I was both right and wrong about the Royal Commission.

I didn’t think it was necessary at the time, nor did I expect it to discover such poor behaviour by the industry. I was shocked at some of the revelations. Its impact on bank share prices was materially higher than I foresaw.

The “right” part was that most of the reforms to “fix” the industry were already underway when the Commission started and that when it came to crafting hard recommendations, the Commissioner and his team of lawyers would struggle to come up with anything that would concern shareholders too much.

And that’s the way it proved with the “wet blanket” set of recommendations delivered last week. If anything, the Commission gave the major banks a big gift with some poorly considered ideas about mortgage broking. The major banks would love to see the demise of mortgage brokers.

So, after last week’s (not unexpected) rally, what’s next for the major banks and in particular, the market leader, CommBank (CBA), which reported its half-year profit on Wednesday? Can it get back to $80?

Strong capital generation, weak on revenue

CBA’s first half cash profit of $4,676m was up 1.7% on the corresponding period. However, the prior period was impacted by a number of one off costs, so operating performance (operating income less operating expenses) fell by 0.7%. Lower loan impairment expenses (bad debts) also assisted the headline number.

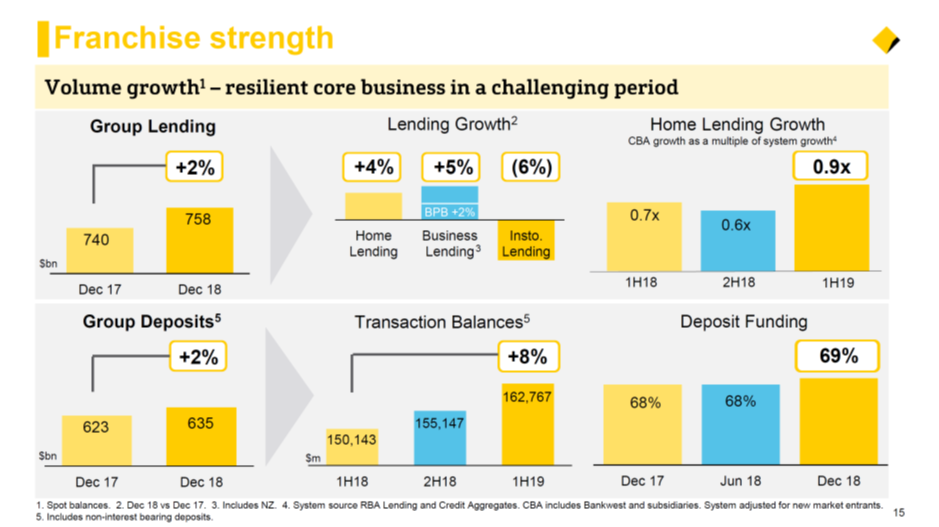

Income fell by 1.9%, with the net interest margin down 4bp (basis points) to 210bp. Balance sheet growth was negligible, up just 2% over the 12 months.

And that’s the story of banking in Australia at the moment. Zero or negative revenue growth as credit growth remains subdued, customer fees are static or being cut, and funding costs are under pressure. Profit growth can only come from cutting costs and no deterioration in bad debts.

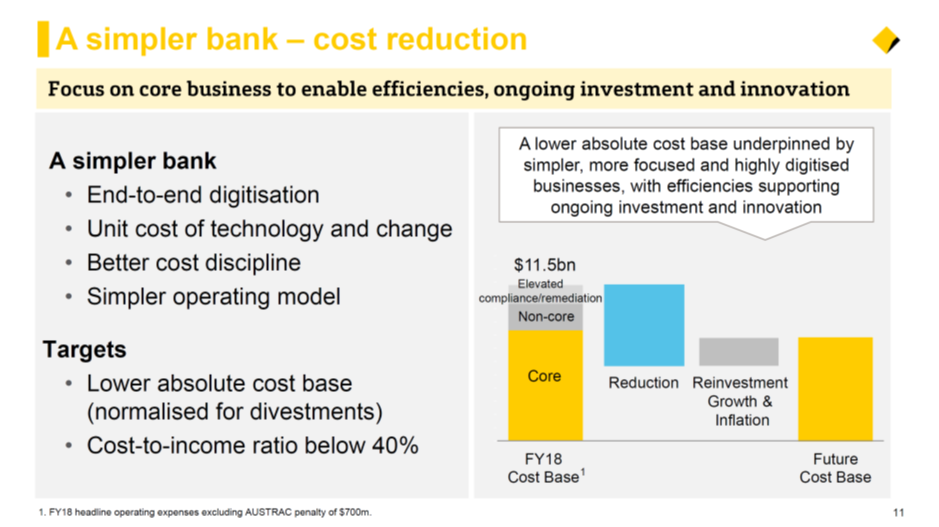

CBA has its sights on being a “simpler bank” and reducing costs. This includes a re-organisation of its business units (for example, Bank West will become part of the main Retail Banking Division) and some new cost targets. A reduction in absolute costs, and a cost to income target of 40% (currently 42.6%). The following slide summarises the Bank’s plans.

The highlight of the result was the “organic” capital generation of 0.66%. CBA’s CET1 (common equity tier one ratio) now stands at 10.8%, above APRA’s “unquestionably strong” target of 10.5%. When already announced divestments are included, CBA’s CET1 ratio (on a proforma basis) rises by a further 1.23% to 12.0%.

While there will be some offset to the capital ratio from the changes foreshadowed by the New Zealand Reserve Bank, analysts are now speculating on the possibility of capital initiatives from the Bank, such as the payment of a special dividend or a buyback. The Bank will “neutralise” the next dividend payment by buying back on market any shares issued under the dividend re-investment plan.

What do the brokers say?

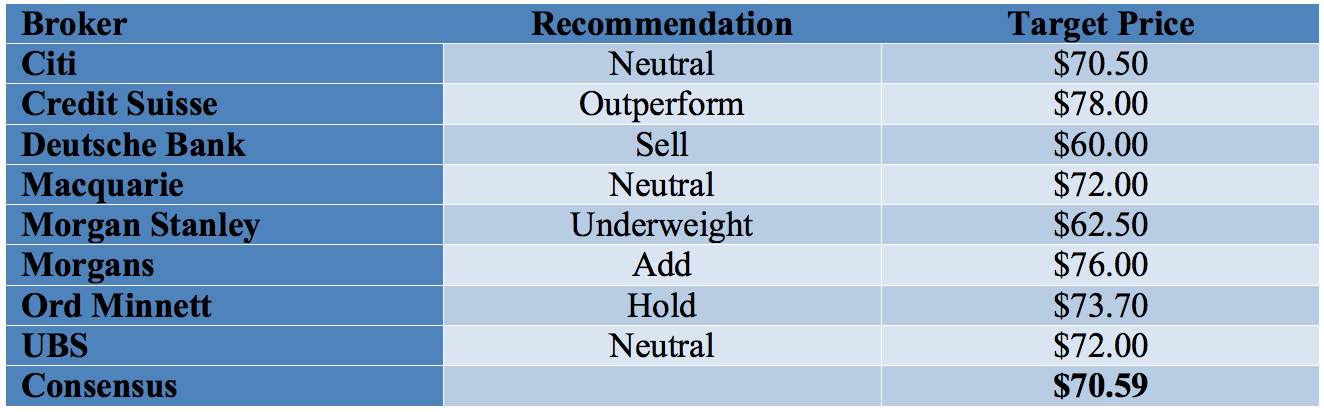

The major brokers, according to FN Arena, are cool on CBA viewing it as “expensive” relative to its peers. There are two buy recommendations, 4 neutral recommendations and 2 sell recommendations (see table below). The consensus target price of $70.59 is 5.6% below Friday’s closing price of $74.75. By comparison, ANZ’s consensus target price of $28.76 is 7.0% above Friday’s price of $26.89, while Westpac is 4.3% higher and NAB is 10.0% higher.

Reflecting its recent “positive re-rating” by the market, CBA is trading at 14.1 times forecast FY19 earnings and 13.9 times forecast FY20 earnings. NAB, which has been under pressure and is expected to cut its dividend, is trading at multiple of 10.9 times FY19 earnings and 10.6 times forecast FY20 earnings.

Notwithstanding its premium rating, CBA’s earnings per share growth is negligible. It is expected to rise by just 2.5c from an actual 534.3 cents in FY18 to 536.8c in FY20. CBA is forecast to yield 5.8% in FY19, rising to 5.9% in FY20.

Major Broker Recommendations

Can CommBank get back to $80?

CBA was over $80 before the Royal Commission kicked off, so in the medium term, my answer is “yes” to this question.

Commonwealth Bank – 2/14 to 2/19

Source: Nabtrade

I am not a member of housing market “doomsday school”, so I don’t think much has fundamentally changed. Employment growth is still reasonable, interest rates are staying low, and there is no sign of any pick up in bad debts.

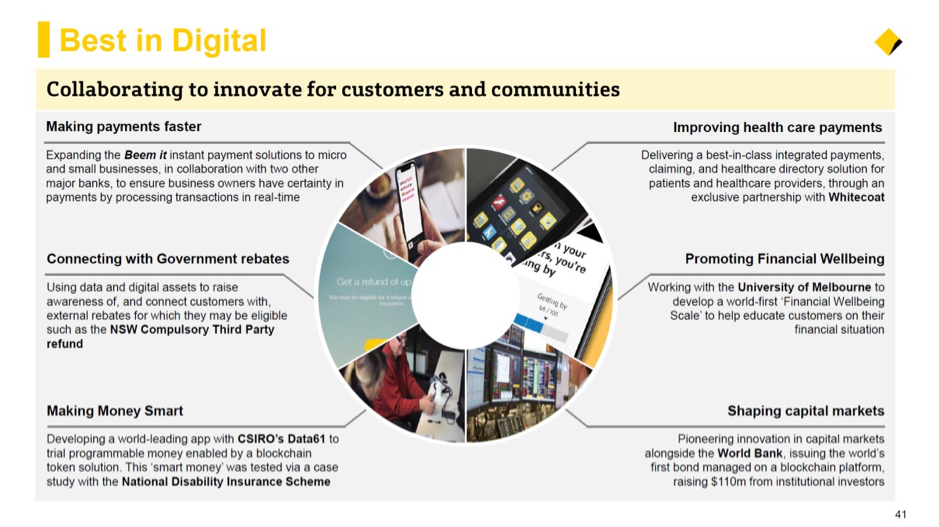

Winning banks will be those that are focussed on delivering services whilst cutting expenses, and with its superior technology and investment in digitisation, CBA will lead in this field. Income investors will be attracted by the secure, high dividend yield and the market will continue to re-rate the sector. The prospect of a capital return will also provide support, particularly if the market dips.

But it is trading at a considerable and I think too high a PE premium to its peers (Westpac is 11.6 times FY19 and 11.4 times FY20). So, while it can go above $80, the other majors (particularly ANZ and Westpac) should provide better short term performance.

CBA goes ex its $2.00 dividend on Wednesday.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.