On a number of occasions, I’ve suggested that these comebacks for the stock market have been sneak previews of what’s likely to happen to tech and other growth stocks when inflation is on the slide and the interest rate rise programs of central banks are near an end.

This week the Yanks get their latest Consumer Price Index number and if it says the Fed’s rates policy is working, it will be great for stocks. If it doesn’t, stocks should drop and the day when these sneak preview rebounds become a fully-fledged comeback rally, rolling into a convincing bull market, will have to wait.

But it will happen, I’m sure of that and the fact that private equity is chasing stocks like Tyro Payments convinces me that tech stocks will ride higher in the not-too-distant future.

As a shareholder of Tyro, I was glad to see the likes of technology-focused private equity firm Potentia Capital, along with HarbourVest Partners, MLC and construction industry superannuation fund Cbus, seeing the potential of the company. They also know the current share price looks low compared to where it will be in a few years’ time.

That said, I’ve noticed a few tech companies have shown a pattern that says that smarties have seen these companies having a lot more potential and that their share prices looked too low.

Let me start with one company, Audinate (AD8), that has defied a lot of the volatility we’ve seen for those tech stocks that get easily re-loved but then dumped as Wall Street sentiment changes about what’s going to happen to interest rates.

When US market players think rate rises might be near an end, tech stocks take off and we follow suit. But when the view on rates changes (as it did after Jerome Powell’s speech at Jackson Hole a couple of weeks ago), tech stocks copped it.

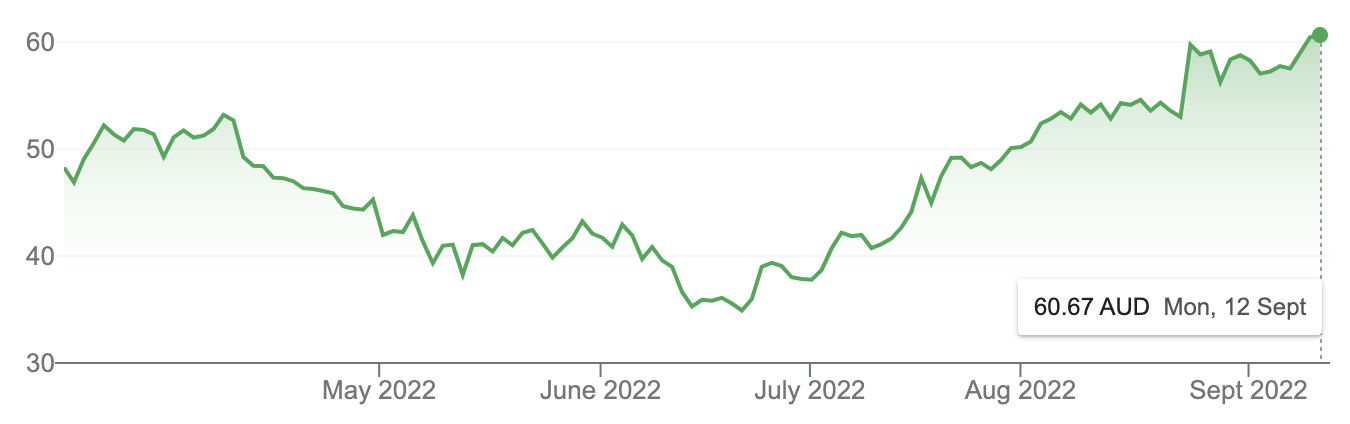

Have a look at Audinate’s chart for the past six months and note its 24% rise.

Audinate Group Limited (AD8)

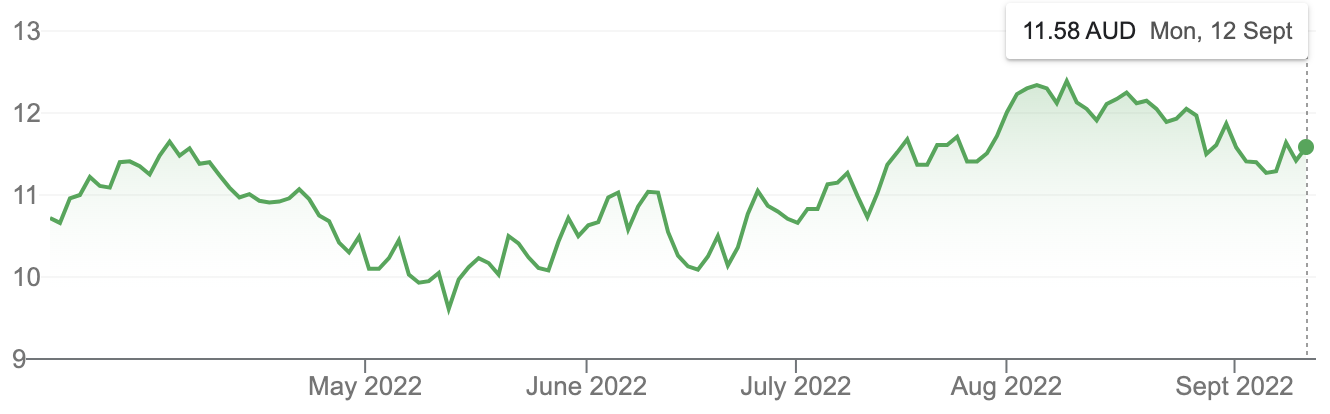

Let’s now look at another one of my favourites — WiseTech (WTC).

WiseTech Global Limited (WTC)

Last week it rose a huge 5.5%, while Megaport (MP1) spiked 21.85% but WTC rose 25% over the past six months, showing its unquestioned quality while MP1 lost 38%, indicating that it still has doubters out there.

(I think MP1 will deliver eventually but it might need a bull market and a strong global recovery not threatened by recession talk, to see it get back to its $21 share price in November last year.)

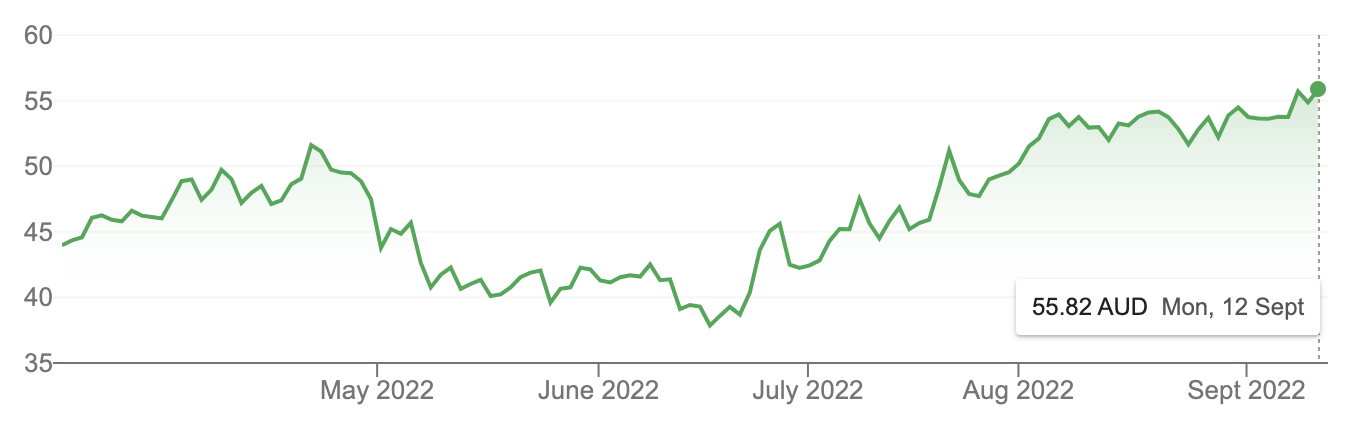

Here are some other good six-month performers:

1. TechnologyOne (TNE), which was up 6.5% over the past six months while the S&P/ASX 200 was down 3.5% over the same time.

TechnologyOne Limited (TNE)

2. Pro Medicus (PME), which was up 24.7% over the six months.

Pro Medicus Limited (PME)

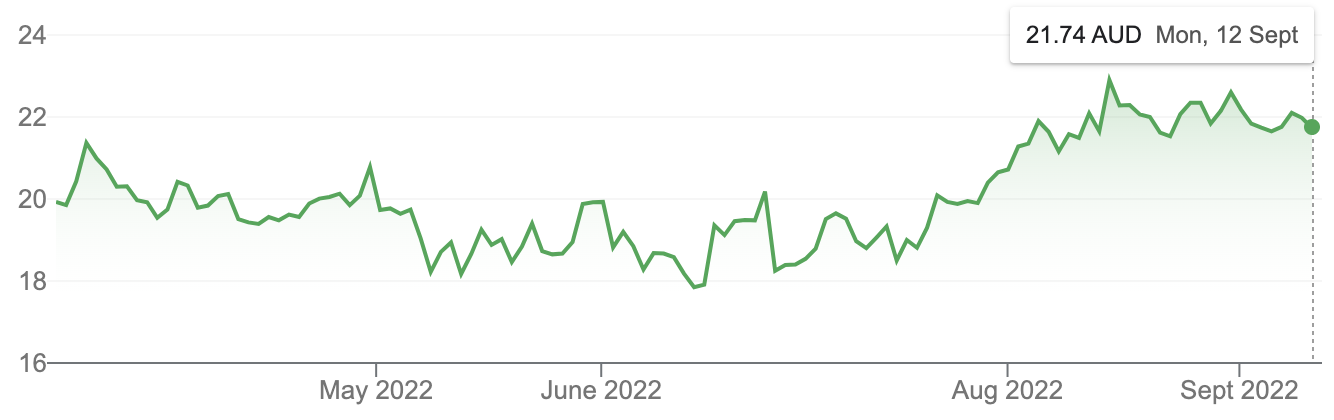

3. Carsales.Com (CAR) is up 10.3% over six months.

Carsales.Com Limited (CAR)

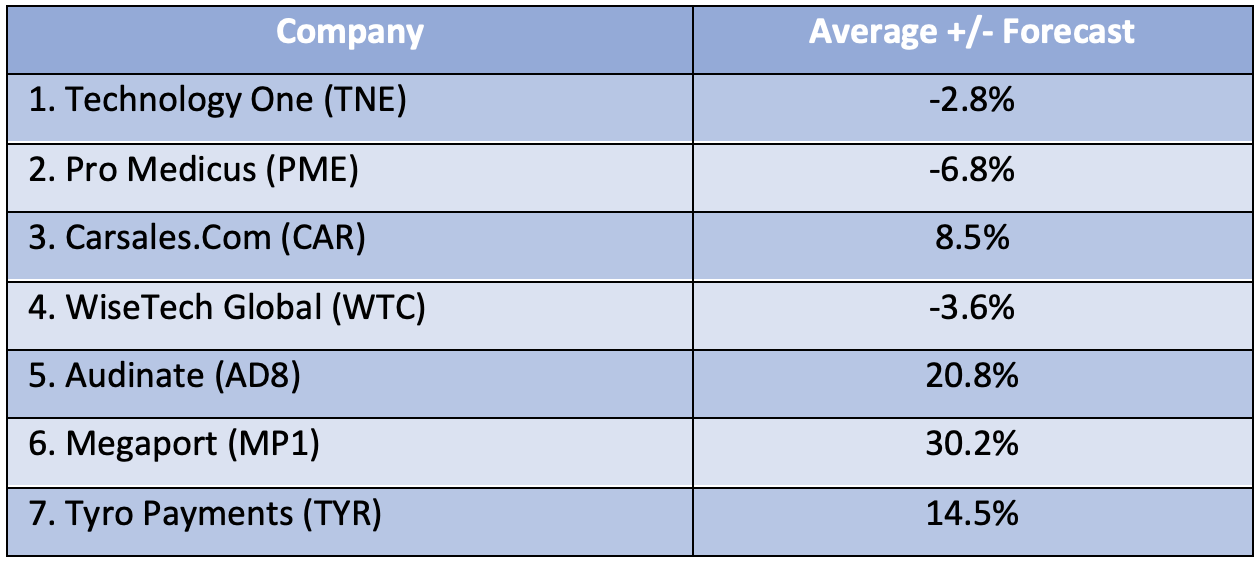

For those wondering what the consensus of analysts thinks about the companies I’ve mentioned today, here’s a quick summary:

The good six-month performers are not predicted to jump much in the short term (except for AD8), but I suspect over the next year, when tech stocks are re-loved, many of these will be reliable performers. Meanwhile, the less reliable types and poor six-month performers could be big improvers when tech stocks regain friends in the market, but they’re a bigger gamble.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.