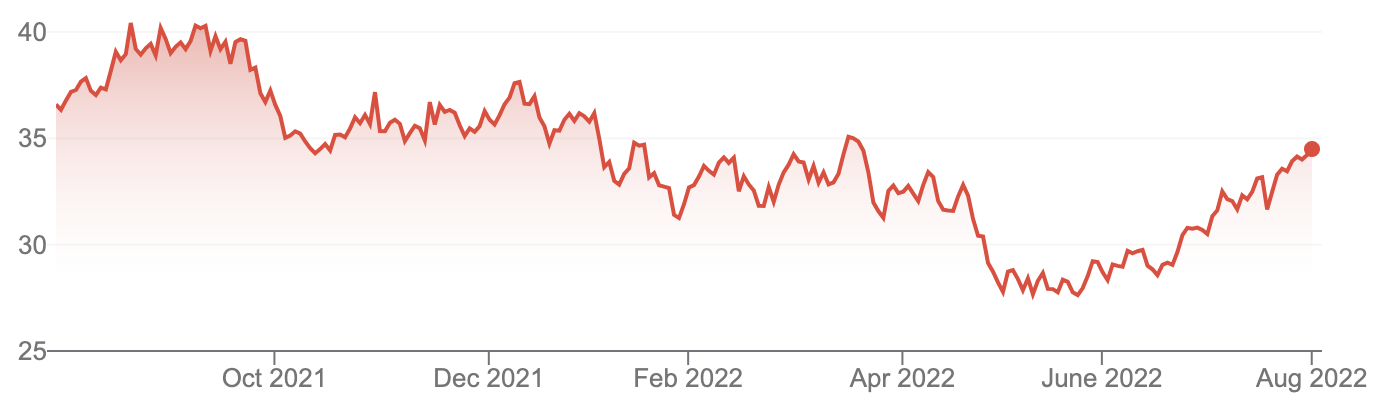

“After a notable outperformance initially during COVID,” Raymond said, “the healthcare sector underperformed in financial year 2022. But this recent rally has attracted investor attention.”

“In terms of sector valuation, it’s back to the historical average at … 33x!

“It’s interesting to note that over the past 20 years, the healthcare sector outperformed the market 80% of the time.

“Australian dollar weakness is a tailwind for net exporters such as CSL, COH, RMD, SHL, ANN, NAN,” Raymond says.

My key picks going into reporting seasons

“In terms of medical devices, ResMed (RMD) is our top pick.

“It was marked down after a soft third quarter in May. We expect strong device growth.

“Furthermore, its major competitor, Philips, is still recalling its products, which should result in higher demand for RMD’s product.

“The key risk is supply constraints, which may cap the upside potential,” Raymond said.

ResMed Inc (RMD)

Healthcare services

“Sonic Health Care (SHL) is now trading on 19x times,” Raymond said.

“We expect a solid result, given strong financial year 2022 COVID testing.

“The key risks will be SHL’s financial year 2023 outlook, given a slowdown in COVID testing.

“However, we expect other testing services will be normalised on the re-opening.

“Ramsay Health Care (RHC) with a target price of $80, has lumpy earnings and has been hurt by COVID restrictions, which now should be over,” Raymond points out.

“While labour is one of its biggest costs, the key is KKR’s $88 bid, which implies a 25% upside on its current level.

“If the deal falls over, then we’ll see RHC trading at $65.

Pharma

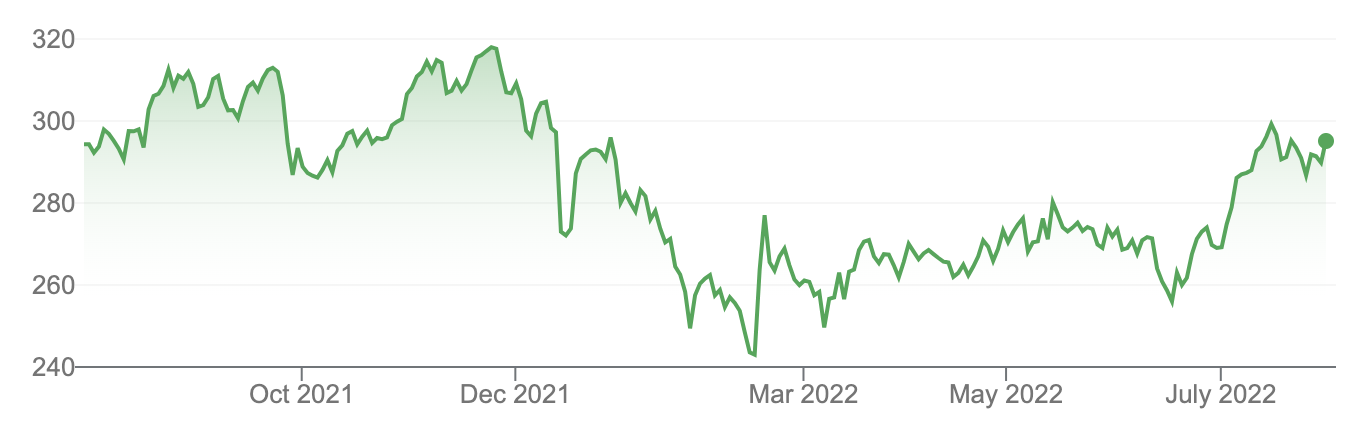

“CSL is our top pick,” Raymond said. “The company struggled through COVID given lack of plasma collection.

“The collection is now back to its pre-COVID level.

“Last year’s acquisition should deliver returns in the long term.

“CSL is expected to deliver double-digit earnings growth … trading at 31x,” Raymond concluded.

CSL Limited (CSL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.