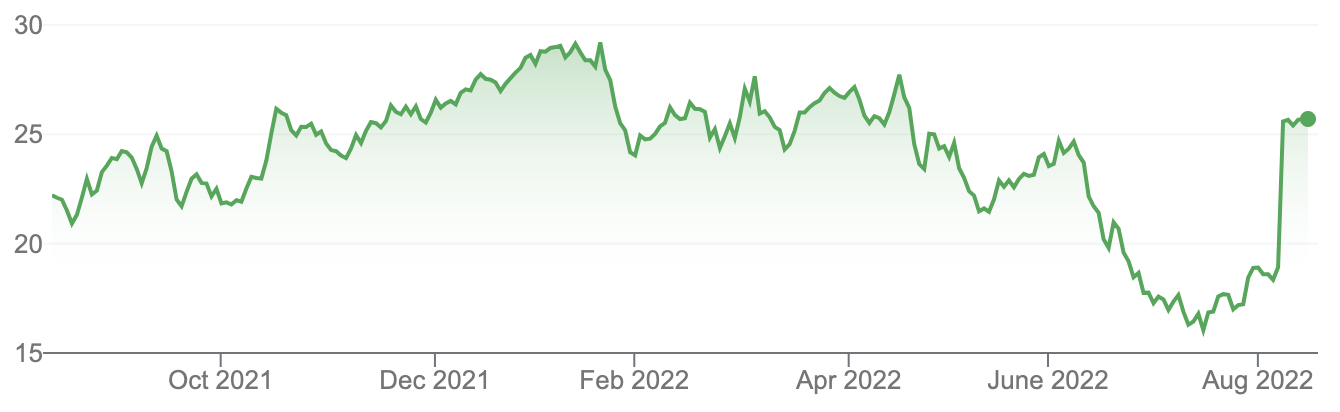

In an article for this Report in July (below), Raymond Chan of Morgans talked about upgrading Oz Minerals Limited (OZL) to ADD, given OZL’s price was trading at a 20% discount to its NPV – a level where we normally see good long-term returns.

OZL rejects BHP’s $25 a share takeover proposal

July article:

This week, BHP made a non-binding indicative proposal to acquire OZL at $25 cash per share via a scheme of arrangement. The offer is subject to several conditions including extensive due diligence; various financial assumptions and unanimous board approval from OZL. BHP has acquired a minor shareholding in OZL via derivative instruments. OZL’s board has unanimously rejected BHP’s offer on the grounds that it significantly undervalues the company.

The $25 a share offer sits at a 21% premium to the median consensus valuation of OZL (Facstet, 18 Brokers) and sits at a narrower premium to our valuation of OZL (under review). This immediately looks like too little of a premium to account for change of control, which typically ranges from 30-40% in Resources. We also think that it’s easy for OZL to argue that consensus valuations are too low, given a consensus long-term price assumption of only US$3.40/lb. There is clear upward pressure on long-term price assumptions linked to; 1) rising all-in copper production costs; 2) increasing difficulty is sustaining current copper supply (mine grade, technical hurdles, labour disruption); 3) threats to new copper supply linked to financing, difficult geopolitical jurisdictions and increasing resource nationalism.

This looks like smart/opportunistic timing from BHP, with OZL having corrected ~35% from its 12-month high above $29. OZL’s correction has mirrored the copper price, and we think also reflects recent technical issues at Carrapateena, and arguably some hesitance from shareholders about the West Musgrave development and implications for funding.

Now Raymond answers the question: what happens next?

We think that it’s unlikely that this is BHP’s first and only approach to OZL. BHP can easily afford to offer a high enough price to get the OZL board to the table and has the strategic motivations to do so. We think that OZL takes a defensive stance in the interim to justify its comments around rejecting the first approach. It’s plausible that this may even crystallise some decisions that OZL shareholders may want to see including making an exit from the Brazilian business or deferring WMP. We think OZL’s shareholders will also put pressure on the board to consider another approach at a higher price more carefully, should it eventuate. In the meantime, it’s easy to see OZL trade with an included takeover premium of say a minimum of 15%.

Could a third party make an approach?

“It’s plausible but less likely in our view for now,” Raymond said.

“It’s well-known Fortescue (FMG) has clear ambitions in copper, and overseas names like Freeport or Antofagatsta may get mentioned in speculation.

“However we don’t think anyone can realistically compete with BHP, particularly as BHP would be able to extract the most synergies in South Australia (corporate, logistics, marketing) where it operates the nearby Olympic Dam operation,” Raymond said.

And what’s the investment view?

“The stock may quickly move to a decent premium to valuation,” Raymond said.

“Hold on for the ride for now.

“We’ll likely learn a lot more at OZL’s first half 2022 result on August 29,” Raymond concluded.

Oz Minerals Limited (OZL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.