Borrowing to buy property has become the hot topic for SMSFs since the Australian Tax Office released a draft ruling that clarifies some of the key concepts related to gearing within your super to buy or renovate property. And given the enquiries we’ve had from Switzer Super Report readers, we’ve found out what ‘pre-packaged’ solutions are offered by the major banks and given them a quick road test for you.

If you haven’t already, you can bring yourself up to speed with the ATO’s draft rules in Tony Negline’s column New opportunities open for SMSFs investing in property.

The good news for SMSFs is that the Commonwealth Bank has a product called Super Gear. The bad news is that some of the other banks are still working out what to do. Our guess is that within six months, most of the banks will have a packaged solution that allows SMSFs to gear to buy property because in a quiet lending market, this is one of the fastest growing parts. St.George has a product called Super Fund Home Loan, which I have also reviewed on our website.

So what do I mean by a ‘pre-packaged’ solution? Simply, a compliant structure that passes the test for gearing – formally known as a Limited Recourse Borrowing Arrangement. You don’t have to prepare separate documentation and set up a bare trust to hold the asset – the financial institution has done the hard work for you.

Like any pre-packaged solution, Super Gear comes with a number of rules, and not unexpectedly, some fees and charges.

The rules

Let’s start with the rules. On paper, you can borrow within your SMSF to invest in residential property, commercial property or rural property. That’s fairly straightforward.

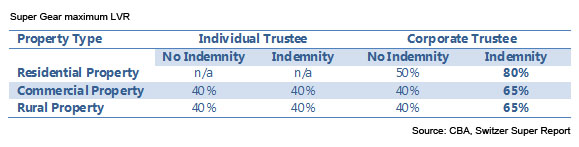

It becomes more complicated when determining how much you can borrow because this depends on your SMSF’s trust structure (is it a corporate or individual trustee?) and whether the members are willing to provide ‘individual indemnities’ (that is, personal guarantees).

Following recent changes to the Consumer Credit Legislation, the Commonwealth Bank will only lend against residential property if the SMSF has a corporate trustee. The following table sets out the maximum loan-to-valuation ratio (LVR, which is the amount the bank will lend you expressed as a percentage of the property’s value) offered by Super Gear:

Another rule worth noting is that the loan has to be positively geared and the investment income within the SMSF (including any rental income on the property) has to be more than 125% of the estimated interest expense on the loan.

Another rule worth noting is that the loan has to be positively geared and the investment income within the SMSF (including any rental income on the property) has to be more than 125% of the estimated interest expense on the loan.

Also, before the bank will lend to your SMSF, you are required to obtain a sign-off from a qualified financial planner – no exceptions. While this may seem prudent given the potential overexposure to a single asset, it seems to be an overly cautious approach by the bank and I can’t really see the difference between this product and an SMSF investing in the share market through installment warrants.

So, what does it cost?

Well, it turns out there are quite a few fees. Your SMSF will pay an establishment fee of 0.8%, a product maintenance fee of $45 per month, and a loan-servicing fee of $8 per month (for residential property) or $32 per month for commercial property. So, for a loan of $300,000, your SMSF will pay an establishment fee of $2,400 plus a fee to your financial adviser, and then annual bank fees ranging from $636 to $924.

There’s better news on the interest rate front. For a variable rate loan secured by residential property, you can expect an interest rate that is close to the Commonwealth Bank’s standard variable rate, which was at 7.31% at the end of 2011. For loans secured by commercial or rural property, this will be quite a bit higher.

Overall, the Commonwealth Bank deserves credit for being one of the first banks to develop a specific product for the SMSF market. The fees are on the high side and it is very “Commonwealth Bankish” with an overly restrictive set of rules, however the interest rates are competitive. As some of the other banks realise the potential of this market, competitive pressure will lead to lower fees and more accommodating product structures.

One final point – the product is only available through the Commonwealth Bank’s Business Bank, so if you go to a branch, don’t be surprised if you get a blank stare. Ask specifically for a business banker, or telephone their business line on 13 19 98.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Rudi Filapek-Vandyck: The broker wrap

- Tony Negline: Should I invest in super or pay off my mortgage?

- Peter Switzer: It’s going to be a huge one