Two weeks ago I wrote that the market was too complacent in its view on the Coronavirus and last week in this report warned it was too early to go bargain-hunting. After a 12% fall in the Australian share market from its peak, it has paid to stay on the sidelines.

So, is it time to buy stocks? Yes, with caveats. The first is that the Coronavirus event will be punctuated by “relief rallies” amid ongoing market weakness, as we saw earlier this week.

Second, nobody knows how the Coronavirus will play out, so bargain hunters must be able to tolerate further price falls. This is arguably the biggest shock to the global economy and financial markets since the 2008-09 Global Financial Crisis. Talk of a quick, v-shaped recovery in the second quarter and business returning to normal is vastly overstated. Third, we are yet to see how third- and fourth-quarter effects from the Coronavirus emerge. For now, the market is focused on the health crisis and its effect on global trade. What happens when more events are cancelled, supply chains are reconfigured and business-investment plans cancelled? Or if a lingering virus sparks political and social unrest overseas?

Don’t buy stocks assuming they will quickly retrace Coronavirus-related losses in the next few weeks. Take extra care with stocks at the epicentre of China-related weakness: tourism, education and mining stocks, for example. Focus on companies less affected. There is some good news on the Coronavirus. Assuming China’s data is reliable, the rate of new cases declined over February, there were fewer deaths and more recoveries. The hope is China is getting the virus under control and that other countries will eventually follow that pattern.

More new cases emerging outside of China, in more countries, is cause for concern. But if China’s pattern is followed – a big “if’” at this stage – the market might be more confident by month’s end that global authorities are starting to get the virus under control.

Equities could fall further in the next few weeks, but they look oversold to me as panic selling set in. Key fear indicators (the VIX index in the US) have spiked to 12-month highs, suggesting the type of capitulation selling that characterises a market bottom getting closer

As nerve-wracking as it is, retail investors need to buy into volatility when markets tank. I favour companies with high rates of recurring revenue that will keep turning over, regardless of the Coronavirus. The software-as-a-service companies, many of which were too pricey before the correction – and still have challenging value, look interesting for retail investors with a long-term (3-5 years) perspective.

Here are two I favour:

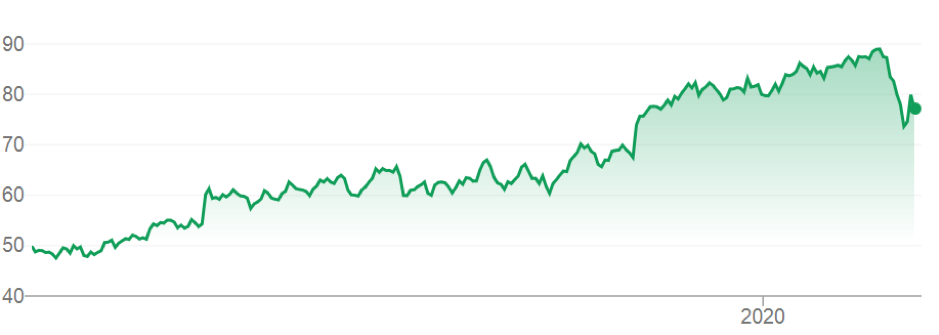

1. Xero (XRO)

I couldn’t buy the accounting-software star when it peaked above $90, but it looks a lot more interesting after falling 17% in the current market sell-off to $74.

I first wrote favourably about Xero for The Switzer Super Report in April 2015, in a column on technology disruptors, at $24 a share. I followed the stock higher, but lost interest when it and its fellow WAAAX stocks (Wisetech Global, Appen, Afterpay Touch Group, Altium and Xero) went through the roof and traded on nose-bleeding valuation multiples.

Xero is a good stock for this market. Like other software-as-a-service stocks, it is not manufacturing goods in China or exporting products there. Customers will cancel their Xero software because they are concerned about a Coronavirus-related slowdown.

Few products are stickier than accounting software. Businesses that get used to accounting software tend to stay with it for years. A virus-related global economic slowdown might make it harder for Xero to sign up more customers overseas, but that seems a marginal risk for now.

Xero reported $764 million in annualised monthly recurring revenue for its half-year results to September 2019. It added $175 million in just 12 months. Subscriber numbers grew by about a quarter to 2.06 million and the total lifetime value of customers rose $1.4 billion to $5.4 billion.

At $74, Xero trades on an enterprise value to revenue multiple of 15 times and a Price/Earnings multiple of 266 times, on Morningstar numbers. Morningstar believes Xero is significantly overvalued and has a fair value of $46 a share. That looks too bearish.

Xero has a long growth runway ahead as it becomes the global platform of choice for cloud-based accounting software for small and medium-size enterprises. Stock with Xero’s growth prospects and business model always look super expensive, meaning you have to watch and wait for better value during savage market sell-offs such as now.

Chart 1: Xero

Source: ASX

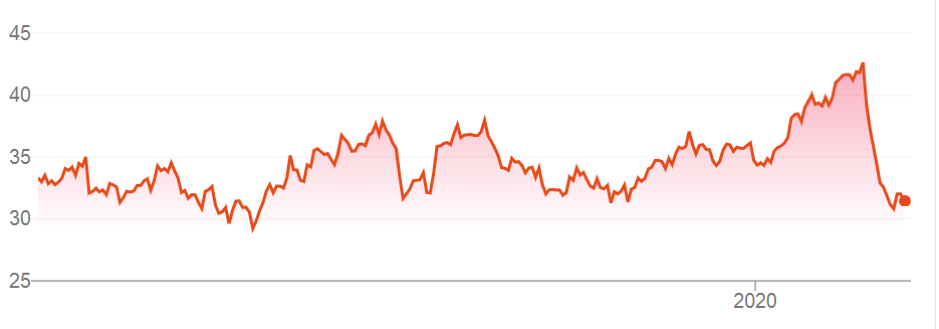

2. Altium (ALU)

After Xero, Altium is my preferred WAAAX stocks. Like Xero and other ASX-listed tech stars, Altium has been pummelled during the current market correction. It was an easy stock to sell for fund managers seeking to reduce market exposure and lock in gains.

Altium has fallen from a 52-week high of $42.76 to $31. The company in February reaffirmed its full-year guidance, but warned that profits could be at the lower end of the range due to the effect of the Coronavirus on Altium’s Octopart component search engine.

Still, it’s hard to see how a company that confirmed full-year guidance, albeit at the lower end of its range, warranted such a sharp fall from its high. That’s what happens when markets panic about events with as much uncertainty as potential pandemics, and dump high-flying stocks.

Chart 2: Altium

Source: ASX

To recap, Altium develops and sells software for electronic-product design. As billions of devices are connected through the Internet of Things (IoT), demand for printed circuit boards – and Altium’s software to design them – will grow.

Design software used in 3-D printing is another long-term opportunity for Altium.

Altium is pricey, even after recent falls, trading on a trailing Price Earnings (PE) multiple of 55 times. The market has continually underestimated Altium and may be doing so again. Few ASX tech stocks have as much leverage to the IoT and its staggering predicted growth as many more household and industrial devices talk to each other via the internet.

As with Xero, Altium deserves a spot on portfolio watch lists. I’ll be watching and waiting for better value in both stocks over the next few weeks as market uncertainty about the Coronavirus lingers.

Both companies will be among the first bought back when greater clarity on the Coronavirus emerges, markets stabilise and begin to rise again. Each has terrific long-term global growth prospects, reflected in their (still) challenging valuations.

Buying into these stocks after they have shed around a fifth of their value in a few weeks – for reasons mostly unrelated to company performance – is an opportunity worth investigating for those wanting to add tech exposure to portfolios during market weakness.

Investors who want to take advantage of global tech-sector falls this year – and are more risk averse – could consider the ETFS Morningstar Global Technology Exchange Traded Fund (TECH), an idea I outlined last week for this report.

TECH tracks mostly larger tech stocks in developed markets that have higher Morningstar ratings and has an equal-weighted index approach.

Chart 3: TECH

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 2 March 2020.