With the release of its first-half profit result, Commonwealth Bank (CBA) showed yet again why it is so far ahead of its major bank rivals and deserves to trade at a premium. It is no surprise that the shares jumped following the release by 5.6% to close at $99.56.

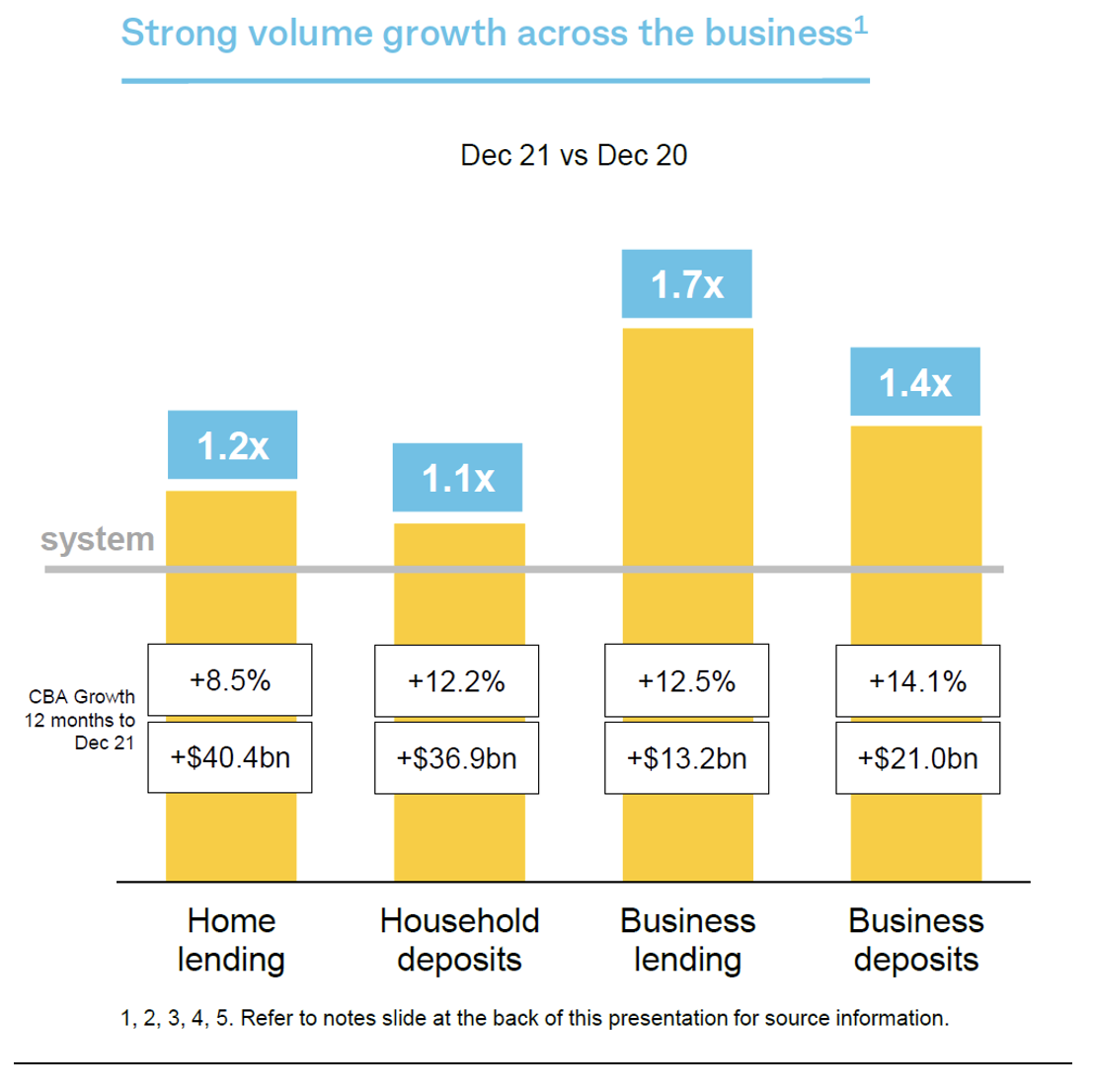

This simple graph below says it all. It is growing volumes in home lending, household deposits, business lending and business deposits at a rate faster than the overall market. And in most categories, CBA is already the market leader!

In the six months to end December, CBA increased the size of its home loan book by $23bn. NAB added $13bn, Westpac $8bn and poor old ANZ went backwards by $1bn. Further, 58% of CBA’s new business is originated by proprietary channels (branches, employed home loan specialists etc), compared to about 40% for the other banks that depend on commission based mortgage brokers.

Despite massive pressures on the net interest margin (the difference between what CBA lends money at compared to what it pays to depositors), CBA increased operating income by 2.0%. With a small reduction in operating expenses, mainly due to lower remediation costs, operating performance rose by 4% compared to the corresponding half and was 3% better than the June half. Throw in a still very benign credit environment (a writeback of $75 million in the period compared to an expense of $882 million twelve months earlier), the Bank’s cash profit of $4,746 million was up 23% on the period. This was $200 million to $400 million above analysts’ forecasts – a big beat!

Shareholders were rewarded with a fully franked dividend of $1.75 per share – up $0.25 from the prior period. With the Bank recommitting to a full-year payout ratio of 70% to 80% of cash NPAT (the first half was 62% or 70% when normalised for long run loan loss rates), this “guarantees” that the final dividend will be $2.00 per share (possibly a tad higher). CBA also announced a new on-market $2bn buyback. When completed, CBA’s capital ratio (on a proforma basis) will be 11.4% – still comfortably ahead of APRA’s “unquestionably strong” target of 10.5%.

The major negative was the deterioration in the net interest margin (NIM) from 2.09% or 209bp in the June half, to 200bp in the December half, a fall of 9bps. When the run-up in liquid assets is included (which impacts the margin but has a minimal impact on net interest income), the margin fell by 17bp to 1.92%. Customers switching to fixed-rate loans, price competition and higher swap rates were the main drivers. Looking ahead, the Bank implied that although the second half would come in lower than the first half, the rate of decline in the margin was slowing.

CBA’s economists have forecast cash rates to start increasing in the second half of the year, with the RBA expected to move as early as August. Because CBA has $170bn of deposits that are not sensitive to rising rates, the bank said that a 0.25% increase in the cash rate would lead to an improvement in NIM of about 4bp over time. Offsetting this will be the unwind of the Treasury Funding Facility (a Government initiative during Covid that incentivised banks to lend money to businesses) but just how this plays out remains to be seen. Overall, an increase in the cash rate will help banks – certainly act to stabilise NIM – but it is not a massive benefit.

What do the brokers say?

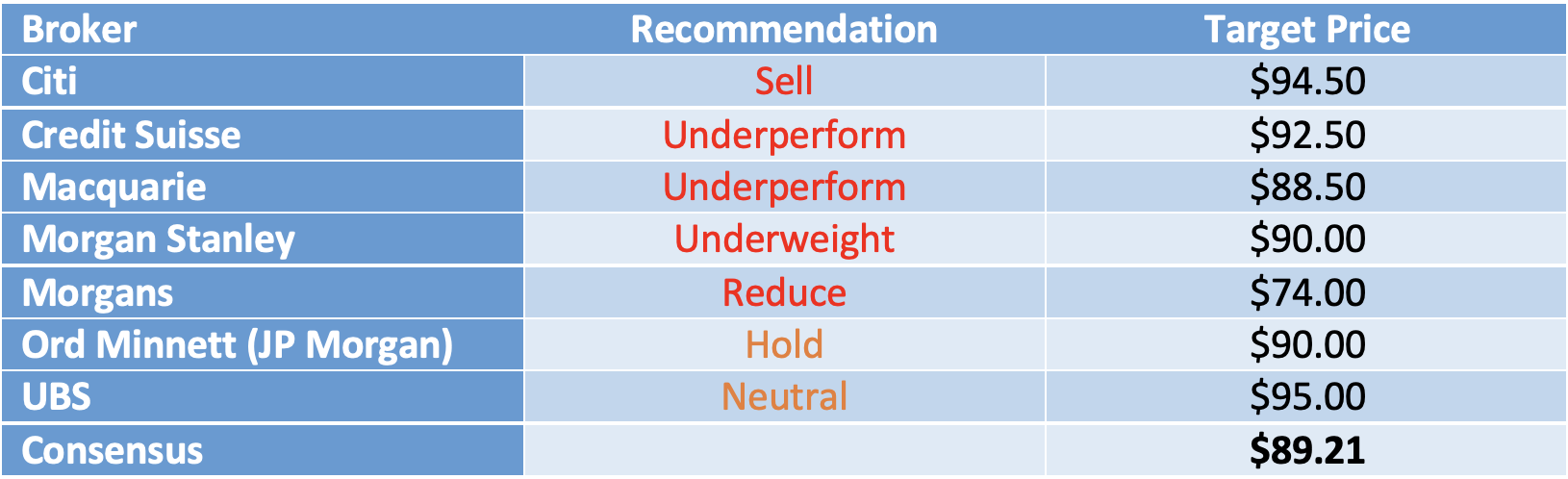

Going into the results, the major brokers were bearish on CBA. They simply say that CBA is too expensive compared to its peers, and while it warrants a premium, the current premium is too big. Accordingly, there were 5 ‘sell’ recommendations, 2 ‘neutral’ recommendations and 0 ‘buy’ recommendations. According to FNArena, the consensus target price was $89.21, 10.4% below yesterday’s ASX close.

Morgans, a clear outlier with a target price of $74.00, missed the profit result badly by more than $400 million. Taking Morgans out of the mix, the consensus rises to $91.75.

But it is hard to take the analysts too seriously when it comes to CBA because they have been so comprehensively wrong about it over more than a decade. Following this result, it is likely that there will be small upward revisions to target prices, but recommendations, which read “too expensive” are unlikely to change.

Bottom line

There is no argument that CBA is expensive. It is trading on a multiple of about 18.5 times forecast FY22 earnings. ANZ is about 13.0 times, NAB 14.5 times and Westpac 14.8 times.

But, I don’t think that institutional investors are going to change their view on CBA. It is the market leader, and market leaders command a premium. While it is a big premium, it is making every effort a winner – and who is to say that the premium can’t increase? There is not a lot of upside from selling.

Because the banks are so big in market cap terms, I have exposure to each of the four majors. But I have overweights in some and underweights in the others. I remain overweight Commonwealth Bank and National Australia Bank.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.