With the Melbourne Cup looming (when normal Australians turn into ‘experts’ on horse flesh on the first Tuesday in November), professional punters are often driven by one important rule of thumb, which is “follow the money.”

The same driver can work with investing or speculating on stocks. And while the weight of money can get it wrong because of misleading signals, which can result in surges in stock prices followed by slumps, there’s also one of my favourite investment lessons worth thinking about which says “the trend is your friend until it bends.”

A stock to watch is Nearmap (ASX:NEA), which FNArena’s Rudi Filapek-Vandyk underlined on last Monday’s episode of my Switzer TV programme at the 23 minute mark:

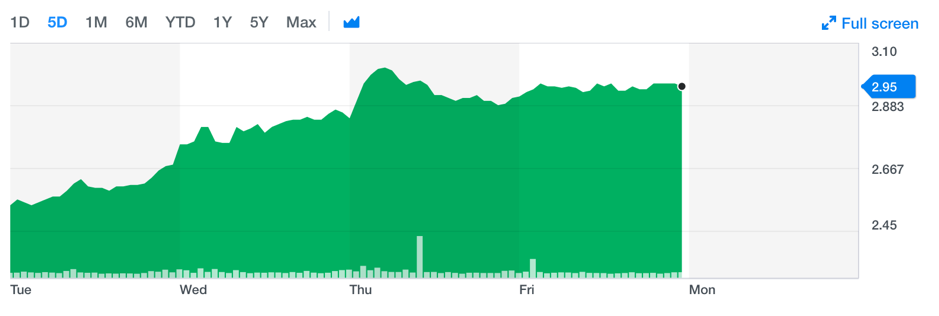

He argued that Nearmap was a stock that was misunderstood by the market and he expected one day that penny would drop. Last week it did, as this chart shows.

Source: au.finance.yahoo.com

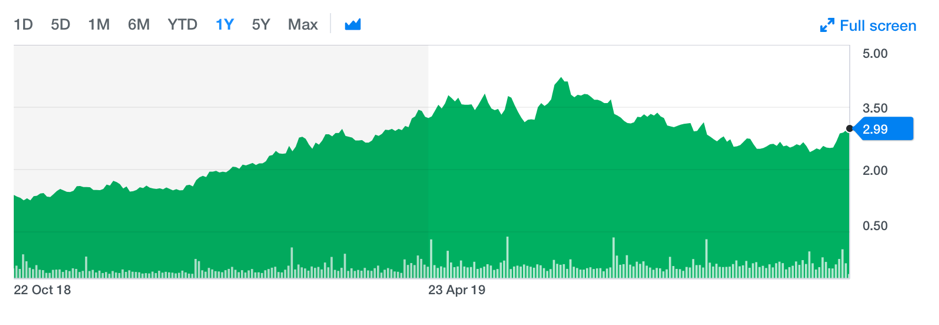

And despite this nice move up — a 17.06% jump — FNArena’s survey of analysts still believes the company has another 38% gain ahead of it! Taking a look at the longer-term chart of the company helps you see where some of these analysts are coming from. This was $4.23 stock in June this year.

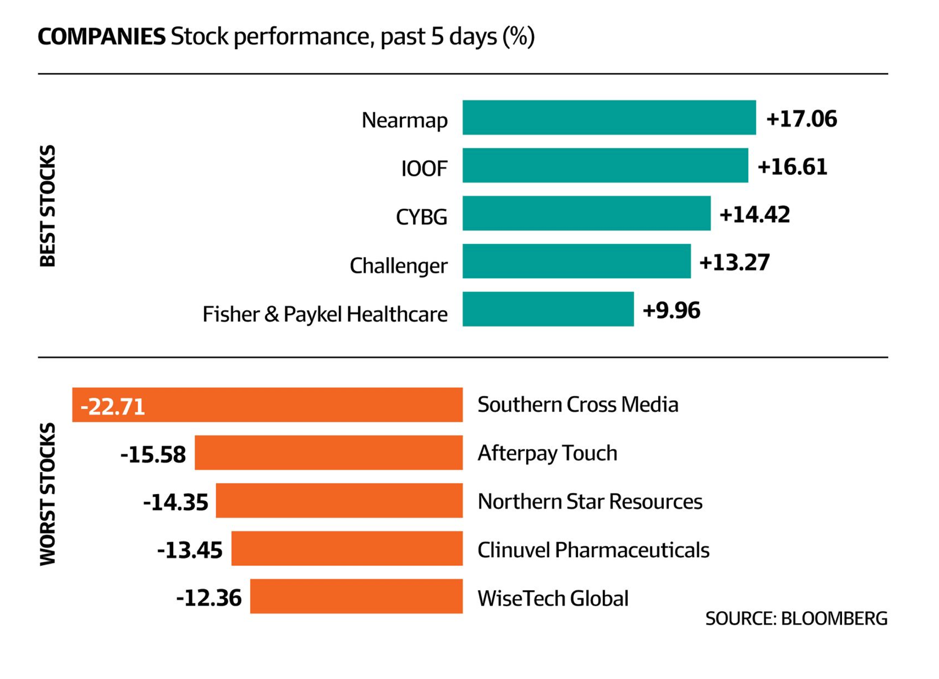

This AFR look below at the best and worst performers could give us further clues on what the money might be telling us.

The old Clydesdale bank, or CYBG as its known nowadays, was a beneficiary of the good news on the Brexit front but this, undoubtedly, will be negatively affected by the delaying tactics of the UK politicians on the historic Saturday sitting last week. But if and when a Brexit solution comes belted up companies like CYBG are likely to be beneficiaries.

In early trade the company was down 3.95% on Monday but last week’s price movement left clues that might be worth noting.

A second stock Rudi liked that the market hadn’t loved until last week was Bravura Solutions Limited (BVS.AX). Maybe my show is starting to influence the market or else it was a nice happenstance! Have a look at the chart for Monday to Friday last week.

The stock rose about 4% last week so the money trail wasn’t as pronounced but it remains a company worth watching. FNArena’s market watchers think this stock has 40.5% upside and on that basis alone, makes it interesting.

This IT company provides software products and services to clients operating in the wealth management and funds administration industries, which is an industry that’s becoming hungry for digital solutions in an increasingly online world.

This is certainly a company I’ll be checking for any continued trails of money.

Finally, I mentioned a few weeks back, that legendary stock-picker Peter Morgan said he was picking up listed investment companies trading at a discount and I’m seeing trends that say this is something that other smarties in the market are piling into.

A company mentioned at our last Switzer Investor Conference was CIE — the Contango Income Generator — which was trading at a big discount to its net tangible asset value, has moved up from around 75 cents to 85 cents over the last month or so. Other LICs have also sneaked up, with many investors liking the old LIC market admission that “I like to buy $1 for 80 cents!”

Of course, a lot of these positive trends can be helped or hindered by big market issues, such as a would-be trade deal and Brexit. It all remains a waiting game but if the best case scenarios prevail, then I suspect these revealed money trails will become more noticeable and lucrative for those who take a punt.

And given the uncertainty of it all, it is a punt — but I hope we’ve got the good oil.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.