“Overall, we saw this as a soft result that was well below market earnings expectations, although clearly a normalisation in Macquarie’s operating environment is the key driver here,” Raymond said.

“We lower our MQG financial year 2024F EPS by approximately -5%, with slight lifts to other future year earnings. Our price target is lowered to $182 (previously $194).

“MQG is a quality franchise, well exposed to structural growth areas, and the company has delivered strong net profit after tax (NPAT) growth in recent years.

“Clearly, cycling an extremely strong financial year 2023 result is proving difficult for MQG, but we remain confident in the medium-term outlook for the franchise,” Raymond said.

“With more than 10% share price upside to our price target, we maintain our ADD recommendation,” Raymond said.

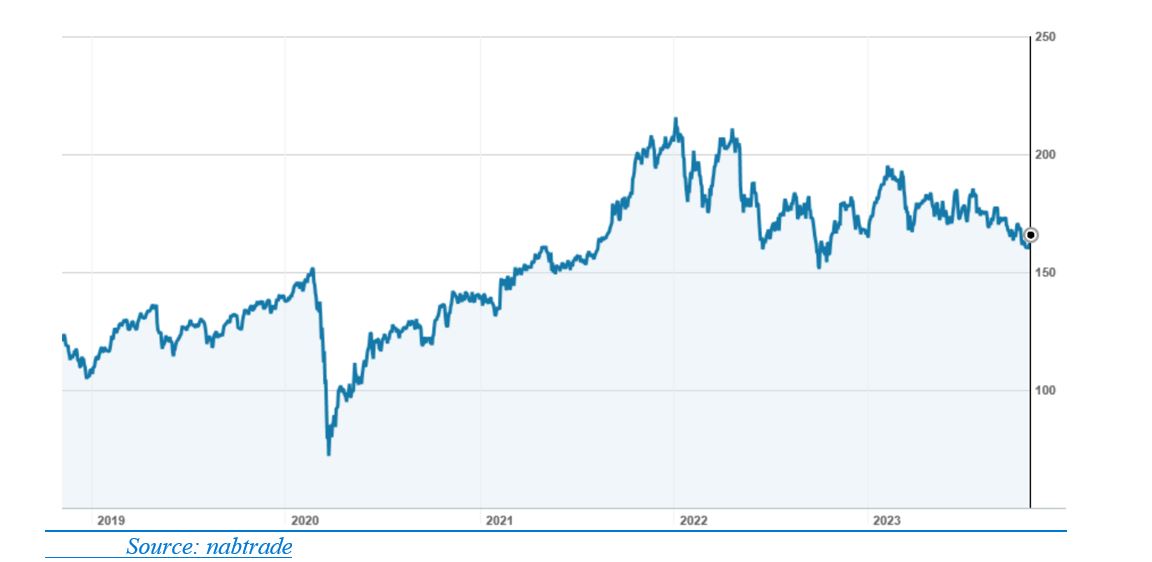

Macquarie (MQG) – Nov 18 to Nov23

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.