With Artificial Intelligence (AI) driving a tech resurgence, which was really sparked by Nvidia’s bigger-than-expected profit two weeks ago primarily because of AI, I was keen to catch up with US-based Ryan Quinn from WCM Investment Management. This Laguna Beach California-based funds management business has two funds on the local stock market — WCMQ and WQG.

Until recently, WCM’s performance was world class and outperformed Magellan even before it had its recent fall from grace. However, because it’s heavily invested in quality growth companies, its returns were affected by the impact of rapidly rising interest rates and the stock market’s decision to dump tech/growth stocks.

These guys got on to Shopify before the tech sell-off in 2022 before most identified it as a stellar performer.

Shopify Inc.

WCM searches for best-of-breed companies and says it wants not ‘shooting star’ operations but ‘picks and shovels’ businesses, that are long-term performers when gold rush-like booms are on. The AI boom is one of those ‘gold rushes’ and WCM’s analysts have looked for those companies that will be big beneficiaries.

Ryan says WCM has a special in-house event where they search for the big picture themes that will be important for stocks going forward.

“We don’t have a pure play big dog AI company in the fund,” he explained. “But we know AI will be pervasive.”

They have a good exposure to chips and Lam Research is a holding Ryan says will benefit from the AI era. He pointed out that the 2022 sell-off was a good time for them to go long the likes of Microsoft, which, of course, has invested heavily in AI.

Earlier this year, Microsoft slammed $14 billion into Open AI, whose artificial intelligence tool ChatGPT has the world buzzing with both the opportunities and the threats that could come from this huge innovation.

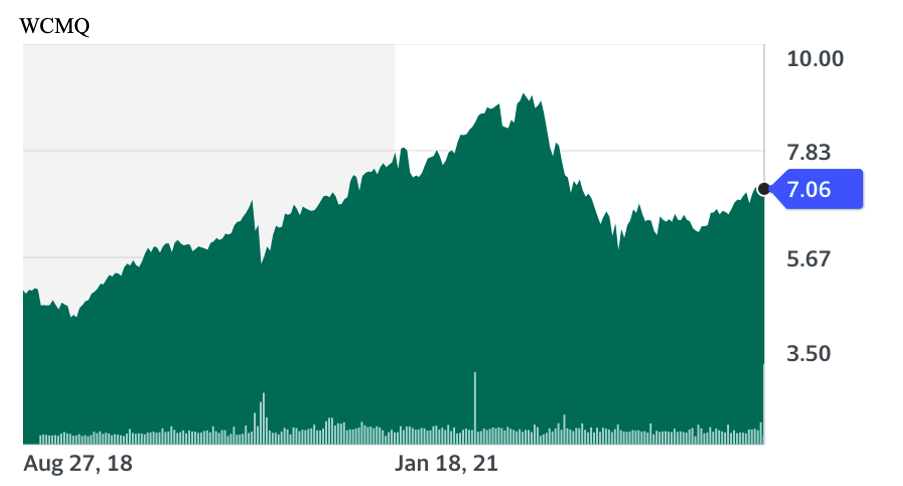

And the chart above shows how WCMQ has rebounded this year 14.2% year-to-date, and is likely to be a beneficiary of the second wave of tech resurgence, which I expect when interest rates stop rising. It will also be helped as more and more businesses tell the market that AI will be a game changer for revenue and/or costs.

I expect this to be a tailwind that will also be effectively inferring that AI will boost productivity, cut costs and help bring inflation down. Of course, there will be gilding of the lily but that’s what stock markets do.

Ryan said better inflation and less interest rate concerns “will be like kerosene put on the fire for tech” and should be good for the fund.

WCM has 40 stocks tops in the fund and every business has to pass a special corporate culture test, which now is conducted by a four-person team. This approach has been important for the long-term showing of the fund.

I asked Ryan what the big themes will be for stocks in 2023 rolling into 2024. He nominated tech, of course, but the WCM analysts are very hot on healthcare, with diabetes and obesity being huge issues worldwide.

They also argue that luxury businesses are set to keep firing, with no sign that consumers are letting higher interest rates get in the way of their addiction for high-priced quality goods.

One new company in the fund Ryan is especially happy about is locally-created Atlassian, which he says has a “great runway” ahead. He argues that there is incredible stickiness of businesses to Atlassian after investing in, for example, its Jira product, that allows bug tracking and agile project management.

Atlassian (TEAM)

The share price is still down 60% from its high but it is up 45% year-to-date, which has clearly helped WCMQ’s bounce.

I noticed Atlassian is back in the top 100 stocks in the Nasdaq and has helped the nice return for HNDQ, which has been a favourite of mine since November of last year. This is now up 31% year-to-date and I suspect this investor enthusiasm for AI and eventually no rate rises will give this ETF even more oomph in the higher direction.

I should add I’m invested in WCMQ and WQG, which is the listed investment company version of WCM locally. It’s trading at a discount to NTA but it’s paying a dividend over 5% right now.

(WCMQ and WQG are managed here in Australia by AGP, which I have a reasonable shareholding in, following the company buying the Switzer Dividend Growth Fund.)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances