On Thursday I read that Bank of America and JPMorgan were both reported as giving the thumbs up to investing in EM or emerging markets (such as Vietnam, India, Brazil) in 2025. These guys weren’t the only ones seeing emerging markets as investments whose time had come. At the same time, Europe too was often talked up by US fund managers as the place for investors’ money.

Some of this was linked to the potential negatives coming out of concerns about what Trump tariffs will do for US inflation, economic growth, retail sales, company profits and, of course, stock prices.

On Friday, however, because it wasn’t negotiating on trade in an acceptable way for the US President, Trump announced that the EU could be in for a 50% tariff on imports into the US as of June 1. Simultaneously, he threatened Apple CEO Tim Cook with a 25% tariff if he didn’t start making iPhones in the USA.

Given Apple was migrating some of its production from China to India, these actions by Trump must raise questions about the potential for economies such as Vietnam, India, Brazil and other emerging economies. To sum up, these new Trump curve balls raise questions about which investments make sense going forward.

Before Friday, I liked the idea of putting more of my clients’ money (as well as mine) into EM funds and those ETFs that had more European exposure. While I wasn’t necessarily reducing my holdings of IHVV, WQG and WCMQ (which is how I personally play the US market), new money was set to go towards EU and EM investments. But given what Trump is saying, what do I do now?

Let’s look at the smarties’ takes on EM investing, which were on show before the Trump re-escalation of tariff threats last week. Here are some important points to consider:

- The MSCI EM Index, which tracks the returns of emerging economies had risen 8.55% year-to-date, while the S&P 500 was up 1%.

- Bank of America (BOA) tipped emerging markets (Ems) as “the next bull market.”

- BOA’s Mike Hartnett linked a lower greenback, higher US bond yields and a China economic recovery as good news for emerging markets investing.

- JPMorgan agreed, with special emphasis on the improving trade talks between China and the Trump team.

- Emerging markets actually went up after the April 2 Liberation Day tariffs sent western stock markets down.

- Emerging markets have underperformed for a decade, so Malcolm Dorson of Global X ETFs, who says a lower US dollar, the underweighting of these investments now and stronger growth prospects are pluses for EM plays.

- JPMorgan says at 12 times of forward earnings, EMs funds look attractive compared to western markets.

- Mohit Mirpuri of SGMC Capital expects a new rotation into EM investments for many of the reasons cited above.

While another recent positive assessment of EMs has come from FXStreet.com, the following revelation must be considered, realising that since Friday, Trump has re-escalated global tariff anxiety. “We have adjusted our forecasts to reflect improved global growth prospects as tariff tensions have de-escalated,” the FXStreet piece explained. “We now forecast global GDP growth of 2.5% for 2025 and 2.4% for 2026, slightly stronger than the 2.3% we forecast for both years a month ago. Much of the global growth revision reflects a more constructive outlook for China’s economy.”

This analysis argued that rate cuts wouldn’t disappoint stock market players worldwide and especially in EM economies. While the US dollar is expected to weaken over 2025, there’s a view that it gains slightly in 2026. (A lower US dollar is seen as a positive for emerging economies.)

These are intriguing views, given no one can confidently predict what the US President might do in coming months. What emerges when the 90-day pause on tariffs with China ends and what the EU decides to do with Trump’s demands is all up for speculation.

Much of FXStreet’s analysis was based on (and I quote): “Reduced trade tensions and more resilient global activity…” but this view is all up in the air now.

One compelling analysis on the potential for emerging markets investments comes from the investment group Franklin Templeton that cites the views of EMs from fund manager Martin Currie. Here are the main points:

- Strong economic growth, improving inflationary environment and easing interest rates should be supportive of EM equities in 2025.

- Artificial investments will be very valuable to EM economies.

- India has the potential to drive returns in EM over the next decade as structural growth opportunities come to fruition and companies rise to the challenges presented to them.

- On China, Martin Currie says “there is a long runway for further growth, and they look forward to seeing this materialise in 2025.”

While all investments come with risks and EM investing has more risk than say putting your money into a fund of blue-chip stocks, as you can see, many experts think it’s time to get exposure to emerging economies. I believe they’ll be right, provided Donald Trump de-escalates trade tensions and, more importantly, creates reasonable tariff deals with the likes of China and the EU. That’s the gamble, which was less risky a week ago.

So, what gives you exposure to emerging markets investments?

The iShares MSCI Emerging Markets ETF (IEM) is a good starting point for exposure to this sector. It had a one-year return of 10.09% and 7.93% since inception.

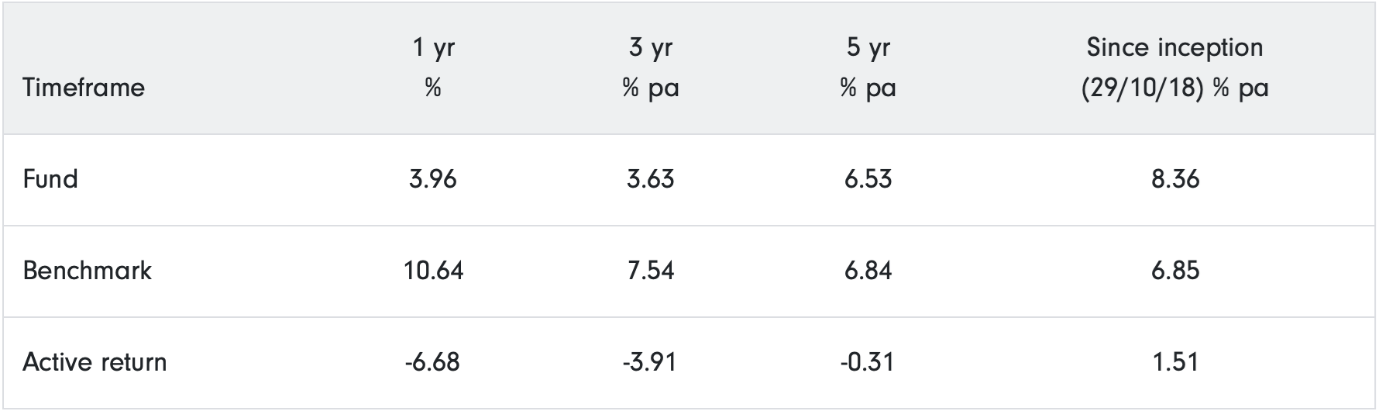

Another with a good reputation is the Fidelity Global Emerging Markets Active ETF or FEMX. While the past year hasn’t been great, since inception it has outperformed the benchmark: 8.36% compared to 6.85%.

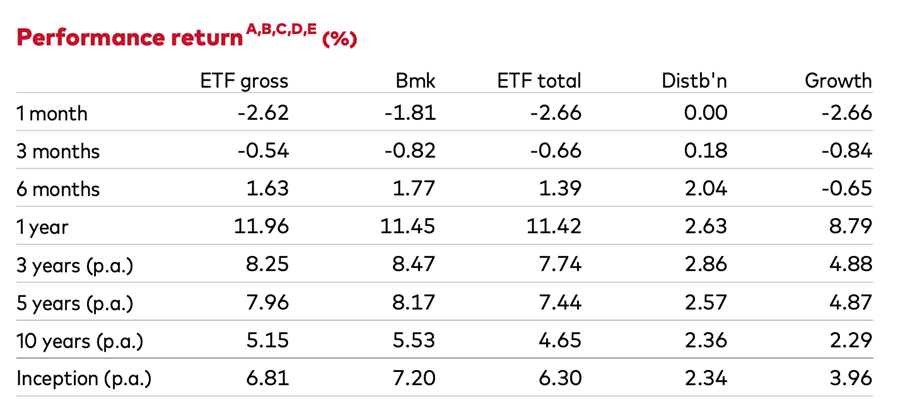

Vanguard’s EM ETF, called the Vanguard FTSE Emerging Market Shares ETF (VGE), has had a good past 12 months. It’s up 11.96% and since inception has returned 6.81%.

While there’s a sensible reason to have exposure to EM investments, the returns could be very much impacted by what the US President gets up to in coming months. That said, given the analysis above and done carefully, there are considerable reasons to be thinking about adding some EM ETFs to your portfolio.