The case to take some profit on gold bullion strengthens after a strong rally and then rotate into gold equities.

A colleague asked about last week’s column on ‘3 assets to sell’. He agreed with my view to take profits on the Commonwealth Bank and US equities, to increase portfolio cash, but disagreed with reducing exposure to gold bullion. Moreover, he struggled to reconcile my bullish view on gold equities in the past 18 months with a more cautious view on gold bullion this year.

These are good questions and a worthy topic for this week’s column, given the gold price’s rally and the gains in gold equities this year.

Before I dive into gold, a quick recap on last week’s column. Suggesting investors take profits on an asset does not mean fully exiting it. Rather, taking advantage of a rally to sell part of an asset, to free up cash to buy undervalued assets.

In fund-manager parlance, this is known as ‘lightening’ a position. In my experience, too many retail investors think about stocks in absolute buy or sell terms, rather than increasing or decreasing exposure as valuations dictate.

To be clear, I don’t suggest investors who hold gold bullion fully exit their position. Far from it: I have long advocated that most portfolios should have a small allocation to gold bullion (0-5%) as a form of insurance, given gold bullion is usually sought as a ‘safe haven’ when market uncertainty spikes.

But I am concerned that gold bullion’s rally is starting to fade. After briefly touching a record-high of US$3,500 an ounce in April 22, gold is back around US$3,300 an ounce – an almost 6% fall.

As an aside, I hope readers considered my April 23 column for this Report, ‘Time to take some shine off gold’, which was timely.

Yes, the fall since April is small in the context of gold bullion’s 33% rally this calendar year (peak to trough). Gold bulls could argue that gold bullion was due for a pullback given the extent of its rally and that the recent fall is a brief pause.

Maybe. Consider events since late April: the Israel-Iran War and US bombing of Iranian nuclear facilities; ongoing wars in Palestine and Ukraine; the fallout from President Trump’s erratic US tariff policy; and a weaker US dollar.

Rising geopolitical tensions and Greenback weakness against a basket of key currencies should be good for gold bullion. But the market preferred to take some profits after gold’s big rally.

Then there’s sentiment. I notice more analysts overseas starting to call time on gold’s rally. In June, Citi analysts predicted the gold price could fall below US$3,000 an ounce by late 2025 or 2026, amid declining investment demand and an improving global economic outlook. If Citi is correct, the gold price could shed as much as a quarter by late 2026.

I’m not as bearish on gold bullion as Citi and other analysts. Granted, a recent easing in geopolitical tensions in the Middle East and signs of an improving global economy could support higher investment in risk assets, and less in safe havens like gold.

But these gains could be short lived. As I have argued in previous columns this year, markets will be more volatile this decade due to an unusual combination of geopolitical risk, macroeconomic threats and structural changes in the global economy, such as the decoupling of the US and Chinese economies.

Anybody who thinks the worst is over and that market volatility and uncertainty will retreat, taking gold bullion lower with it, is too optimistic. Continued central bank buying of gold is another factor that could support its price.

So, while I think the fundamentals for gold bullion’s rally remain intact, it’s more a case of the rally running too far, too fast for now, necessitating some profit taking.

Moreover, both gold bullion and US equities have rallied this year. Gold and US equities can rally together when the US Federal Reserve signals rate cuts, inflation is moderate and the market expects a ‘soft’ economic landing,

But in more normal cycles, rising US equities suggest rising investor confidence, which works against gold and other safe-haven assets. Again, this strengthens the case to take a few profits on gold bullion at these levels.

Gold ETFs

Consider my preferred vehicle for gold-bullion exposure: the Global X Physical Gold (ASX: GOLD) Exchange Traded Fund. I have highlighted GOLD several times in this column in the past few years as a convenient, cost-effective tool for gold exposure via ASX.

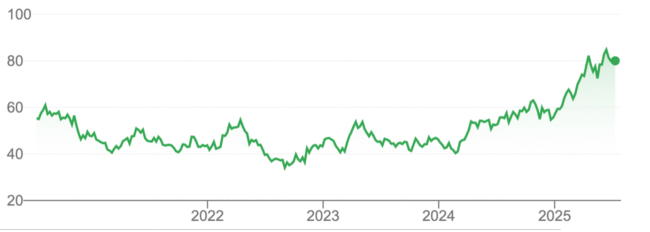

The chart below shows GOLD’s returns this decade. Note the double top on the gold price in the past few months, which some chartists consider a bearish technical pattern when the price retests a previous high and fails.

Chart 1: Global X Physical Gold ETF

Source: Market Index

In my September 2024 column, ‘3 rotation ideas for overvalued to undervalued assets’, I suggested moving from gold bullion into gold equities. The logic was simple: gold equities at the time had badly lagged gold bullion’s rally. That view meant missing out on the latter stages of gold’s rally (September 2024 to April 2025) but benefiting from a larger rally in gold equities.

Over six months to end-June 2025, the VanEck Gold Miners ETF (ASX: GDX) – my preferred gold ETF – returned 44%. In contrast, the Global X Physical Gold ETF had a year-to-date return of about 20% in that period.

Both returns appeal, but ETF investors who reduced exposure to gold bullion as its rally went to nose-bleeding heights, and increased exposure to gold equities that had lagged the gold rally for years, have outperformed.

The question now is whether it’s time to take profits on gold equities given the extent of that rally. Over 12 months, the GDX is up a whopping 57%, thanks to the higher gold price, a belated market recognition of gold equities’ undervaluation.

Chart 2: VanEck Gold Miners ETF

Source: Google Finance

I would continue to hold gold equities rather than take profits, at current valuations, for a few reasons. First, as mentioned earlier, I still expect heightened market volatility, geopolitical tensions and macroeconomic risks. Maintaining exposure to gold equities provides portfolio leverage to those trends.

Second, although GDX’s 12-month gains impress, further catch-up is required. Over five years, GDX’s annualised total return is just below 10%. Put another way, GDX’s recent gains over one and three years follow a longer period of lower returns.

Third, GDX’s forward Price Earnings (PE) ratio of 14.5 times at end-June 2025 is undemanding. It’s less than the average for the S&P/ASX 200 index and broadly in line with this market’s long-term valuation average.

Make no mistake: GDX and other gold equities will retreat if the gold price edges lower, as has happened in the last few weeks. Also, GDX is exposed to market and company risks, unlike the GOLD ETF.

But I still like the medium-term outlook for gold equities, even if the gold bullion price stabilises or retreats a little from here. Retail investors often underestimate how far asset prices can fall – and for how long. Also, how far asset prices can rise and how long full recoveries take to play out.

After a decade of underperformance, the recovery in gold equities could have further to run, although gains will be slower from here if gold bullion edges lower, with occasional pullbacks and setbacks along the way.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 July 2025.