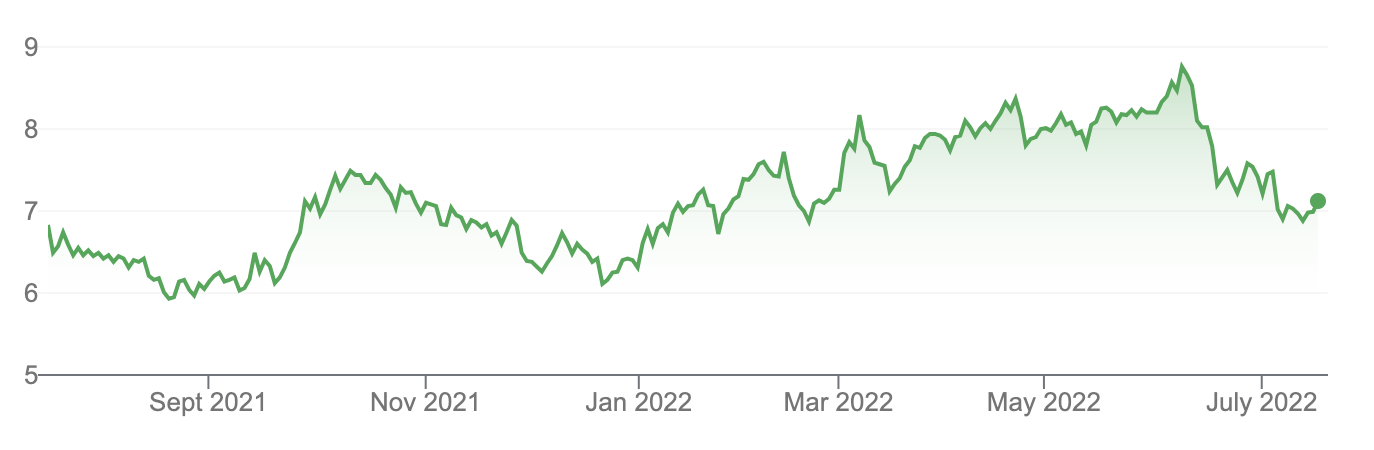

Energy was one of the best performing sectors last financial year. With oil now falling below US$100, this is how we see this market this financial year.

Rising volatility

In the near term, investors have very little visibility on the direction of the oil price given:

- Weakening demand on potential economic slowdown and China’s lockdown; and

- Withdrawal of liquidity e.g. hedge funds and other money managers sold the equivalent of 110 million barrels in six most petroleum-related futures and options in the first week of July (according to Reuters).

China is important as the country accounts for over half of global oil demand growth in 2022.

Supply expectation

Taking into consideration a fall in both US & Russian output, we estimated 2022 world oil production of 100 million barrels per day (+4.6% year-on-year growth) vs world oil consumption of 100.5 million barrels per day. As such, we now expect demand and supply to be pretty much balanced.

Remember, the market was expecting demand to outstrip supply on the COVID re-opening trade! That’s why the oil price got smashed here.

Longer term

However, we’re more positive about oil’s long-term outlook, as long-term supply will remain constrained e.g. many US shale oil producers won’t be back online after the 2016 and 2020 oil crashes and lack of finance in the Energy sectors (over ESG concerns).

We think the current energy stock price weakness will provide long-term buying opportunities for patient investors.

Our key stock is Santos (STO).

We like STO, given its strong cash flow and more synergy from the Oil Search merger.

The key catalysts are:

- Operational Results on 21 July.

- Financial results/dividend announcement on 17 August.

Our action plan

In our view, the best course of action is to NOT go all in against the volatility but gradually accumulate in high-quality energy stocks (say STO and/or Woodside (WDS)) where we see long-term value already on offer.

Santos Limited (STO)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.