One of the best strategies a long-term investor can embrace is to benefit from two maxims. The first is to “buy the dips” and the second is “the trend is your friend until it bends.”

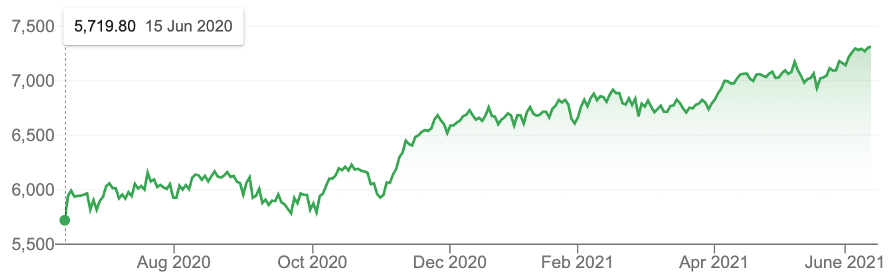

We’ve recently seen how this first rule of thumb pays dividends, with the S&P ASX 200 up 5.4% since the market dropped between the 10th and 19th of May. And the one-year chart of that same Index shows how it’s valuable to add a friendly trend to a ‘buying the dip’ commitment.

But it doesn’t just work for an index play. It also works for individual quality businesses. Note I used the word “quality”.

Let’s put aside any of our negativity that (as consumers) we might have for banks generally, and look at our best-performing bank CBA.

Let’s focus on the long term 22-year+ chart and see what would’ve happened if you’d allowed my two big rules of investing to drive your investing decisions.

CBA

The long game would’ve seen your $23 investment in January 1999 turn into $106 today. That’s a 360% return and gives an average return of over 16% a year before dividends and franking. And note how buying the dip has worked out:

- From June 2002 to April 2002, the stock price fell from $33 to $25 (or 24%).

- From November 2007 to February 2009, the price fell from $61 to $27, which was a gut-wrenching 55% smashing!

- From 2015 to 2020, CBA’s share price fell from $95 to $59 in April 2020. But a buyer at $95 is 11.5% up, plus dividends and franking. However, if they bought an equal amount as they had when the stock fell in 2015 in April 2020 at $58, the gain would’ve been 83%.

Add this to the 6% capital gain between 2015 and 2021 and the overall gain is 89%.

I think this makes a strong case for buying quality businesses when the market goes “mad” and “crazy”. It also tells you not to panic when the market’s panic sends your stock’s share price to ridiculously low levels.

To reinforce my point, let’s go back to the big GFC sell off of 2007-09. It took until December 2012 for CBA investors to get their capital back, but they kept getting dividends. And look at their gain now, with CBA at $106 today. Even if they didn’t buy the dip, the gain from 2007 to now would’ve been 74% (or 7.1% a year plus a dividend of at least 5% plus franking). In fact, it would be a bigger dividend but on my conservative 5%, we are talking about 12% a year on average with one of the best banks in the world!

If they’d bought in February 2009 at $27, the gain today would’ve been 293%, or 24% a year on capital gain alone! Throw in dividends and that would be averaging around 10% plus along with franking, suggests a return over 30%!

Have I made my point? Let me recap:

- Buy quality companies on serious dips and wait.

- Look at the trend. When it starts to rise and defy small dips, with a quality business, that’s likely to be a friendly trend.

- After losing capital in a big sell off, provided you’re invested in a quality business, buying around the bottom (lowering your average cost) can magnify your average returns. Go back and look at my example of the GFC over 2007-09, where this buying at the low turned a good 12% return into a ballistically great 30% plus return!

I haven’t done the numbers but I bet the same kind of story applies to Macquarie (MQG), CSL and Wesfarmers (WES).

MQG

CSL

WES

Funny that!

So, should you expect a sell off any time soon?

The worst time for sell offs tends to be between May and October, though locally July is a good month because end-of-year tax selling before June 30 turns into new financial year buying of stocks dumped in June.

Also with US markets in record territory now, profit-takers could bring stocks down but I don’t expect any big sell offs. In addition, there has been a re-loving of tech stocks lately that should help keep the index from falling too heavily.

And this coincides with an even more positive development for stocks out of the bond market.

“Since the 31 March the US 10-year Treasury bond yield has fallen from 1.74% to 1.45%,” Percy Allen pointed out over the weekend. The fall was especially marked in the last week when it exceeded 0.2%. This would suggest that fears of an inflation outbreak are waning…”

The market reaction to the Fed’s hinting that interest rates might rise in 2023 rather than 2024 has unsettled stock markets and this could provide a short-term buying opportunity. Why? Well, let’s face it, do the maths — 2023 is 30 months away!

This should give any nervous dip-buyers the confidence to stick to stocks. This goes double if you’re invested in quality businesses/shares.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.