The market craziness continues, and every positive day or so when stocks go up they eventually give way to a sell-off. Last Friday’s sell-off left our market up 0.78% for the week.

Meanwhile, year-to-date, our Index has only lost 4.62%, so my positivity on stocks hasn’t been too costly if you’re index players, though individual stocks have reminded us that markets rotate. I told you last year that value stocks gain after crashes, and growth stocks lose out, but I’m surprised how some good quality businesses have gone down so far. But I shouldn’t be because just like the markets got irrational about tech stocks on the way up, they’ve run with the same irrationality on the way down.

Why is that, you might ask?

The answer is that short-term players (fund managers and big traders) are more influential on the prices we see day-to-day because these players are more accountable to their investors/clients or to their own bank balance than the long-term investor.

Think about it, when a market is surging, your big questions are: Should I get in for more? Or is time to sell and take profits before a sell-off? However, these are not easy questions to answer.

Look at Xero’s share price over the past decade where the price went from $5 to over $150 before slumping to its current level near $85. But the chart below shows that an investor could have bought and sold many times and either missed out on its 10-year 1,741% rise or copped the latest 43% sell-off since its high in November 2021.

Xero Limited (XRO)

This chart also shows between its 2014 peak of $40, it took about four years to beat that top before zooming up to about $150 in under four years. That was a great case for being a long-term believer in a quality company.

It was the same thinking that told Paul (Rickard) and me that buying CBA when it was $60 in April 2020 was a no-brainer. Despite all the question marks created by the lockdowns, the pandemic and all the other challenges for markets, going long our biggest bank was just a sensible play.

By the way, it was sensible if it wasn’t the one and only stock that you were invested in — that would’ve been a risky play, despite it netting you 75% in a tick over two years!

So why am I running this analysis by you now? Well, we’re all in a ‘should I time the market or simply be a time in the market investor?’

Investopedia says that a report from Boston research firm Dalbar called Quantitative Analysis of Investor Behavior shows “that an investor who remained fully invested in the Standard & Poor’s (S&P) 500 Index between 1995 and 2014 would have earned a 9.85% annualised return. However, if they missed only 10 of the best days in the market, the return would have been 5.1%. Some of the biggest upswings in the market occur during a volatile period when many investors fled the market”.

Are we in volatile times? Yep. So this story is more relevant now as we ponder whether there’ll be another big leg down or more ups and downs around these lower levels for the stock market indexes.

My best guess is that markets are trying to bottom. But whether there’s another big drop or the rebound begins in the coming months will depend on the news flow. Personally, while I do worry about an unseeable big news story say linked to Putin and Ukraine or another damn virus problem, the flow is looking more positive than negative. Why do I say that? Well, try these positive snippets. They might not swing a market worried about some major events that could take stocks down, but together they could create the base that will propel the market up if we hear something big and positive, such as an end to the war.

Here goes:

- That jobs number in the US on Friday (up 390,000) showed the US isn’t heading into a recession.

- The jobs report saw a higher participation rate, which the New York Times said was “an encouraging sign that the labor market is coming back into balance as demand cools and supply improves”.

- On the jobs report, the New York Times noted that it also showed that “the pace of wage growth has slowed a bit in recent months”, which is another plus for those sweating on lower inflation in order to slow down the Fed’s rate rise program.

- The Fed’s Beige Book refers to anecdotes of hiring freezes and wage increases levelling off. Also, it showed growth in average hourly earnings came in at 0.3% month-on-month in May, which was down from the 0.5% pace seen in the second half of last year. This suggests that wages growth may have peaked.

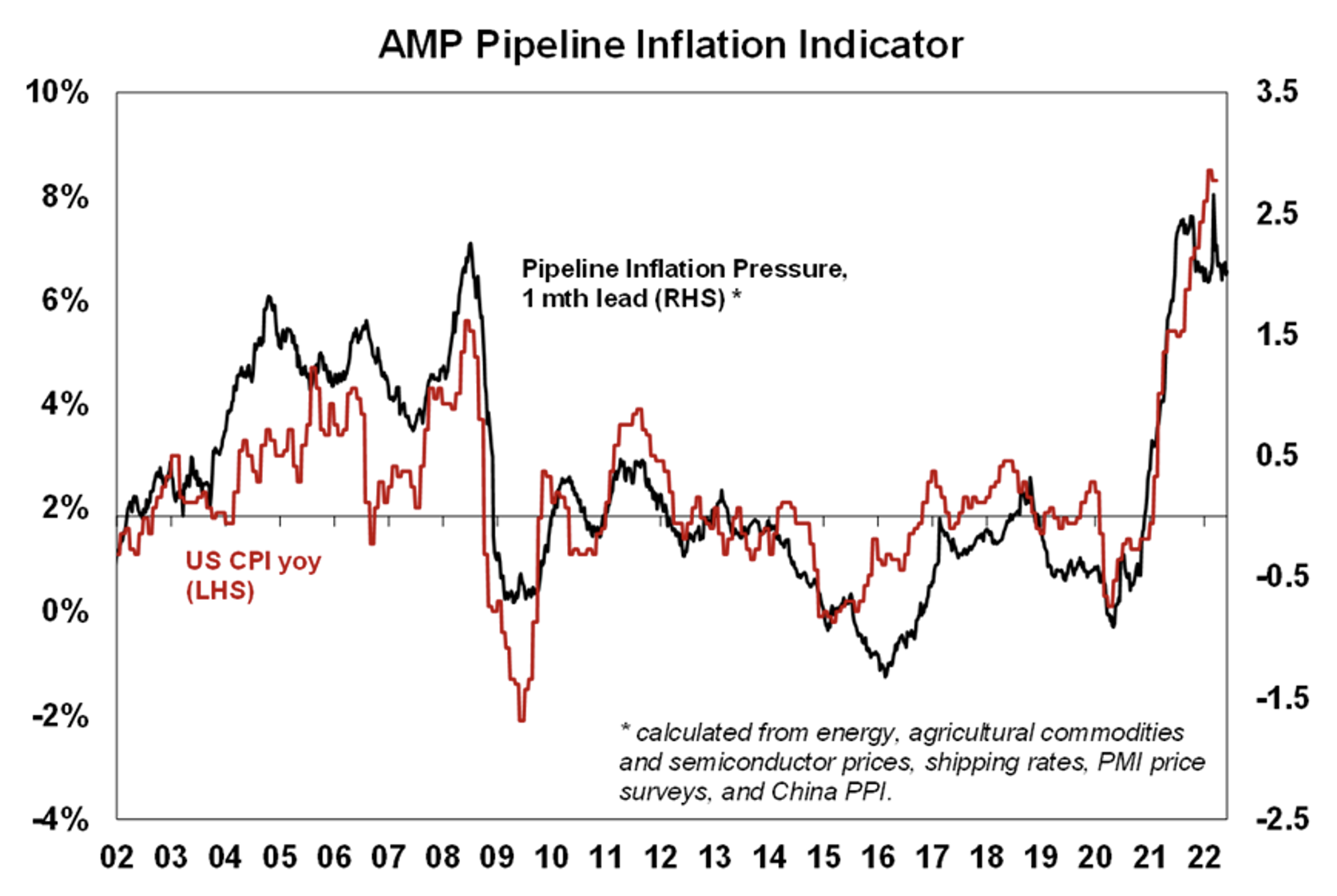

- AMP’s inflation Indicator had Shane Oliver say the following: “Our Pipeline Inflation Indicator continues to point to a peaking in US inflation.” And here’s the chart that shows it:

- Shane also has better news on China and its contribution to our supply chain problems: “Goldman Sach’s Effective Lockdown Index for China had been falling into the end of May and is likely to fall further following the reopening in Shanghai from 1 June”.

- OPEC+ has agreed to pump more crude oil over the next two months, as Russian production begins to drop due to Western sanctions.

- And if you’re a recession worrier, these words from Shane are also worth considering: “Reliable indicators of recession have yet to signal one is on the way – [for] example, in the US the 10-year less Fed Funds rate yield curve is yet to invert and the Fed Funds rate is still less than nominal GDP growth. It’s the same in Australia”.

In case you’re wondering, if often-watched market indicators say it would be wise to think about nibbling in, then one such indicator i.e. forward price-to-earnings multiples, has fallen sharply since the start of the year. This indicator is down from 22 to 17 times now in the US. And here in Oz, this is down from 19 to 15 times in global and Australian shares, which makes shares cheaper. Falling share prices and rising earnings will do that to a PE.

I’ve used a lot of Shane Oliver’s weekly summary to make the case that a bottoming process is happening and justifies anyone wondering if they should nibble into these sell-offs. Here is his overall conclusion about the market ahead: “Share markets have had a nice rebound from oversold lows, but investment markets generally remain in a bit of a no man’s land at present. The critical issue for markets is whether inflation can be brought under control by central banks without generating a recession. We think it can be – at least we can’t see a recession for the next 18 months – but right now the jury remains out”.

My choice is to nibble in for individual stocks that I think have been smashed but I suspect we will have index volatility with us for a couple more months, when we’ll have more clarity on inflation, what the Fed will do, how OPEC plays and the course of the Ukraine war.

That said, I think the big legs down for the overall stock market indexes are over unless a scary left-field news story breaks. I’d rather wait for the indexes to be on a believable uptrend with the positive tailwinds I listed above, given a boost from a bigger gale of unambiguous positivity from one gamechanger story.

Rod Stewart has recently written a song for a woman he’s had a lot of time for — The Queen! But in a Pantene shampoo commercial years ago, one of Rod’s former favourites, Kiwi model Rachel Hunter, gave us a timely message that we can use to believe in a market upswing sooner rather than later when she said: “It won’t happen overnight, but it will happen”.

The run of news stories in the near term, such as the expected 0.4% interest rate rise on Tuesday from the RBA and expected house price falls ahead, won’t bolster confidence but the wise investor has to grasp the opportunity, which often happens when the majority doesn’t see it coming.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.