Even before President Trump made the big decision to enter the Israel-Iran war, taking out the latter’s nuclear facilities, I’d planned to look at how we should be investing given the level of problems we had even before the bombings.

In the past, I’ve looked at market reactions. History has shown shock geopolitical events (including September 11 when the US was attacked by terrorists on planes), the short-term reaction was significantly negative. However, within 12 months, Wall Street had risen by what you might call an average amount.

Last week, AMP’s Deputy Chief Economist Diana Mousina did an in-depth look at how markets are affected by geopolitical events. I thought it was timely to share her big observations relevant to investors.

In light of this from Iranian leader Ayatollah Ali Khamenei that “any American military entry will undoubtedly be met with irreparable damage”, how the market reacts to this US action is likely to be negative. Of late, however, Wall Street has been repelling any negative developments to defy current headwinds to ride higher on future tailwinds, such as rate cuts, tax cuts, deregulation and artificial intelligence. This could change, however, and the success of future positive forces over negative ones will be tested by these US bombs on the sovereign soil of Iran.

Markets will be focussed on Iran’s reaction, the potential for a blockage of the Strait of Hormuz and the impact on oil prices, inflation and global economic growth. These concerns will power the short-term response of markets, but it will be the response of Iran and the economic consequences that will determine how stocks behave between now and year’s end, as well as beyond 2025.

Here are the main points from Mousina’s analysis, which should help your investor response to these huge Middle East developments over the weekend.

Here are the big take outs on a subject that’s hard to make predictions about:

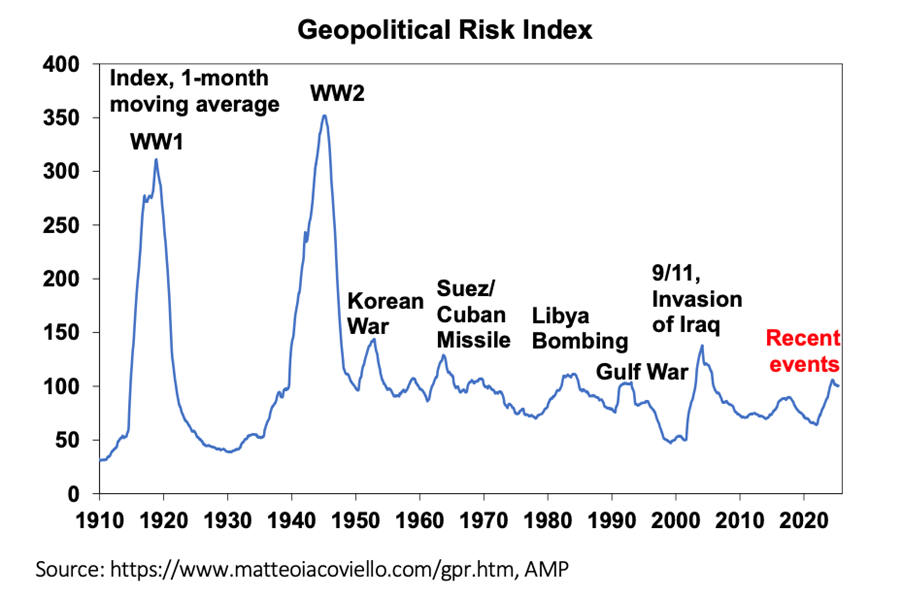

- There is a Geopolitical Risk Index that counts newspaper articles mentioning specific words around geopolitics.

- This is a concurrent indicator of geopolitical risks, rather than a leading indicator of potential risks.

- Spikes in the Geopolitical Risk Index have historically been associated with initial moderate falls in share markets.

- Market reaction can be clouded by other economic events that could be happening at the same time.

- Geopolitical expert Ian Bremmer says we’re approaching “G Zero”, that’s when shock geopolitical events are extremely elevated.

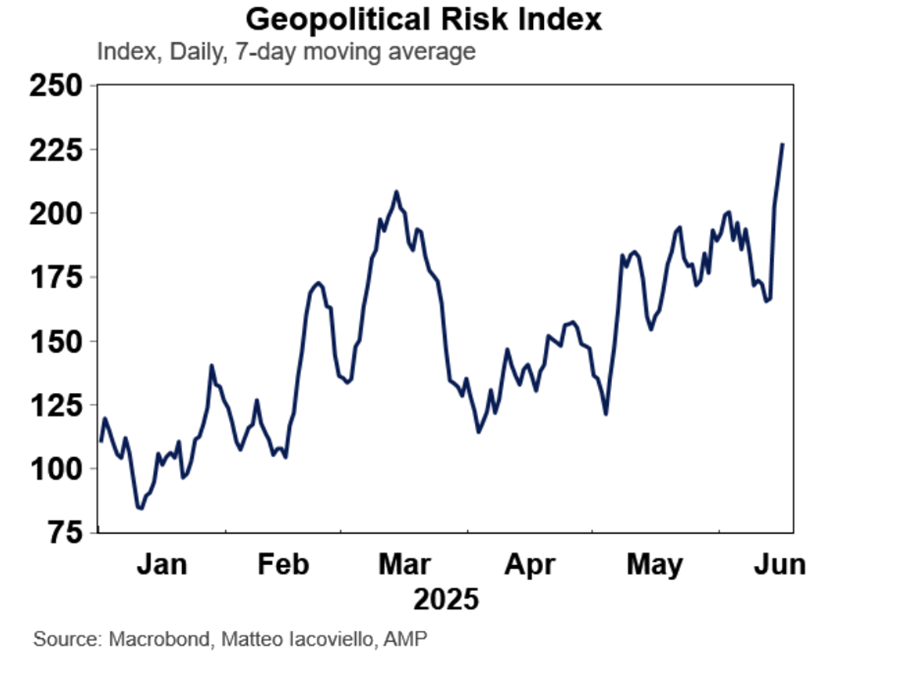

The next chart is a 7-day look at the subject. It shows geopolitical risk is at a high for 2025. This was before the weekend’s bombing.

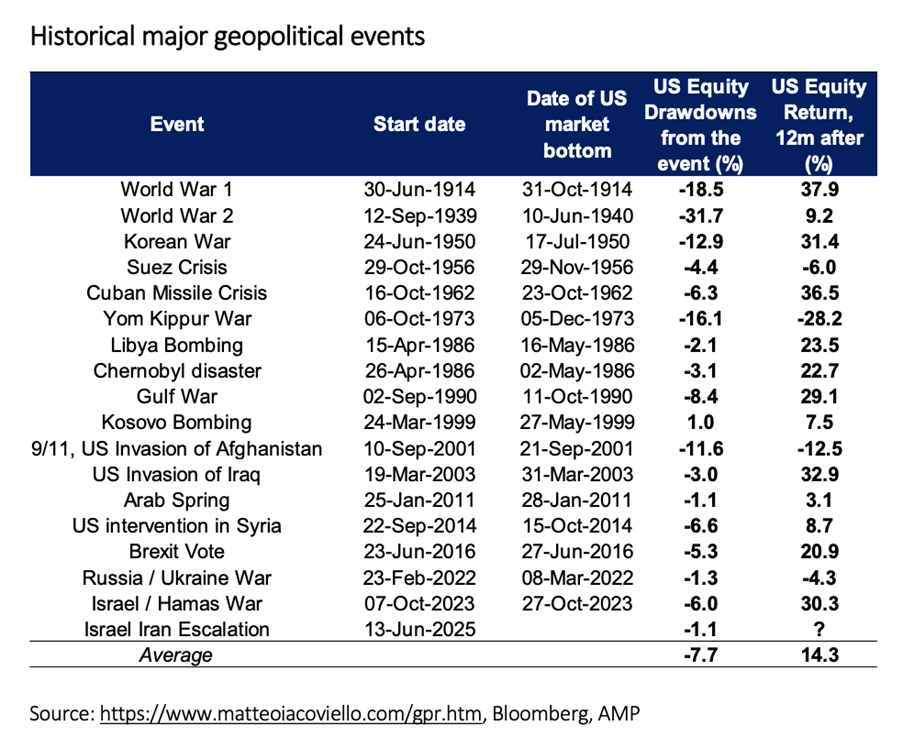

The next table shows that the average short-term reaction to a shock geopolitical event is about an 8% fall in the market.

This table shows that when the US gets involved in a war, there’s a longer-term negative effect for stocks. September 11 was followed by the US invasion of Afghanistan and stocks fell by 12.5% for the year.

While the table looks at the Yom Kippur War of 1973, this coincided with the OPEC oil crisis and then stocks fell by 28.2% over the year.

In contrast, the Gulf War saw the US and a coalition of nations invade Iraq after that country led by Saddam Hussein marched into Kuwait. Quicker-than-expected solutions for the current hot war engagements will be the best hope for Wall Street to turn positive. If history is any guide, the immediate reaction of stock markets should be negative.

While history is a better guide when the big structures that determine world events remain the same, the US decision to elect Donald Trump has changed a big rule of the investing game.

The following observations from Mousina makes it harder for me to work out how I want to invest over the next 12 months.

“The world is moving from unipolarity (with the US as being the main sphere of influence) to multipolarity, from the rise of China,” she noted. “In purchasing power parity terms (which considers actual buying power based on differences in exchange rates), China surpassed the US as a share of world GDP in 2016 and is now at 19% (with the US at 15%).

“Trump indicates that he wants to be the peace president, that he wants to avoid conflict, end wars and not get involved in new wars. However, Trump’s MAGA party is turning the US more internally and the US is retreating from global institutions. This trend has further to grow while Trump is in power (and potentially after as well, if he is still dominant in the Republican party). This will keep geopolitical risks high in the next few years. Actions in recent days also appear to indicate that the US is indirectly involved with the Israeli strikes against Iran also goes against Trump’s supposed peace narrative.”

In the short term, oil prices will spike, Woodside, Santos and other energy stocks will do well, and so will defensive stocks as nervous investors look for cover.

How the market behaves over the next 12 months will be dependent on Iran’s response and whether negotiations for an end to hostilities are possible. However, for the short term, buckle up your financial seat belts because the headlines and our portfolios are bound to be negative.