Every now and then, a statistic stops you in your tracks. For me, that was a recent comparison between the Commonwealth Bank of Australia and global banks.

Around $120 a share, CBA is on a forward Price Earnings (PE) ratio of 20 times and Price-to-Book (P/B) ratio of 2.66 times, on Morningstar numbers.

The BetaShares Global Banks ETF – Currency Hedged (BNKS) is on an average forward PE of 8.2 times and P/B ratio of about 1. The ETF holds 60 of the world’s largest banks (ex-Australia). Most are in the US or Europe.

Simply, CBA is more than twice as expensive as a basket of the world’s largest banks. Many of these banks serve much larger markets than CBA, yet trade on half the valuation of CBA and well below other Australian banks. CBA is 24% overvalued, estimates Morningstar.

What gives? Has CBA become the world’s most expensive retail bank? Or are global banks undervalued and an opportunity for long-term investors?

To consider those questions, here is some brief commentary on the banking sector. This column’s readers know I made a bullish call on the banks during the COVID-19 pandemic after their share prices tumbled when global markets tanked.

In April 2020, I wrote for the Switzer Report: “I am less bearish over the next 12 months than some forecasters and do not believe banks are underestimating likely loan impairments, or that bad debts will soar beyond expectation.”

I added in October 2020: “Risks aside, it won’t take much for more capital to move back into banks, as fund managers are positive for the next stage of the recovery. As such, I remain positive on the big banks.”

I still like banking stocks, but my view has changed, given CBA has more than doubled since April 2020. Global banks look more attractive than Australian banks at current valuations, particularly those in Europe.

Although the US will likely cut interest rates before Australia, I expect rates generally will remain higher for longer due to the persistently higher inflation. That will help support banks’ Net Interest Margins (NIM) and earnings.

Moreover, the US Federal Reserve and European Central Bank appear to have achieved the seemingly impossible: higher interest rises to quell inflation, without tipping their respective economies into recession. Although bad debts will rise, improving economic growth will contain loan impairments.

There are, of course, many challenges for banks. Slowing credit demand and revenue growth and rising costs are big headwinds. So, too, is growing competition in the sector from fintech firms.

Ultimately, the key issue is valuation. Bank of America, for example, trades on a trailing PE of 11.6 times and a P/B of 1.07, on Morningstar numbers. Bank of America, one the world’s great retail banks, serves a market many times larger than that of Australia, yet trades at a sharply lower valuation than CBA.

Remarkably, HSBC, Europe’s largest bank by assets, trades at a trailing PE of 6.32 times and P/B of 0.85. HSBC’s return on equity (ROE) at 12% compares to CBA’s ROE of 13%.

Investors who have profited from CBA’s staggering rally could consider taking some profits and rotating into global banks that trade at far lower valuations. That idea might not suit long-term investors in CBA who are sitting on massive gains since its Initial Public Offering (IPO) in 1991 and would face hefty capital gains tax bills.

But lightening positions in CBA after its rally and freeing up capital to invest in far more attractive banks (at current valuations) makes sense. Here is a brief update on Australian and global banks.

- Australian Banks

CBA is an exceptional bank. Thanks to its technology leadership position, CBA is the best bank in Australia by a long way and up there with the world’s best in some aspects of performance.

Also true is CBA shares have rallied because of momentum-based factors. About six months ago, fund managers lightened their positions in Australian banks as revenue growth slowed, net interest margins contracted, and costs rose.

When the US and other central banks signalled in late 2023 that rates would be cut in 2024, asset managers who were underweight Australian banks had to buy more, particularly as fears of sharply lower house prices abated.

At the same time, the boom in passive investing through Exchange Traded Funds (ETFs) saw more capital pour into CBA and to a lesser extent other Australian banks. On some reports, CBA receives about $1 out of every $10 of new passive funds into the S&P/ASX 200 index, such is its weighting in that index.

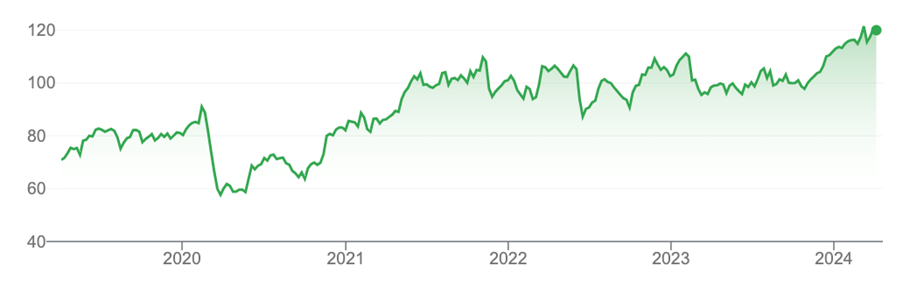

This weight-of-money took CBA’s share price too far, too fast. Yes, it’s a great bank and a core holding for long-term retail investors. But a 20% gain since October 2023 is more about market momentum than company fundamentals.

It’s hard to make the case to rotate profits from CBA (after lightening the position) into the other big-four Australian banks. Based on my analysis of consensus estimates, ANZ and Westpac are a touch undervalued and National Australia Bank is a touch overvalued at current valuations.

Either way, Australia’s big banks look less attractive compared to current valuations in the US and European banking sectors.

Chart 1: Commonwealth Bank of Australia

Source: Google Finance

- Global banks

The easiest way to add global banking exposure to portfolios is through an ETF. As mentioned, the BetaShares Global Banks ETF- Currency Hedged (BNKS) provides exposure to 60 global banks.

About 35% of BNKS is invested in US banks such as JP Morgan Chase & Co, Bank of America, Wells Fargo and CitiGroup. Another 15% of BNKS is invested in Canadian banks. At least 20% is invested in UK and European banks.

The weighted average market capitalisation of BNKS is $208 billion.

BNKS has returned 6.37% over one year to end-February 2024. Over five years, the ETF has returned a paltry annualised 3.29%, reflecting the underperformance of offshore banks. BNKS has had a nice rally since November. but has a lot of ground to make up. The ETF’s price is roughly back to where it was in 2017.

In contrast, CBA has a total shareholder return of 27% over one year and a 14.6% annualised return over five years. Investors who held CBA in that period have done remarkably well compared to those who owned global bank shares.

But every stock has its price. Over the years, I’ve seen too many investors fall in love with stocks that rally. They refuse to take profits, believing those stocks will continue climbing higher, seemingly in perpetuity.

Nobody is suggesting long-term investors in CBA fully exit their position. Rather, that they consider taking some profits as CBA and the Australian equities market rallies – and rotating into banks that offer better value at current prices.

BNKS’s average forward PE ratio of 8.8 times – versus 20 for CBA – is food for thought. Granted, the ETF’s average dividend yield of 1.9% is a drawback for income-focused investors who seek fully franked yield from Australian banks.

As always, the key is total shareholder return. It’s sometimes better to sacrifice some dividends rather than overpay for assets and take too much risk.

As a currency-hedged ETF, BNKS eliminates currency risks. Its annual management fee of 0.57% is reasonable given it includes currency hedging.

Chart 2: BetaShares Global Banks ETF – Currency Hedged

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation, or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 3 April 2024.