If you looked at the market’s reaction to CSL’s half year profit result, you would conclude that it was a “surprise” and a definite “beat”. On a day when the ASX rose by 1.1%, CSL soared by over 8.5% to close at $263.69.

You could be forgiven for asking “why” the market was surprised, given that CSL has a history of surprising on the upside. Year after year, half year after half year, CSL has consistently “beaten” forecasts. But moreover, as recently as last December, CSL confirmed profit guidance when it announced the purchase of renal specialist Vifor Pharma and set about raising $6.3bn in capital. This was 5.5 months into the half year – little can have changed in the final two weeks of December.

So why the surprise?

Well, I guess there were two main drivers. Firstly, since bond rates started to move higher and inflation became a dirty word again, the market has been down on “high growth”/”high multiple” stocks. While this has largely been felt in the tech sector, companies such as CSL haven’t been immune from the pressure. In fact, prior to Wednesday’s result, CSL has performed relatively poorly this year – down 16.4% compared to the market’s loss of 3.2%. So perhaps some position squaring and covering of short positions.

But the other reason was in the profit guidance. While the company confirmed full year profit guidance of US$2,150 million to US$2,250 million at constant currency, it said that this would include US$90 million to US$110 million of Vifor transaction costs – essentially an “upgrade” of US$100 million. Further, it painted an improving outlook for plasma collections which would underpin stronger immunoglobulin and albumin sales.

In the post-Vifor Pharma world, CSL Behring will drive 70% of CSL’s revenue, with the former contributing about 16% and Seqirus (influenza vaccines) about 14%. Driving CSL Behring’s revenue are immunoglobulins and albumin, with CSL having said in the past that if ‘’we can collect the plasma, we can sell the products”.

Blood plasma collections are typically carried out in working-class neighbourhoods across America, with donors being paid for their attendance. Covid, and factors such as the strong US employment environment and closure of the Mexican border, have impacted collections. For shareholders, the good news is that collections are almost back to pre-pandemic levels. In FY22, CSL plans to open up 35 new plasma collection centres.

The Seqirus business, which makes money in the first half coinciding with the northern hemisphere winter and loses money in the second half, was a standout. Revenue increased by 17% in constant currency terms and EBIT by 24% to US$894 million.

Interestingly, Seqirus was CSL’s last major acquisition prior to Vifor Pharma, and although it didn’t look like much of an acquisition at the time, it is proving to be a winner. Vifor Pharma is forecast to be low to mid-teens NPATA accretive (net profit after tax and before amortisation) in the first full year of CSL ownership (expected to be FY23).

What do the brokers say?

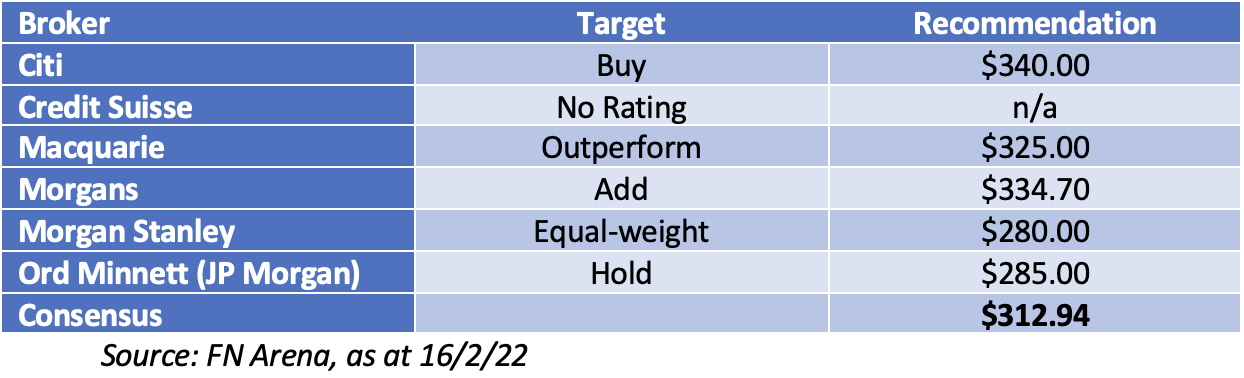

Going into the result, the major brokers were positive on CSL. According to FNArena, there were 3 “buy” recommendations and 3 “neutral/no rating” recommendations (n0 “sell” recommendations). The consensus target price was $312.94, with Morgan Stanley the “bear” at only $280.00 and Citi the “bull” at $340.00.

Recommendations and Target Prices by Major Brokers

On consensus, they had CSL on a PE (price-earnings multiple) of 39.5 times FY22 earnings and 31.9 times FY23 earnings.

Bottom line

Post the result, the brokers will increase their earnings forecasts which will reduce CSL’s multiples a touch but are unlikely to make major changes to their target prices. This was ultimately an ‘in-line’ result that shouldn’t have been too much of a surprise.

But it has confirmed CSL’s reputation for delivering on expectations and quality execution. A major concern, plasma collections, has been mitigated.

The market will look ahead to CSL completing the Vifor Pharma acquisition, a US$2bn revenue business. Specialising in the treatment of renal (kidney) disease in three broad product areas (nephrology, iron deficiency and dialysis), it gives CSL access to a global market forecast to grow from US$13bn in 2020 to over US$25bn in 2026, a double-digit compound annual growth rate.

It is unlikely that the market will change its negative disposition to high multiple stocks in the short term. However, CSL has re-affirmed all the reasons why it trades on a high multiple and is rated one of Australia’s leading companies, if not the best.

Long term investors will buy dips. Add.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.