In our “HOT” stock column today, Raymond Chan, Head of Asian Desk at Morgans, shares his views on REA Group (REA).

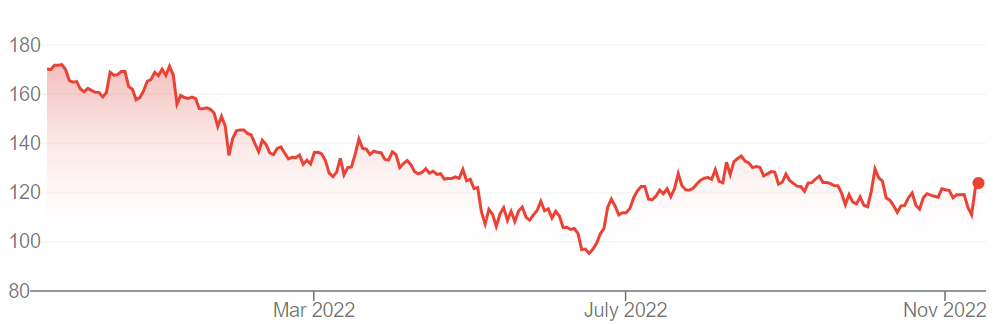

“My view is that REA is an add or a hold,” Raymond said. “We see its target price as $138 (previously $143.0). REA’s current price: $114.10.

“REA reported good first quarter results with group revenue up 16%.

“Australia and India revenue grew by 14% and 47% respectively.

“REA is made up of three key divisions: Australia, India and Financial Services.

“However, consensus is downgrading REA post results, due to a number of factors:

- Second quarter is likely to be more challenging e.g. October National residential listings was down 18% year-on-year on rising interest rate environment.

- Rising costs was another concern.

- While India recorded impressive growth, it only accounts for 5% of REA’s overall business, which REA will require to make further investments.

- De-rating of high PE stocks. Despite year-to-date price weakness, REA is still trading on a financial year 2023 PE of 34x.

“We think REA presents a long-term buying opportunity for the following reasons:

- Its dominant market position in Australia (3.3x the audience share of its nearest competitor).

- Strong financial position (net cash).

- During a property slowdown, REA revenue could be protected by higher fees over a longer advertising period and vendors opting for a premium option at a higher fee.

- Corporate activity. News Corporation (NWS) remains REA’s majority shareholder. Further weakness may attract corporate activities.

- While REA India and Financial Services business remain small, both divisions should offer long-term growth opportunities,” Raymond said.

REA Group (REA).