There are not many companies that successfully cost cut their way to greatness. Generating revenue usually requires ongoing investment and the more operating costs are culled, the harder it becomes.

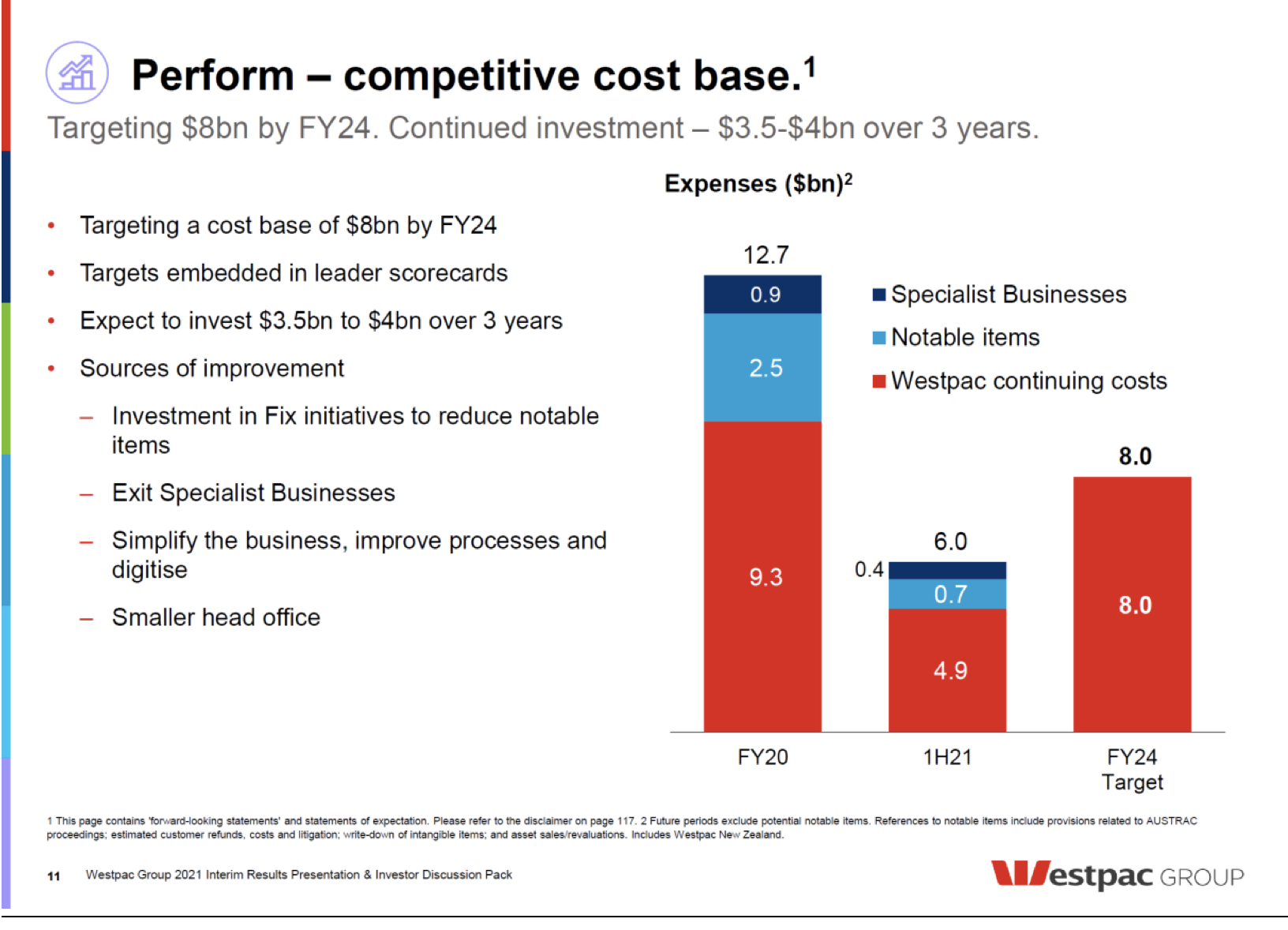

But that is essentially what Westpac CEO Peter King proposed to the market in May last year when he outlined an ambitious plan to take the Westpac cost base to $8bn by FY24 (see graphic below). While this would involve jettisoning specialist businesses and fixing the “one off” problems that Westpac was dealing with (customer remediation, AUSTRAC and financial crimes etc), continuing costs would still fall from $9.3bn in FY20 to $8.0bn in FY24. Allowing for inflation, a fall of about 25% over 4 years.

Understandably, the market didn’t give him credit at the time for this seeing it very much as an “aspirational target”.

Last Thursday, Westpac provided its first quarter (1Q22) trading update. The highlight was that expenses were down 7% or $191 million on the average of the last two quarters of FY21. Excluding notable items, a fall from $2,850 million to $2,659 million. A reduction in headcount of 1,100 persons (head office staff plus third party contractors) was the main driver.

But at an annualised rate of $10,636 million, a long way to go to $8bn. Westpac says that “costs (excluding notable items) are expected to be lower in FY22 and decline further through the year. The Group remains committed to its $8bn cost target by FY24”.

Overall, with cash earnings excluding notable items up 1% to $1,580 million for the quarter (compared to an average for the last two quarters of $1,567 million), the market gave the result “the tick” with the shares rallying by about 4%. The fall in expenses offset a small fall in operating income and higher (though historically very low) credit impairment charge.

On the negative side, the net interest margin (or the difference between the rate it lends money at compared to the rate it pays to depositors) fell from 1.98% to 1.91% (7bp). Westpac said that this was driven by an increase in holdings in liquid assets along with competitive pressures in mortgage and business lending and the continued growth in (lower spread) fixed-rate mortgages. It forecast that the net interest margin would decline further in FY22, with the exit rate in the December month 4bp lower than the quarterly average.

And if it hadn’t been for a boost in contribution from the trading activity by Treasury & Markets, the margin decline would have been even higher. Growth in risk-weighted assets of $5.8bn over the quarter allowed Westpac to report flat operating income.

Westpac announced an organisational re-structure which is designed to produce a more focussed head office and a reduction in the size of corporate functions by about 20%. Under the re-structure, two Group Executives will leave.

CEO King will still have ten direct reports – 4 Operating Divisions (Consumer & Business Banking, Institutional, NZ and Specialist Business), 2 Shared Services and 4 Group Head Offices. Interestingly, there is not a single word about ‘St George Bank’, ‘Bank of Melbourne’ or ‘BankSA’ or the idea of “one kitchen, multiple dining rooms”. It wasn’t that long ago that Westpac’s differentiating strategy was through the provision of multi-branded customer offerings. It seems like it can only be a matter of time before these brands disappear.

What do the brokers say?

Macquarie’s take on the result summarised the mood. According to FNArena:

“Macquarie notes Westpac’s first-quarter trading was marginally ahead of expectations and while the broker expects this suggests underlying recovery, the result was supported by elevated trading income that is expected to normalise.

Less positively, margins were down -10 basis points and revenue growth was down -4%. Macquarie finds Westpac’s trading discount to peers justified, and expects this to persist until underlying trends improve”.

None of the major brokers changed their recommendation. Three brokers marginally reduced their target prices, with the consensus falling to $24.64, 14.5% higher than Friday’s closing ASX price of $21.52. The table below shows the individual recommendations and target prices.

Bottom line

Westpac remains a “work in progress” and it is unclear whether CEO King yet has the team, technology or strategic intent to drive revenue growth. While cost-cutting is good, it’s too competitive a market (including Fintech entrants) to think this alone can lead to “greatness”. And $8bn remains a very ambitious target.

While Westpac is “cheap” with the buyback set to further reduce the number of ordinary shares by more than 5%, prefer others, in particular, the NAB.

And the buyback?

Westpac’s $3.5bn off-market share buyback closes on Friday at 7.00pm (Sydney time). The market price will be determined from trading in Westpac’s shares this week on the ASX, with the announcement of the tender discount and share buy-back results on Monday 14 February. Payment of proceeds will be made on 18 February.

Because Westpac’s share price has rallied since its 1Q financial result, the buyback is relatively more attractive for 0% or very low rate taxpayers. With a fixed capital component of $11.34, the franked dividend component increases as the market share price increases and decreases as the market price decreases.

Westpac has re-affirmed its intention to proceed, saying: “We are committed to completing our capital management programme. Should there not be sufficient demand for the off-market buyback, we plan to commence an on-market buyback to complete the $3.5bn reduction in capital”.

Noting Westpac’s determination to proceed, the fact that it reduced the tender discount range from 8% to 14% to 0% to 10% and an expectation that participants require a “safety margin” to participate, I am sensing that this will be a very low discount margin. While this will ultimately be determined by the enthusiasm or not of the big super funds (who play their cards very close to their chests), I am guessing a tender discount margin of about 4%, potentially even lower.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.