Aristocrat (ALL) is the largest gambling machine manufacturer in Australia and the second-largest manufacturer of poker machines in the world. Founded by Len Ainsworth, the company produced its first machine in 1953 and listed on the ASX in 1996. Raymond Chan says Aristocrat Leisure is a buy.

“Earnings (NPATA) in the first half of financial year 2022 were 41% higher than in the first half of last financial year, exceeding our estimate by 13%,” Raymond said.

“Investment in product and partnerships paid off handsomely in the Americas Gaming, which saw segment profit rising 56% in US dollar terms.

“There was also positive earnings growth in ANZ and International Class III Gaming as well as the Digital business, Pixel United.

“Operating cash flow increased by 42%, which combined with the proceeds of October’s equity raise, left ALL with $0.5 billion in net cash, giving it the confidence to announce a $0.5 billion share buyback.

“We have increased our earnings estimate by 7% this financial year and by 3% next financial year.

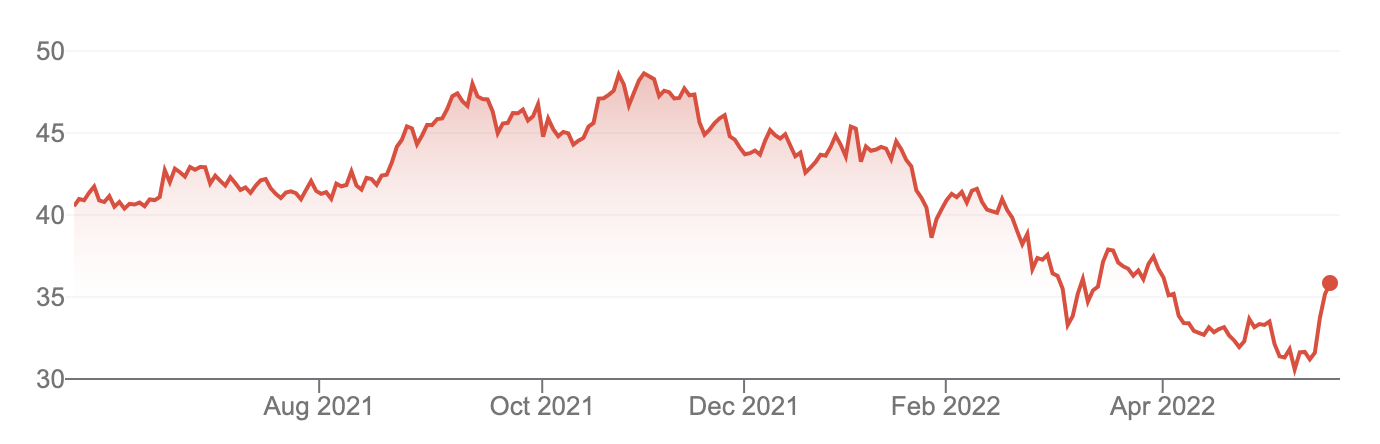

“We reiterate our high conviction ADD rating with a 12-month target price of $43,” Raymond said.

Aristocrat Leisure Limited (ALL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.