and household spending. In turn, stock markets will boom.”

The core stocks of my portfolio are proven quality companies. I’ll buy these and even the Index on silly sell offs of the market but I’ll be looking to collect a nice spread of these businesses of the future!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.