My idea of an ‘income” stock is that it should be relatively defensive (hold its value in a “down” market), pay a reasonable dividend and have growing earnings. While It is unlikely that the growth will be high, importantly, it won’t be going backwards. Also, it won’t be particularly vulnerable to exogenous shocks or things it can’t control. The latter eliminates most resource companies.

Leaving the major banks to one side, here are five stocks to consider for 2023. They are from five different sectors which provides support to diversification objectives.

1. Telstra (TLS)

Telstra need no introduction. It has proved to be a remarkably resilient stock in 2022, largely trading in a very tight range between $3.85 and $4.05 per share.

Telstra – last 12 months

Source: nabtrade

The good news is that earnings are on the rise as a result of some tough work on costs, competitive pressures easing in the mobiles market and improved execution by the Telstra management team. The 16c per share annual dividend now looks to be secure, with a strong chance this will increase to 17c in FY23.

At $4.05, Telstra is no bargain, and the prospective yield of 4.2% fully franked is interesting without being compelling. But if you are waiting for a sell-off, don’t expect too much of a pullback.

For the record, the major brokers are moderately bullish on Telstra, with a consensus target price of $4.45, about 10% higher than the last ASX price. The range is a low of $4.00 through to a high of $4.75. According to FN Arena, there are 4 ‘buy’ recommendations and 2 ‘neutral’ recommendations.

2. Endeavour Drinks (EDV)

Specialty drinks and hotel operator Endeavour Drinks has had a couple of tough months; firstly with increasing calls for regulatory oversight of gaming machines, and then the partial sell-down by Woolworths of Endeavour shares.

Endeavour Drinks – last 12 months

Source: nabtrade

When Woolworths demerged Endeavour Drinks, it kept a 14.9% shareholding. Last week, it sold via a block trade a 5.5% parcel at $6.46 per share, leaving it with an economic interest of 9.1%. It said that it “has no current intention of a further selldown in the short to medium term”.

Endeavour comprises two major business units: the retail drinks business (Dan Murphys, BWS etc) and the hotels business. The former had EBIT of $666m in FY22, while the higher margin hotels business delivered EBIT of $315m. Both are cycling periods of Covid and lockdowns – which positively impacted sales in the retail business, and caused the pubs in NSW and Victoria to be shut. In the first quarter of FY23, overall group sales increased by 3.1% on the comparable period of FY22 which was generally assessed by the market to be better than expected.

According to FN Arena, the major brokers are a tad negative on Endeavour due to potential gaming regulation reform, with 2 ‘buys’, 1 ‘neutral’ and 3 ‘sells’. The target price is however 6.9% higher than the last ASX price of $6.59 at $7.05.

The brokers forecast a full year dividend of 22c per share, putting Endeavour on a yield of 3.3%. This will be fully franked.

While the yield is not particularly attractive, it is a relatively low risk stock and if you are ok with its ownership of poker machines and attended gaming risk, there is value in Endeavour around current prices.

3. Ampol (ALD)

Ampol is Australia and New Zealand’s leading transport fuel and convenience retailer. It operates the Lytton fuel refinery in Brisbane (which is eligible for the Federal Government’s fuel security services program), 6 pipelines and 24 terminals. In retail, it has 670 company controlled sites, another 1,860 branded network sites and 526 network sites in New Zealand through Z Energy.

According to FN Arena, the major brokers see upside in Ampol. There are four ‘buy’ recommendations and 1 ‘neutral’ recommendation, with a consensus target price of $34.75 – about 21.6% higher than the last ASX price of $28.58.

Ampol (ALD) -last 12 months

Source: nabtrade

For the FY22 year (which ends on 31 December), the brokers forecast a total dividend of 209c per share (following an interim dividend of 120c), implying a current yield of 7.3%. Earnings and dividend are expected to decline in FY23 (due to lower oil prices and refinery margin), with a resultant dividend of 179c per share and a prospective PE multiple of 10.4 times. The prospective yield for FY23 is 6.3%, which should be fully franked.

While Ampol is still somewhat exposed to the global oil market, in particular refinery margins, it is in an overall sense less vulnerable than it used to be due to steps it has taken to expand its convenience retail business and potential payments by the Government to secure the refining business. It is well capitalised, and the prospect of a potential capital return and ongoing high dividend payments should put a floor under the share price.

4. Charter Hall Long WALE REIT (CLW)

Charter Hall Long WALE REIT is a listed property trust that invests in real estate assets that are leased to corporate and government tenants on long term leases. The $7.2bn portfolio consists of 549 properties in convenience retail, hospitality, industrial and logistics, office, agri-logistics and social infrastructure. The WALE (weighted average lease expiry) is 12.0 years, with 99.0% of the portfolio leased.

Like all property trusts, higher interest rates have taken their toll on CLW meaning that it is now trading at a significant (around 30%) discount to NTA (net tangible asset value) – on the ASX at $4.62 compared to a 30 June pro-forma NTA of $6.26. The trust has guided to earnings per unit of 28.0c for FY23 and a distribution return of 28.0c per unit. This sees it trading on a prospective yield of 6.1% (unfranked).

Charter Hall Long WALE REIT – last 12 months

Source: nabtrade

The brokers feel it is fairly valued, with a consensus target price of $4.53 (about 2% below the last ASX price). The range is from a low of $4.08 through to a high of $4.70. The discount to NTA provides a considerable margin of safety for future movements in asset values.

5. JB Hi-Fi (JBH)

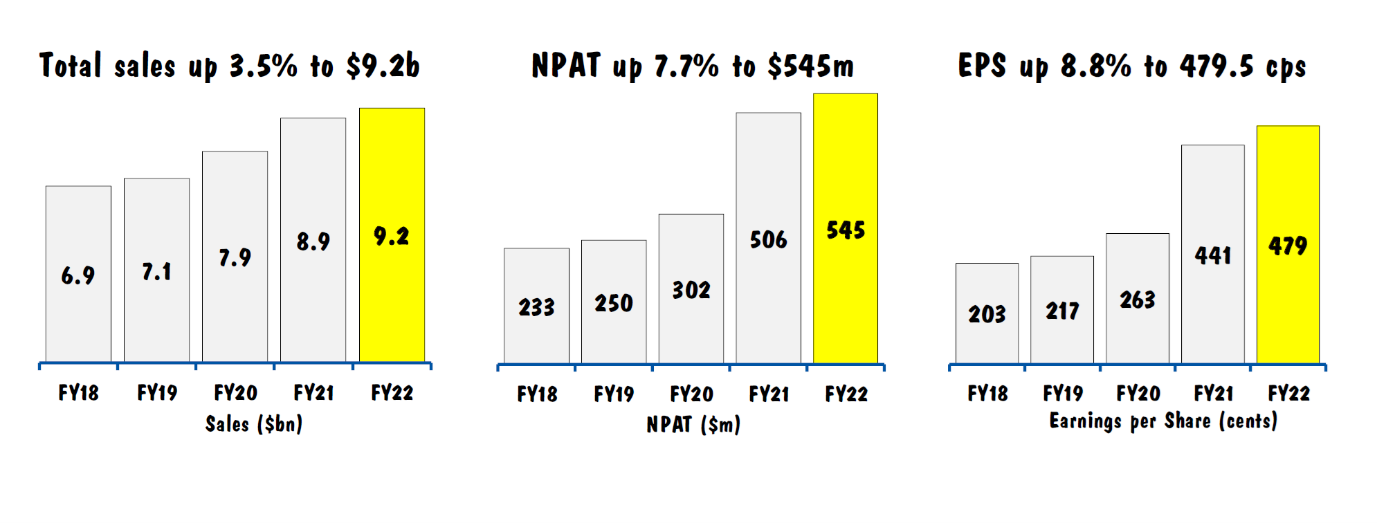

The chart below explains why I am such a big fan of electronic and furniture retailer JB Hi-Fi (JBH): sales up each year, profit up each year and earnings per share up each year. With a payout ratio of around 65%, the latter translates into higher dividends.

JB Hi-Fi – Sales, NPAT & EPS FY18 to FY22

Source: JB Hi-Fi

While 2023 has got off to a good start, with sales up around 14% on the comparable quarter of FY22 (which was impacted by Covid), the market expects sales to slow as higher interest rates bite and consumers reign in discretionary spending. This explains the price fall to June, but since then, it has largely been trading in a range from $40.00 to $45.00.

JB Hi-Fi – last 12 months

Source: nabtrade

The major brokers are cautious on JB Hi-Fi, expecting 2023 to be challenging year for consumers with discretionary spend expected to weaken. They see moderate price upside, with a consensus target price for JB Hi-Fi of $45.58 (range $41.30 to $50.00).

They forecast earnings per share falling by 20.5% in FY23 to $3.81 per share, putting JB Hi-Fi on a multiple (price earnings) of 11.1 times. The dividend is forecast to be on consensus $2.51 per share – a prospective fully franked yield of 5.9%.

Of the five stocks, JB Hi-Fi is arguably the most exposed to a slowing economy and market sentiment. But it has proved to be a great business and more resilient than the market expects at managing economic and other competitive pressures. The track record is worth backing.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.