“Westpac (WBC) provided a trading update with unaudited cash earnings of $1.58 billion,” Raymond said. “We think the market remains too bearish on the outlook for WBC.

“In terms of valuations, if we apply a cost of equity of 9% p.a., $21.50 stock valuation would mean:

1. WBC could only reduce its cost base to $9.3 billion by FY24 as compared to FY20 cost base of $10.2 billion and

2. Net interest margin (NIM) contracted by 50 basis points!

“As to its cost base, we continue to believe WBC will achieve its $8 billion cost base target by FY24. “Last week’s update provides a big relief that the cost-cutting is on track.

“Yes, NIM continues to be under pressure for all major banks, however, we think the drag from fixed rate mortgages is almost peaked and any potential interest rate rise could result in some improvement in NIM.

“Finally, on the top of the current $3.5 billion capital management (via buyback), we think WBC has room to do more capital management in future.

“Overall, WBC is our preferred major bank,” Raymond concluded.

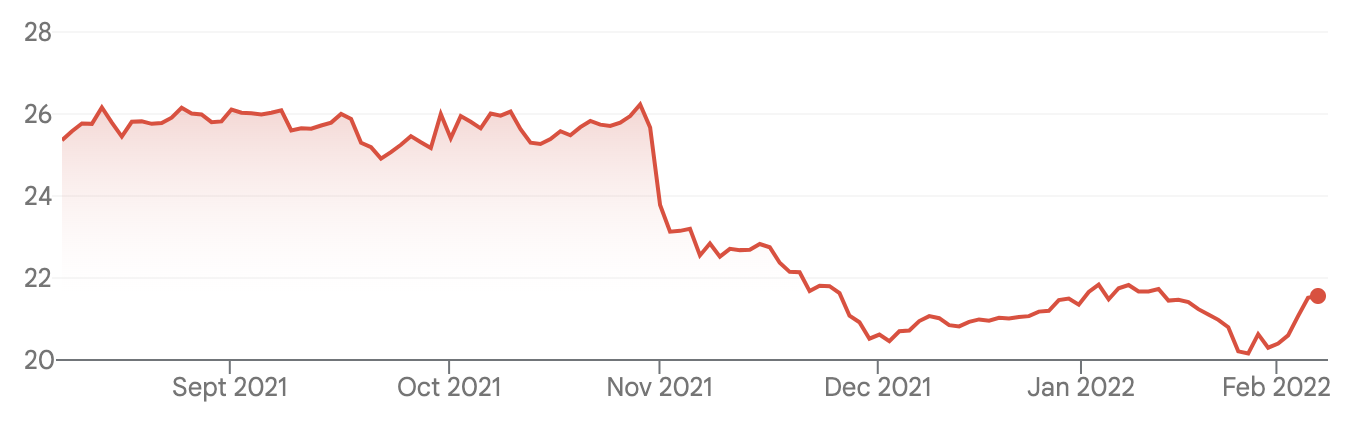

Westpac (WBC)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.