Woolworths has announced the issue of a $500 million hybrid security – ‘Woolworths Notes II’ – to be listed and traded on the Australian Stock Exchange.

The issue has raised the eyebrows of many self-managed super fund trustees because of its income-generating properties. But is it a good buy? Let’s look at the details to find out what this investment has to offer.

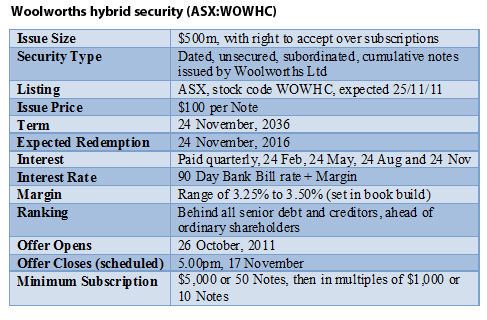

The Notes are unsecured, subordinated, pay interest quarterly at a rate referencing the wholesale 90-day bank bill rate, and have a nominal maturity date of 24 November 2036. More likely, they will be redeemed at face value on 24 November 2016. Details are as follows:

On paper, these Notes offer a fairly attractive interest rate. With the 90-day bank bill at 4.75%, noteholders can expect an interest rate in the range of 8-8.25% for the first quarter, depending on the final margin set in the institutional book build on Tuesday. The interest rate floats relative to the benchmark 90-day bank bill rate, which means noteholders are protected from movements in interest rates and over the life of the investment, they should be able to look forward to a rate well in excess of that offered by a three-month term deposit.

On paper, these Notes offer a fairly attractive interest rate. With the 90-day bank bill at 4.75%, noteholders can expect an interest rate in the range of 8-8.25% for the first quarter, depending on the final margin set in the institutional book build on Tuesday. The interest rate floats relative to the benchmark 90-day bank bill rate, which means noteholders are protected from movements in interest rates and over the life of the investment, they should be able to look forward to a rate well in excess of that offered by a three-month term deposit.

How does the rate stack up?

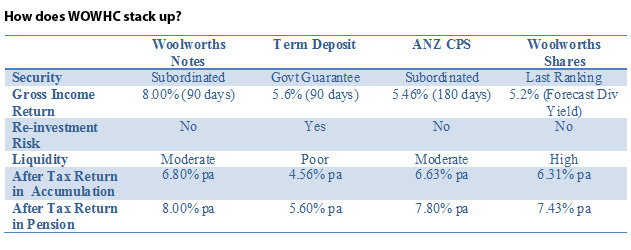

The table below shows the comparable ‘income return’ for an SMSF in both the accumulation and pension phase investing in the Woolworths Notes, a three-month term deposit, ANZ’s Convertible Preference Share CPS (read, ANZ offers a good alternative to term deposits) and Woolworths ordinary shares.

The example above assumes that interest rates remain around current levels and that Woolworths continues to pay fully franked dividends, which are forecast to be $1.29 per share for in fiscal 2011/12.

The example above assumes that interest rates remain around current levels and that Woolworths continues to pay fully franked dividends, which are forecast to be $1.29 per share for in fiscal 2011/12.

The Woolworths notes come out fairly well for a strong, brand name credit – the question is whether a margin of 3.25% to 3.5% is enough? Moreover, is an investment in the ordinary shares preferable to an investment in the Note?

My sense is that this offer is a little on the light side. Unlike the recent ANZ CPS3 issue – which several commentators ‘bagged’, attacking some of the conversion nuances and missing the whole point about ANZ being ‘too big to fail’ – I’m not sure Woolworths is in that category. Basically, this is a good deal for Woolworths as an issuer.

That said, this issue will be comfortably sold and is more than likely to be increased. It will suit many SMSF trustees and other investors, and is a realistic alternative to term deposits and some fixed interest securities. Woolworths has reserved the right to accept over-subscriptions and increase the issue, so don’t be surprised if the issue ends up at around $750 million to $1.0 billion. Keep some powder dry – if this is successful, other new issues will follow.

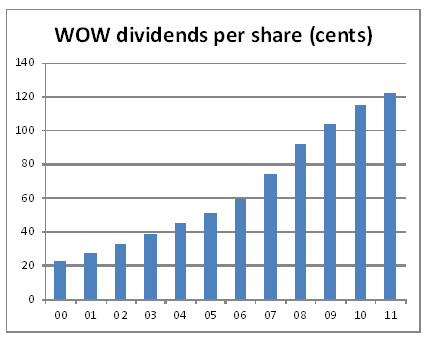

But, let’s go back to the question of whether it’s better to buy the Woolworths Notes or the Woolworths ordinary shares. The table below shows Woolworths’ track record in increasing dividends (cents per share) each year since 2000:

Between 2001 and 2011, Woolworths increased its dividend from 27 cents per share to 122 cents per share – a factor of 4.5 times. Over the last five years, dividends have doubled from 59 cents in 2006 to 122 cents last year. What might happen over the next five years?

Between 2001 and 2011, Woolworths increased its dividend from 27 cents per share to 122 cents per share – a factor of 4.5 times. Over the last five years, dividends have doubled from 59 cents in 2006 to 122 cents last year. What might happen over the next five years?

At a current share price of around $24.70 and a forecast dividend yield of 5.2% for 2011/12, I think you can make a pretty strong case to buy Woolworths shares as an income investment – and back Woolworths’ track record to at least maintain and potentially increase the income return each year.

In the first year, the Notes will return approximately 6.8% and 8% after tax to SMSFs in accumulation and pension phases, respectively, compared with 6.31% and 7.43% for the ordinary shares. With the prospect of capital gain and increasing income returns, the ordinary shares start to stack up pretty well.

Admittedly, the stock market presents a little more risk involved in buying the ordinary shares. However, as a blue chip corporate in a non-cyclical industry, the risk is not that much more. Perhaps this provides some clues as to why Woolworths is issuing these Notes rather than ordinary shares.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: It’s just like punting on horses

- Charlie Aitken: How great is the upside for Australian iron ore stocks?

- JP Goldman: Which Aussie index ETF is best?

- Tony Negline: Should you have income protection insurance?