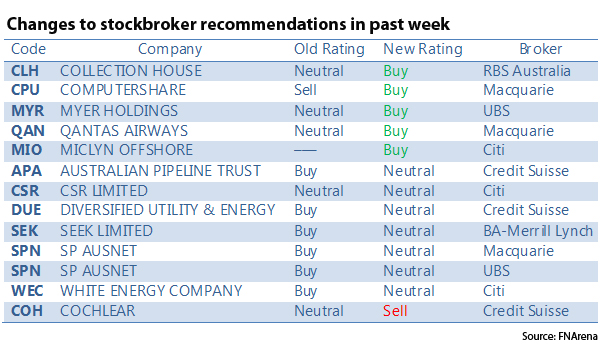

The past week has proven to be a more balanced one for broker rating changes following last week’s downgrading frenzy, with the eight brokers in the FNArena database upgrading five ratings while downgrading seven stocks. Total Buy ratings now stand at 57.7%.

The past week has proven to be a more balanced one for broker rating changes following last week’s downgrading frenzy, with the eight brokers in the FNArena database upgrading five ratings while downgrading seven stocks. Total Buy ratings now stand at 57.7%.

During the week, RBS Australia lifted its rating on Collection House (CLH) to Buy from Hold post a trading update that showed ongoing earnings momentum. While an equity raising is expected, the size should be modest. RBS sees the decision as a positive.

Also upgraded during the week was Computershare (CPU) after the company announced it had received approval for the acquisition of BNY Mellon Shareowner Services. Macquarie saw the announcement as enough of a positive to move to an Outperform rating from Underperform previously, given the long-term growth the deal should deliver.

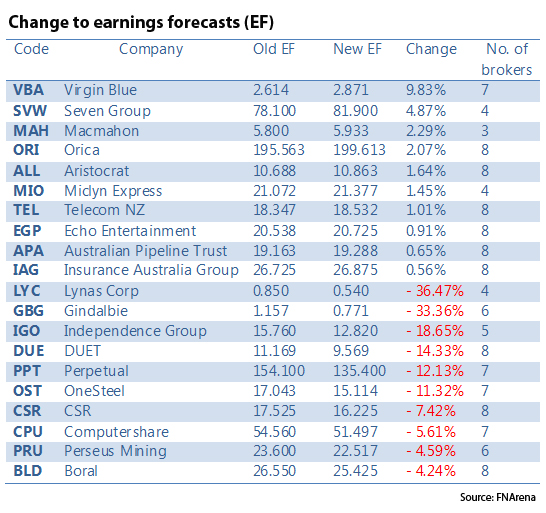

Brokers across the market have adjusted earnings estimates and price targets for Computershare, not only to reflect the acquisition and two other small bolt-on deals, but to also include AGM earnings guidance that implied still weak operating conditions.

UBS upgraded Myer (MYR) after its quarterly sales result met expectations, which for the broker implies evidence of some form of positive momentum building into the Christmas sales period. While no other ratings were adjusted, brokers in general lifted earnings estimates and price targets for Myer on the back of the sales result.

An upgrade to Outperform from Neutral for Qantas (QAN) by Macquarie is a reflection of a de-risking of the earnings profile, this following some industrial resolutions. Macquarie has also lifted its price target but lowered earnings for fiscal 2012 to account for the airline paying compensation to passengers impacted by the recent grounding.

On the downgrade side of the ledger, Australian Pipeline Trust (APA) saw two downgrades during the week, Macquarie and Credit Suisse moving to Neutral ratings from Outperform previously to account for a less attractive valuation following recent gains for the former and a sector review by the latter.

Credit Suisse similarly downgraded Diversified Utility and Energy Trusts (DUE) to Neutral from Outperform as part of its sector review, while Macquarie has downgraded SP Ausnet (SPN) to Neutral from Outperform on the back of a fall in price target. The change reflects cuts to earnings forecasts to account for higher interest costs and a delay to some earnings.

Citi downgraded CSR (CSR) to Neutral from Buy post the interim earnings result. This came as management downgraded the outlook for coming periods at the time of the result. Cuts to earnings estimates and price targets reflect ongoing headwinds, a theme identified by others in the market also.

Expectations of further falls in employment advertisement volumes have seen BA Merrill Lynch downgrade Seek (SEK) to Neutral from Buy, the move accompanied by cuts to earnings estimates and price target. As BA-ML points out, the current share price implies an unemployment rate of 6% for Australia, meaning there is downside risk if conditions in the labour market worsen beyond this level.

Citi has moved to Neutral from Buy on White Energy (WEC) to reflect uncertainty from news its joint venture partner and coal supplier PT Bayan plans to increase the cost of feedstock coal. The move means increased risk to production expectations at the Tabang plant and so creates enough uncertainty for Citi to take a more cautious stance. The share price tanked following the news.

Ongoing uncertainty as to the full extent of recall issues for Cochlear (COH) has prompted Credit Suisse to downgrade it to an Underperform rating from Neutral previously. The removal of a previous multiple premium sees the broker lower its price target for the stock as well.

With Citi initiating coverage on Miclyn Offshore (MIO) with a Buy rating and $2.15 price target, overall ratings and the consensus target for the company have improved.

Note: FNArena monitors eight leading stockbrokers on a daily basis. They are: BA-Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, JP Morgan, Macquarie, RBS and UBS.

For more financial news and data, visit FNArena.com.

For more financial news and data, visit FNArena.com.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Paul Rickard: Our advice on weighting your share portfolio

- Peter Switzer: The reasons for and against a stock market rally

- Tony Negline: Get real about retirement