On Saturday I referred to a question posed at our Boom! Doom! Zoom! webinar from an attendee who wanted to know if it was safe to buy stocks again. This person wants to know if we think the worst of the recent sell-off is over, and should we ready ourselves for a Santa Claus rally? And he threw in another related question: if the worst is over, what stocks would I recommend as good money makers?

Neither question is easy to answer but I guess that’s my beat, so let’s deal with the easier question first about the future course of the overall market.

Of course, I could easily get the S&P/ASX 200 Index right (direction-wise) but the stocks I recommend or the ones you buy could go in the opposite direction. So I’ll try and bring off the double play and get the direction and stocks right, though the implied third leg of these questions is the hardest and I don’t expect to nail this one.

I suspect the questioner wants to make money by Christmas, but that’s too hard, so I’m giving myself until sometime before April for the money-making part of these questions. I’ll explain why I need more time with these stocks, after dealing with the direction question.

Until recently, I was negative on stocks in the short term — that’s why I got the above questions.

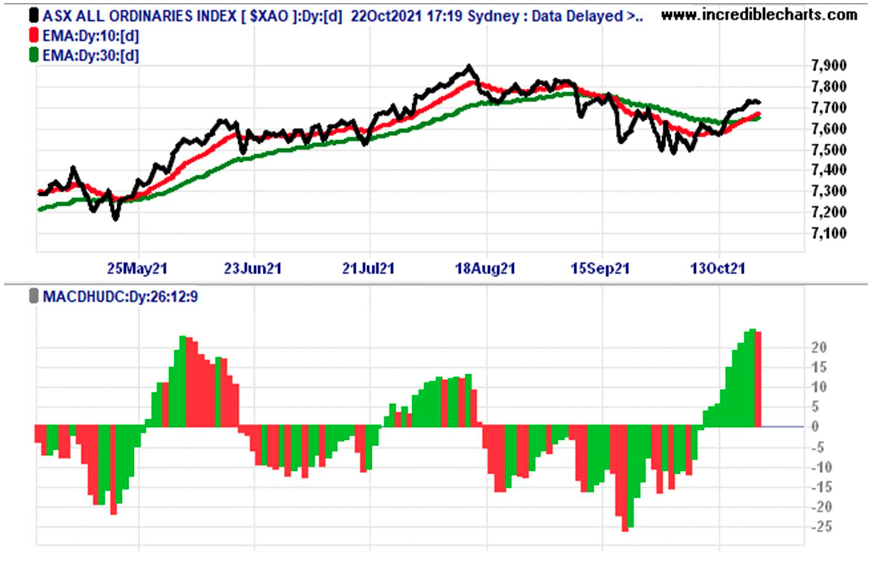

On Wednesday I interviewed ex-NSW Treasury Secretary, Percy Allan, who is a market-timer enthusiast and diligent data watcher when it comes to stock markets. During the podcast, Percy actually said what he wrote in his most recent report: “The Australian share market last Wednesday went bullish on short-medium term trend analysis. It’s been bullish on medium-long term trend analysis for the past year. See Australia’s Market section.”

Percy had been negative short term too but his reading of the recent charts changed his view.

Incidentally, despite his short-term negativity, his charts’ analysis was telling him that the medium to long-term outlook for stocks was nicely positive, which conforms with my view as well. Correctly, he noted: “The turnaround in the index largely reflects the halt to the fall in iron ore prices (see next chart), the end to Sydney’s four-month lockdown and the acceleration in vaccination rates across Australia.”

This leaves a number of other headwinds that will act as a brake on stock price spikes but I do think they will become lesser negatives in the coming months.

What headwinds?

Here’s Percy again: “Globally, concerns linger about supply bottlenecks and soaring energy prices fuelling inflation, higher long-term rates in anticipation of central banks slowing their bond buying, China’s debt-driven property bubble bursting and the US Government defaulting if its debt ceiling remains fixed beyond December 3rd.”

On Wednesday, the All Ords red 10-day trend line went above its green 30-day one and its price momentum (as measured by its MACD oscillator) kept strengthening until Friday when it took a breather.

To the issue of a Santa Claus rally, Investopedia is too precise in defining it as being “a sustained increase in the stock market that occurs in the last week of December through the first two trading days in January”.

It goes on with “there are numerous explanations for the causes of a Santa Claus rally including tax considerations, a general feeling of optimism and happiness on Wall Street, and the investing of holiday bonuses. Another theory is that some very large institutional investors, a number of whom are more sophisticated and pessimistic, tend to go on vacation at this time, leaving the market to retail investors, who tend to be more bullish”.

Either way, the last months of the year are generally good for stocks, unless there are major calamities that play havoc with the share market.

My reading of history tells me that November is seasonally optimistic and this tends to roll into December.

Sam Stovall (who I interviewed a few years back in New York at Standard & Poor’s and who now does the numbers for CFRA) says since 1945, the S&P 500 has seen an average December return of nearly 1.5% — the third-best of the year.

December has risen 73% of the time, for the highest frequency of advance for any month, so with a strong economic growth year ahead and with Westpac’s Bill Evans tipping a 7% rise for the Oz economy, a Santa Claus rally, even if it comes earlier in December, makes a lot of sense.

Helping my positivity is the belief that the Yanks will sort out the debt-ceiling issue. As Winston Churchill once said: “You can always count on the Americans to do the right thing after they have tried everything else”.

Also, late last week, the Chinese property problem child Evergrande made its coupon payment of the US-denominated bond, which gave European stock markets a shot in the arm.

All in all, I’m comfortable with both the economic and market outlooks in an increasingly vaccinated world.

Now to what companies could make us money over the next six months. They could come good earlier but I want to focus on the companies that will benefit from the reopening of economies.

My first company is tech-oriented and should benefit when we get back to mass live events. It’s called Audinate (AD8). The FNArena survey thinks a 30.7% rise lies ahead, with all three analysts expecting a rise over 24% with the most bullish being Morgan Stanley with a near 40% rise speculated.

In a recent interview, Rudi Filapek-Vandyck, founder of FNArena, said he liked this company as a company with a future.

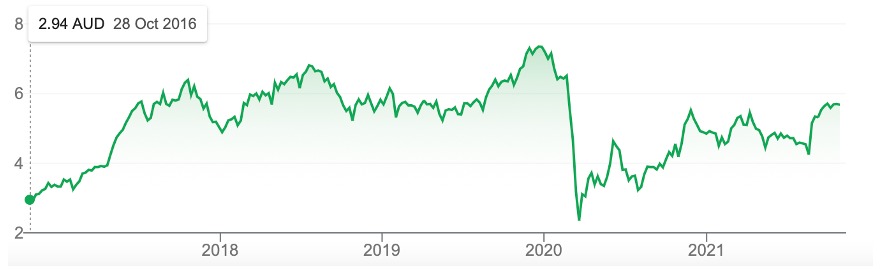

That’s a speculator. To play it safe, I can’t help but think the market will get warmer to Qantas as borders open up and we start to travel. The consensus of analysts say a 5.4% gain is ahead but I think in time that will be seen as a conservative call.

Qantas (QAN)

Five out of six company assessors see upside for the share price, with Morgan Stanley thinking a 22.81% gain lies ahead for the flying kangaroo. Provided vaccinations ban lockdowns and closed borders, I think the Qantas share price will fly higher. Looking at the chart above, you’ll see it’s now a $5.68 stock. Before the pandemic, it went as high as $7.35!

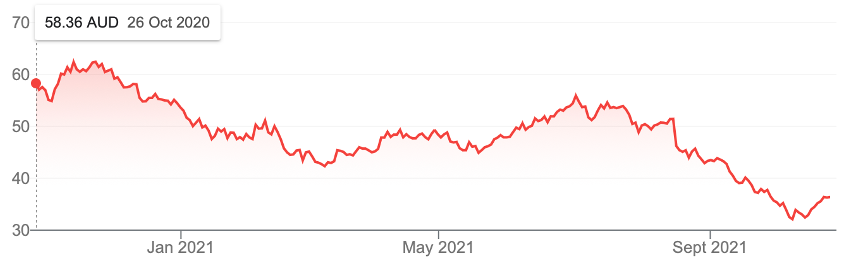

For my final call, it’s a toss-up between ELMO Software (which reported well last week and shot up 15%) and Magellan Financial Group (which also had a good week, rising 5.4%). I think both will do well in the coming months but they might not get it going before Santa flies in. Both charts look promising.

ELMO Software

Magellan Financial Group (MFG)

Hamish Douglas, who runs MFG, won’t get it wrong for long, and even Morgans tips a 49.8% gain ahead, though there are others who are less optimistic. Meanwhile, Macquarie’s analysts only have a 3.8% upside prediction on MFG but it did change its rating from “Neutral” to “Outperform”, which is a good sign.

Both of these companies should be beneficiaries of strong global economies and the business world getting back to post-pandemic normalcy.

(Anyone wanting to look into ELO can check out my interview with the CEO of the company, Danny Lessem, on tonight’s Switzer Investing TV program.)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.