Insurance companies have been underperforming the broader market on the back of rising natural disasters and COVID business disruption. Will the sector result be seen as a catalyst for better times ahead? Raymond Chan takes a look at QBE, SUN and IAG and reveals which one he recommends as a BUY.

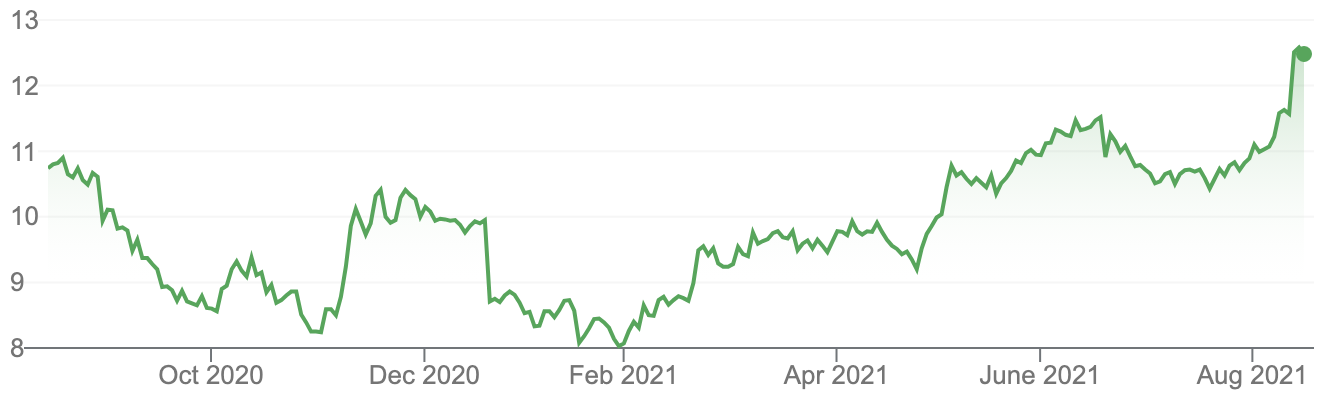

1. QBE

“When I first joined the stockbroking industry in the late 90s, QBE was a star performer, with industry leading insurance margin,” said Raymond. “Since then, the company spent years with earning disappointment and declining underwriting margin,” he added.

“QBE’s first-half result was well ahead of consensus forecast. Its dividend of $0.11 also exceeded expectation.

“This result was the best in a decade, with a 5-year high underwriting margin, strong revenue growth and good cost control … the rising revenue trend may continue into this financial year,” he said.

QBE (QBE)

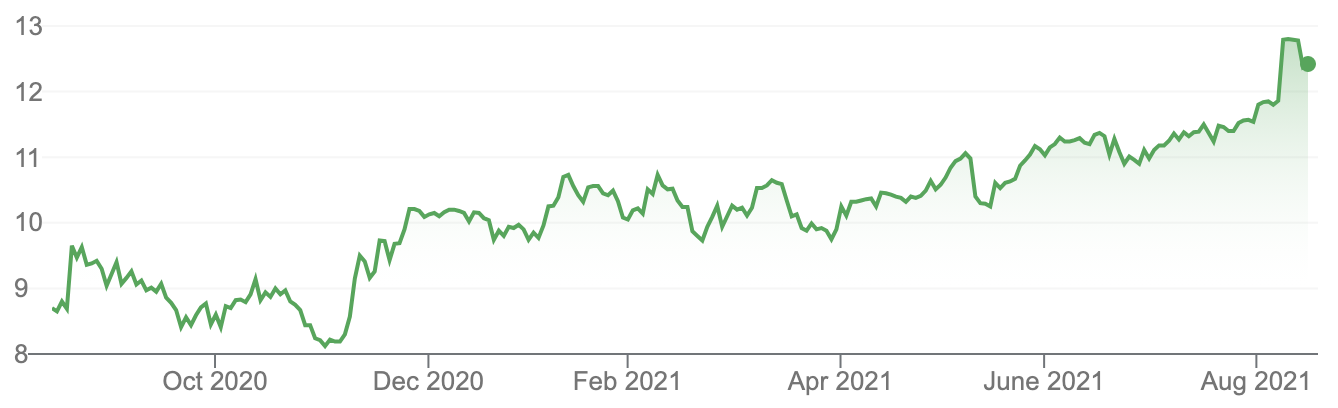

2. SUN

2. SUNSUN’s results was ahead of consensus. The highlight was a better than expected “capital return” with dividend of $0.40 plus special dividend of $0.08 special dividend and buyback.

“After a strong rally from COVID low, we think SUN is now trading at fair value,” he said.

Suncorp (SUN)

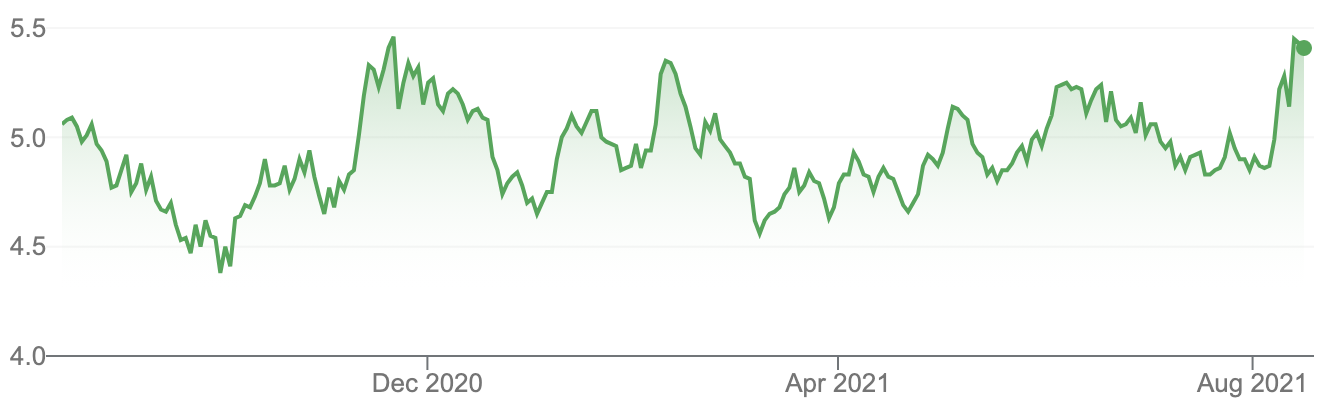

3. IAG

“IAG result was largely pre-realised but its price fell on results on the suspicion that its revenue growth trend might not be as strong as SUN,” Raymond said.

“IAG is now trading around a 7-year low.

“Last financial year was clearly a difficult one, however from here we feel IAG looks attractive at its current price given:

- Rising premiums

- Improving underwriting costs

- other cost control programmes

that should see the stock recover from here. Overall, our analyst has maintained an ADD/BUY recommendation on IAG,” Raymond concluded.

IAG (IAG)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.