I enjoy looking beyond the usual suspects during earnings season, to uncover interesting pockets of value in the market. One of them is Listed Investment Companies (LICs).

Several LICs impressed during the recently concluded profit-reporting period. Profits and ordinary dividends were up and some LIC boards declared special dividends.

Even better, LICs such as MFF Capital Investments (MFF) said they intended to pay higher dividends over the next few years. Some LICs have years of retained earnings dividend coverage (based on their latest dividend), meaning they are well placed to deliver future dividends.

I suspect more income investors this year will use LICs for yield, particularly companies paying quarterly dividends and with fully franked yield of at least 5%. Knowing a LIC has the equivalent of the next few dividends tucked away in its retained earnings is attractive.

After a tough few years, when many LICs traded at large discounts, it’s pleasing to see the sector trading closer to its pre-tax Net Tangible Assets (NTA). The knock-on for the sector is persistent large discounts in some LICs, although that’s not as clear-cut as it seems.

That’s the good news. The reality is the LICs should have had a strong year in 2020-21. If active managers can’t deliver decent returns in a recovery as buoyant as this year, they should give up.

The LIC structure was another advantage. As closed-ended funds, LICs have a fixed capital pool. Unlike open-ended funds, they don’t have to sell at the bottom of markets to meet investor redemptions or buy at the top when fund inflow is strong. Their structure was an asset when markets nosedived in March 2020 and LIC managers could pounce on value.

The other reality is valuation. The market has recognised the LIC sector’s improving performance and narrowed the gap to NTA. In hindsight, LICs were a steal in March 2020 when they traded at an average discount of 13.5% – the highest since 2012. Now, the average discount is closer to 5%, suggesting the sector is almost fully valued.

Averages, of course, only tell part of the story. There are always outliers and opportunities if you look hard enough. Also, assessing a LIC on its discount or premium to NTA is only half the battle. The trick is comparing the discount to the LIC’s five-year average. LICs have a habit of returning to their mean discount or premium over time.

For example, if a LIC is trading at a current 10% discount to NTA and has traded at an average 5 per cent discount over the past five years, that warrants further investigation. There could be a reason for the unusually large discount; or the LIC could be oversold.

Like any stock, a LIC can trade below, at, or above fair value. So too can an Australian Retail Estate Investment Trust, relative to its net assets. There’s nothing special about LIC discounts or premiums – it’s just a reflection that investors buy and sell shares in the company, not units in its underlying fund. If there aren’t enough buyers, the LIC’s share price will drift lower.

Small-cap and global LICs are two interesting LIC sub-sectors at current prices. Both have tended to lag Australian equity LICs, trading at large discounts on average. A year ago, several global LICs traded at whopping double-digit discounts to NTA, and some still do.

Buying one dollar’s worth of assets for, say, 90 cents in an NTA that trades at a discount can be rewarding – provided you are confident the manager will keep growing the assets.

Here are 3 LICs worthy of further research:

1. Spheria Emerging Co Ltd (SEC)

Spheria has cracking underlying fund performance. The company’s investment-portfolio value leapt 55.5% over 2020-21 – beating its benchmark index by about 23%.

With corporate profits up, Spheria declared an FY21 annual dividend of 8.5 cents, up 55% on the previous year. The LIC is yielding almost 5% after franking at $2.40.

At the start of FY21, Spheria traded at a ridiculous 25.5%. discount. Now, it trades near an 8% discount as the market recognises the quality of its investment performance.

Switzer readers will recall I included Spheria in my column “3 top LICs” in July 2019 at $1.80 a share, when it traded at an 11% discount to NTA. I wrote then: “The LIC’s portfolio performance has slightly lagged … since inception but looks well placed to outperform in the medium term.”

I’m kicking myself for not doing a follow-up for readers when Spheria offered even better value a year ago.

As the Australian economy recovers next year, Spheria’s portfolio could deliver another year of good performance – albeit not on par with FY21 – driving its NTA and share price higher.

As a small-cap fund, Spheria suits investors comfortable with the features, benefits and risks of this form of investing.

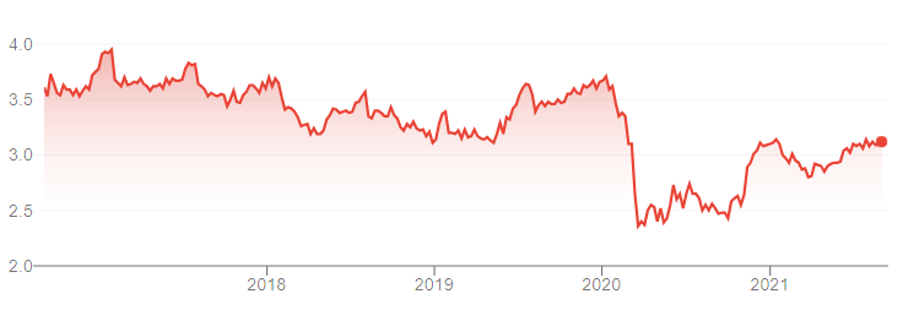

Chart 1: Spheria (SEC)

Source: ASX

2. Djerriwarrh Investments (DJW)

I don’t understand why the income-focused LIC trades at a 10.5% discount to pre-tax NTA, on Bell Potter numbers. Djerriwarrh’s five-year average discount is a 4.8% premium.

That’s a good example of the benefits of analysing a LIC’s discount against its long-term average. Djerriwarrh is trading at a double-digit discount when it usually trades at a premium, on average. Its peak premium over the past five years was 18.4%.

Djerriwarrh comes from the team at Australian Foundation Investment Company (AFIC) – the market’s largest LIC by capitalisation and one of its most respected.

AFIC now trades at a 10% indicative premium to its NTA, as Djerriwarrh trades at a 10% discount. I’d love to see the last time the gap between the two LICS was that large.

Djerriwarrh, an income-focused LIC that used options strategies to enhance returns, increased its final dividend by 9.5% to 5.75 cents in FY21. Its underlying portfolio performance was 29.6% for the year, a touch ahead of the S&P/ASX 200 Accumulation index.

Djerriwarrh has tweaked its portfolio style to include more companies that provide a better mix of dividend and capital growth potential. I like the look of its portfolio and expect the LIC to narrow the gap to NTA and eventually get back to a premium.

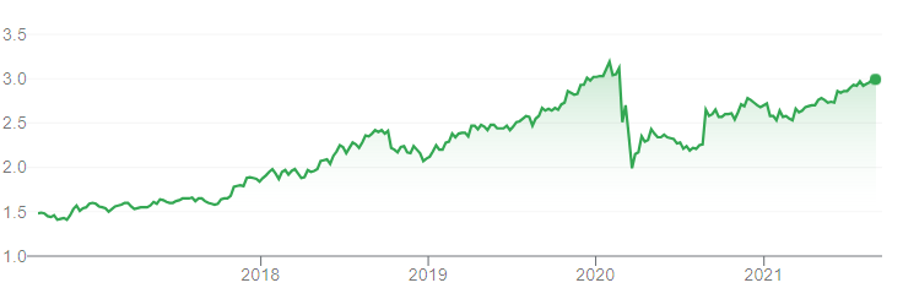

Chart 2: Djerriwarrh (DJW)

Source: ASX

3. MFF Capital Investments (MFF)

Global LICs are still mostly a sea of discounts to NTA, even though several reported strong underlying portfolio performances in FY21 and good dividend growth.

MFF Capital is on a 13.4% discount to NTA on Bell Potter’s latest numbers. Its five-year average discount is 9.1%. MFF has ranged from a peak discount of 21% to a peak premium of 6.3%.

The LIC has strong profit reserves, franking credits and its guidance for higher dividends over two years. MFF Capital Investments, a global equity LIC, plans to increase its interim dividend within two years, from 3.5 cents a share to 5 cents.

The LIC’s underlying portfolio has had consistent performance in a difficult market.

Like Djerriwarrh, MFF’s discount to NTA looks overdone. In MFF’s case, I suspect the market’s lack of interest in global LIC performance is part of the problem.

As investors pour into global Exchange Traded Funds, they could overlook value in global LICs – and underestimate the benefits of active funds management in volatile markets.

Another advantage of global LICs is that as Australian companies, they pay Australian corporate tax and generate franking credits, despite investing in offshore stocks. That’s attractive for zero-tax investors in the pension phase, such as self-managed superannuation funds.

Chart 3: MFF

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 1 Sept 2021.