In our webinar last Friday, many subscribers wanted to know whether banks, including both the majors and regionals, will rise or fall in the next few months. Here’s what Peter and Paul had to say.

“I think they’ll rise in price, but at a very slow rate compared to what we’ve seen. Probably the regionals might have a little bit more upside,” Peter said.

Looking at Bank of Queensland (BOQ) following their recent acquisition of ME Bank, Peter noted that the stock had an upside of 8.4% according to the seven brokers surveyed by FNArena. In comparison, the brokers had a downside of 10.8% for Commonwealth Bank.

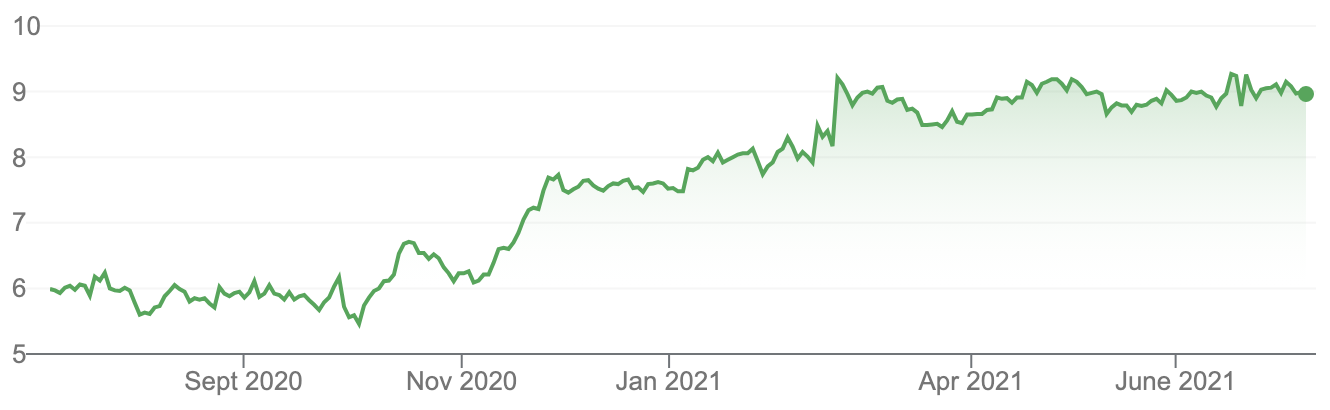

Bank of Queensland (BOQ)

Source: Google

“The regional banks will have more upside than the biggies, but I still expect CBA to rise,” argued Peter.

Commonwealth Bank (CBA)

Source: Google

“I think you and I are of the view, if I’m summarising this correctly, Peter, that most of the rise has already happened,” Paul said, adding that he doesn’t believe the banks will fall if the rest of the market goes up both because of their importance and their “reasonably attractive” dividends.

“In terms of exposure-wise, I’m back to neutral on banks, maybe a little bit going slightly more underweight,” Paul explained.

Despite the apparent downside for CBA currently, Paul highlighted that the stock rose by almost 10% in June while the other banks remained mostly unchanged.

“A lot of that was just going for the $100 mark, but it’s just interesting that we suddenly saw, I guess, that the market recognised that there’s a huge price for being the leader and the best, and the market’s prepared to reward leadership stocks,” Paul said.

Click here to watch the full webinar recording or download the transcript.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.